Grocery Outlet (GO) to Report Q1 Earnings: Factors to Consider

Grocery Outlet Holding Corp. GO is likely to register an increase in the top line when it reports first-quarter 2023 earnings on May 9 after market close. The Zacks Consensus Estimate for revenues stands at $948.5 million, indicating an increase of 14.1% from the prior-year reported figure.

The Zacks Consensus Estimate for earnings per share is pegged at 23 cents. The consensus estimate has been stable over the past 30 days.

We expect Grocery Outlet to generate revenues of $941 million, suggesting an increase of 13.2% year over year, and post earnings of 22 cents a share.

Grocery Outlet, the extreme value retailer of quality, name-brand consumables and fresh products, has a trailing four-quarter earnings surprise of 11.9%, on average. In the last reported quarter, this Emeryville, CA-based company surpassed the Zacks Consensus Estimate by a margin of 8.7%.

Factors to Note

Grocery Outlet’s flexible sourcing and distribution business model, which helps it offer products at an exceptional value, and excellent service from independent operators are among the key factors driving revenues.

The company’s opportunistic purchasing strategy, marketing efforts, store-growth endeavors and e-commerce initiatives to deepen the customer reach also appear encouraging. Cumulatively, these are likely to have favorably impacted the to-be-reported quarter's top line.

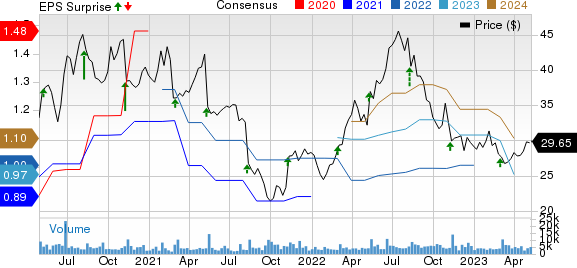

Grocery Outlet Holding Corp. Price, Consensus and EPS Surprise

Grocery Outlet Holding Corp. price-consensus-eps-surprise-chart | Grocery Outlet Holding Corp. Quote

Grocery Outlet has been offering the same-day delivery of everyday essentials and staples from nearly all its stores in collaboration with Instacart. We believe that Grocery Outlet’s compelling value proposition continues to attract bargain hunters, encourage customers to revisit stores and increase basket sizes.

On its last earnings call, management guided first-quarter 2023 comparable store sales growth of 10% compared with the 5.2% witnessed in the prior-year quarter. Management projected a gross margin of approximately 30.6% for the first quarter compared with the 30.2% reported in the year-ago period.

While the aforementioned factors raise optimism, we cannot ignore the margins. Any deleverage in SG&A expenses due to higher store-related expenses and store occupancy costs may weigh on margins.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Grocery Outlet this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that’s not the case here.

Grocery Outlet has a Zacks Rank #3 but an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

3 Stocks With the Favorable Combination

Here are three companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Performance Food Group Company PFGC currently has an Earnings ESP of +2.82% and a Zacks Rank of 2. The company is likely to register an increase in the bottom line when it reports third-quarter fiscal 2023 results. The Zacks Consensus Estimate for the quarterly earnings per share of 71 cents suggests an increase of 39.2% from the year-ago quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance Food Group’s top line is expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $13.94 billion, which suggests an increase of 6.6% from the figure reported in the prior-year quarter.

Burlington Stores BURL currently has an Earnings ESP of +5.57% and a Zacks Rank #3. The company is likely to register a bottom-line increase when it reports first-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for the quarterly earnings per share of 94 cents suggests an increase of 74.1% from the year-ago quarter.

Burlington Stores’ top line is expected to increase year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $2.19 billion, which indicates a rise of 13.6% from the figure reported in the prior-year quarter. Burlington Stores has a trailing four-quarter earnings surprise of 7%, on average.

Walmart WMT currently has an Earnings ESP of +0.28% and a Zacks Rank #3. The company’s bottom line is expected to remain flat year over year when it reports first-quarter fiscal 2023 results. The Zacks Consensus Estimate for the quarterly earnings per share is pegged at $1.30.

Walmart’s top line is expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $148.5 billion, which suggests a rise of 4.9% from the figure reported in the prior-year quarter. WMT delivered an earnings beat of 6.5%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report

Performance Food Group Company (PFGC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance