If You Had Bought a2 Milk (NZSE:ATM) Stock Five Years Ago, You Could Pocket A 332% Gain Today

Some The a2 Milk Company Limited (NZSE:ATM) shareholders are probably rather concerned to see the share price fall 30% over the last three months. But that does not change the realty that the stock's performance has been terrific, over five years. To be precise, the stock price is 332% higher than it was five years ago, a wonderful performance by any measure. Arguably, the recent fall is to be expected after such a strong rise. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 51% decline over the last twelve months.

View our latest analysis for a2 Milk

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

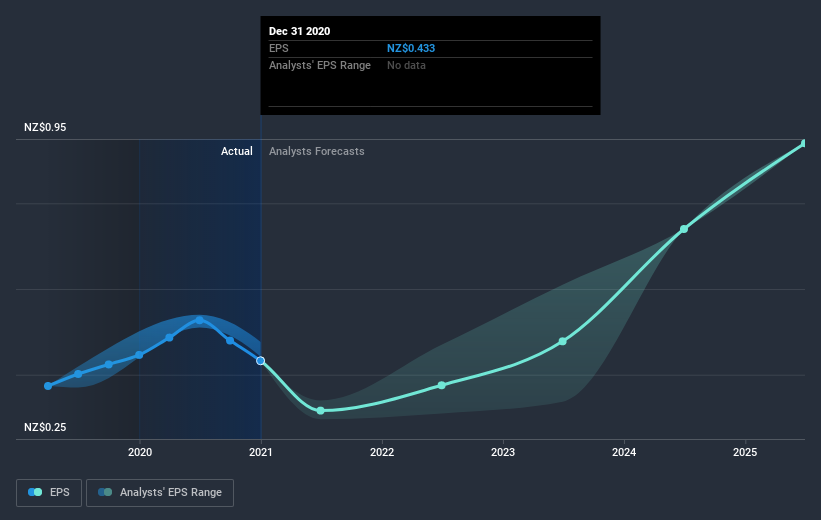

During five years of share price growth, a2 Milk achieved compound earnings per share (EPS) growth of 105% per year. This EPS growth is higher than the 34% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on a2 Milk's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in a2 Milk had a tough year, with a total loss of 51%, against a market gain of about 32%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 34% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand a2 Milk better, we need to consider many other factors. For example, we've discovered 1 warning sign for a2 Milk that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NZ exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance