Green Thumb Industries And Two Other Stocks Estimated As Undervalued On TSX

The Canadian market has shown positive momentum, rising 1.1% over the past week and achieving a 9.9% increase over the last year, with earnings projected to grow by 15% annually in the coming years. In this context, identifying stocks that are potentially undervalued can offer investors opportunities for growth, especially when market trends suggest a favorable economic environment.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

Name | Current Price | Fair Value (Est) | Discount (Est) |

Calibre Mining (TSX:CXB) | CA$1.77 | CA$3.22 | 45% |

goeasy (TSX:GSY) | CA$189.39 | CA$313.65 | 39.6% |

Trisura Group (TSX:TSU) | CA$40.50 | CA$80.18 | 49.5% |

Aura Minerals (TSX:ORA) | CA$11.67 | CA$21.10 | 44.7% |

Kinaxis (TSX:KXS) | CA$148.84 | CA$250.22 | 40.5% |

Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

Endeavour Mining (TSX:EDV) | CA$28.79 | CA$53.42 | 46.1% |

Jamieson Wellness (TSX:JWEL) | CA$28.45 | CA$46.78 | 39.2% |

Kits Eyecare (TSX:KITS) | CA$8.55 | CA$14.33 | 40.3% |

Capstone Copper (TSX:CS) | CA$9.76 | CA$16.41 | 40.5% |

Let's explore several standout options from the results in the screener

Green Thumb Industries

Overview: Green Thumb Industries Inc. is a company based in the United States that manufactures, distributes, markets, and sells cannabis products for both medical and recreational use, with a market capitalization of approximately CA$4.05 billion.

Operations: The company generates revenue primarily through its retail operations, which brought in $806.38 million, and its consumer packaged goods segment, contributing $583.78 million.

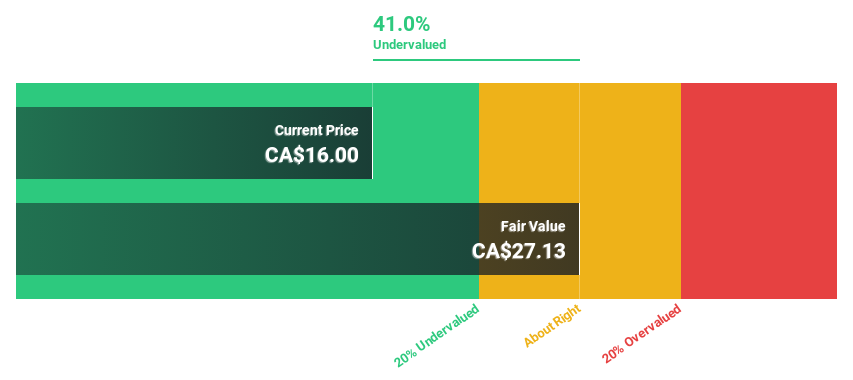

Estimated Discount To Fair Value: 37.1%

Green Thumb Industries, with a current trading price of CA$17.08, is significantly undervalued based on discounted cash flow analysis, reflecting more than a 20% discrepancy from its estimated fair value of CA$27.16. Despite low forecasted Return on Equity at 10.2%, the company's earnings and revenue growth projections are robust, outpacing the Canadian market with expected annual increases of 27.3% and 11.8%, respectively. Recent strategic expansions and potential merger discussions suggest proactive management in enhancing market presence and diversification.

Capstone Copper

Overview: Capstone Copper Corp. is a copper mining company with operations in the United States, Chile, and Mexico, and has a market capitalization of approximately CA$7.04 billion.

Operations: The company generates its revenue primarily from the Cozamin, Mantoverde, Pinto Valley, and Mantos Blancos mines, with respective earnings of $216.78 million, $307.90 million, $438.59 million, and $379.16 million.

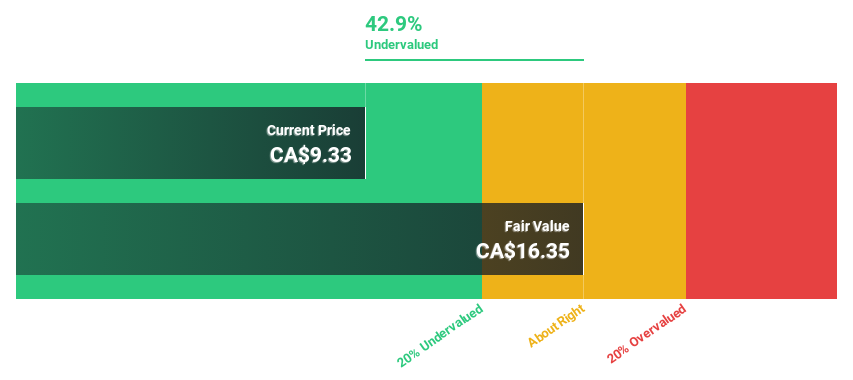

Estimated Discount To Fair Value: 40.5%

Capstone Copper, priced at CA$9.76, is undervalued by 40.5% compared to its fair value of CA$16.41, signaling potential upside based on discounted cash flow analysis. Despite a low forecasted Return on Equity of 10.3%, the company is expected to turn profitable within three years with revenue growth projected at 18.1% annually, outstripping the Canadian market's 7.2%. Recent production advancements at its Mantoverde Development Project highlight operational progress, though shareholder dilution and significant insider selling pose concerns.

Constellation Software

Overview: Constellation Software Inc. operates globally, focusing on acquiring, developing, and managing vertical market software businesses primarily in Canada, the U.S., and Europe, with a market capitalization of approximately CA$82.16 billion.

Operations: The company generates CA$8.84 billion from its software and programming segment.

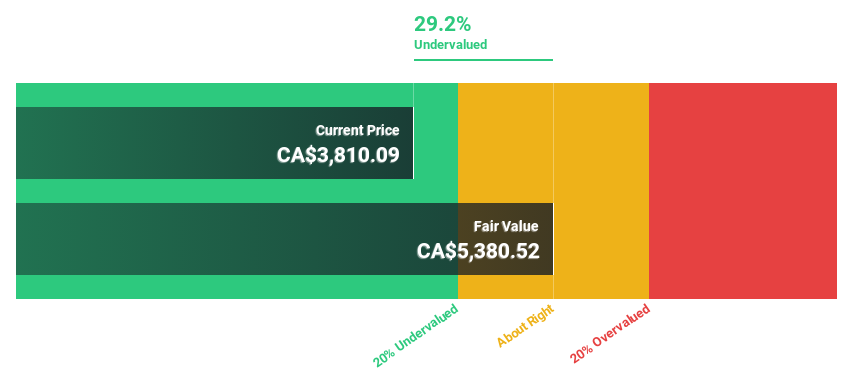

Estimated Discount To Fair Value: 28.2%

Constellation Software, valued at CA$3868.23, appears undervalued by 28.2% relative to its estimated fair value of CA$5384.96 based on discounted cash flow analysis. The company's earnings have increased by 13.4% over the past year with a robust forecast for revenue and profit growth—16.1% and 24.4% per annum respectively—surpassing Canadian market averages significantly. However, concerns include high levels of debt and significant insider selling in the last quarter, which may warrant caution among investors.

Where To Now?

Access the full spectrum of 22 Undervalued TSX Stocks Based On Cash Flows by clicking on this link.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include CNSX:GTII TSX:CSTSX:CSU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance