‘Destructive’: This government move could make Australia’s recession even worse

There’s no longer any doubt that Australia is heading for a recession – but one particular decision by the government will make the economic downturn worse, according to some experts.

With thousands of businesses forced to shut their doors to comply with the coronavirus restrictions, the nation has all but ground to an economic standstill.

Treasury estimates are that the unemployment rate could hit 10 per cent, meaning 1.4 million people would be out of a job. Fresh ABS figures revealed this morning found the unemployment rate rose to 5.2 per cent over the March quarter.

In a bid to control government spending, various levels of government have announced or proposed pay freezes to public servants, including federal public servants, the Queensland Government, NSW Government and Brisbane council staff.

But economists Troy Henderson and Jim Stanford have said that calls for public servants to cop freezes on planned pay rises would be “destructive” for Australia’s economy.

“Scapegoating public sector wages would be a mistake economically, not just politically,” the economists wrote in a briefing paper released today.

“Freezing or cutting public sector wages would substantially exacerbate the dangerous deflationary risk we already face.”

Also read: The easing of lockdown conditions: what should we expect?

Also read: Why property prices will shoot up after the pandemic

Also read: Coles, Woolworths, Domino’s are hiring: Where to find a job

Henderson and Stanford argued that this current point in time was “an especially dangerous moment for Australia’s macroeconomy”, and pointed out wage growth stalled in 2019.

“The country was already teetering on the brink of deflation even before being slammed by the double shock of bushfires and coronavirus,” the economists said.

Wages have a particular significance to the Australian economy, they added. “The price of labour is the most important price in the economy; and governments are by far the biggest employers in the land.

“Federal, state and municipal governments should all proceed with the normal, negotiated pay increases that were in course before this crisis hit.”

“Scapegoating the public servants who are doing so much to help us through this crisis, and suppressing their incomes, will make things worse, not better.”

Public sector pay freezes would spill over

Federal and state governments are major employers: together, they keep more than two million Australians in a job and represent 16 per cent of national employment.

So when they sneeze, the rest of the jobs market catches a cold.

“The negative ‘example’ set by governments in suppressing normal wage increases for their own employees has a contractionary influence on broader labour market functioning.”

There are three ways public sector wage restrictions spread into the wider economy.

Firstly, lower public sector wage growth will impact overall wage growth, called the ‘composition’ effect.

Secondly, public sectors have a ‘trend-setting’ effect on wages, and are used as a benchmark by private employers. If public sector wages go down, private employers will reduce their own wages. This is called the ‘demonstration’ effect.

Thirdly, suppression of wages means less money to spend, which means lower consumer spending overall.

“This in turn saps the vitality of private-sector activity – especially in retail trade and other consumer-sensitive industries.”

“With less spending power in the pockets of millions of Australian workers, market conditions for tens of thousands of Australian businesses are undermined – and this in turn undermines their own employment decisions and wage offers.” This is called the ‘macroeconomic effect’.

All of this would ultimately undermine the government’s own bottom line, the economists said.

“The macroeconomic spillover from public sector pay freezes in turn feeds back negatively on the budget positions of the governments which imposed those pay freezes in the first place.

“Less income for their own employees translates directly into reduced income tax and GST revenues. Indeed, that direct impact immediately offsets a substantial proportion of the supposed ‘savings’ that were supposed to result from the pay freeze.”

The motivation for freezing public sector wages seems more “ideological than fiscal or economic,” according to the economists.

“Pay freezes are justified with appeals to ‘shared sacrifice,’ and a symbolic desire to look ‘tough’ on finances at a moment when governments, of all political stripes, are about to incur their largest deficits in history.

“But government policy should be driven by economic reality, not political optics. These arbitrary pay freezes are both unfair and economically counterproductive.”

Short-term pay freeze have permanent effects

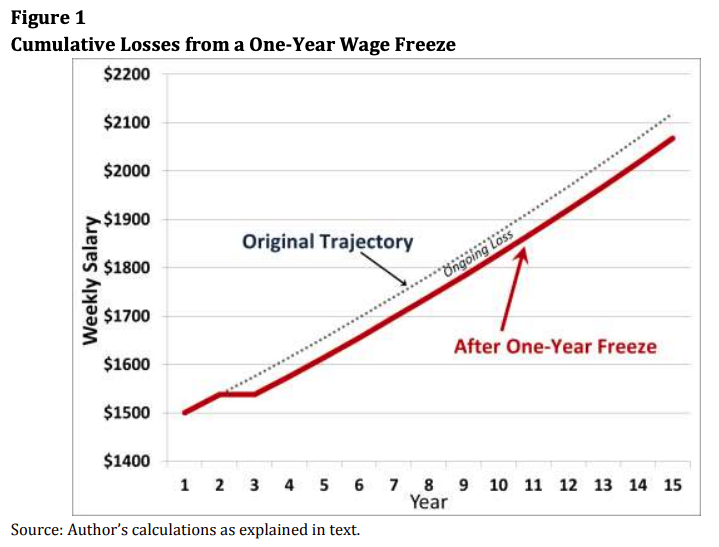

According to the economists, even one-time pay freezes will have a long-term effect on an employee’s wages – so much so that it can affect retirement nest eggs.

“This claim that pay freezes cause only temporary financial losses for workers is false. Even if nominal wages do begin to grow again at the end of the freeze period, in reality workers continue to experience cumulating annual losses,” they wrote.

Here’s what that looks like:

“Even when those workers retire, they experience an additional loss of income that extends into retirement.” This will in turn mean an accumulating loss of superannuation contributions.

The only way that compounding losses can be prevented is if there are ‘catch-up’ wage increases to make up for the loss.

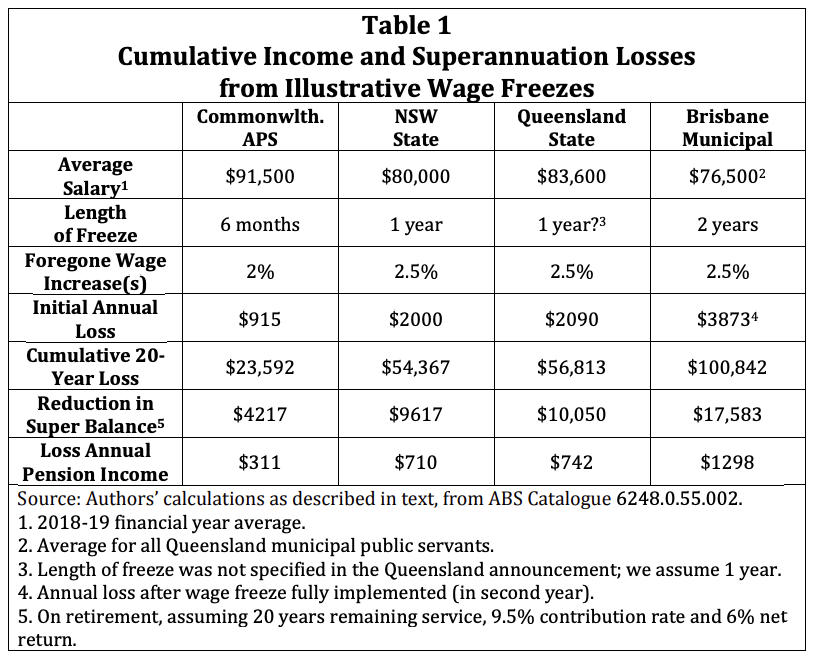

If the current proposed or announced pay freezes went ahead, some public servants would lose more than $100,000 across 20 years, Australian Institute analysis revealed.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance