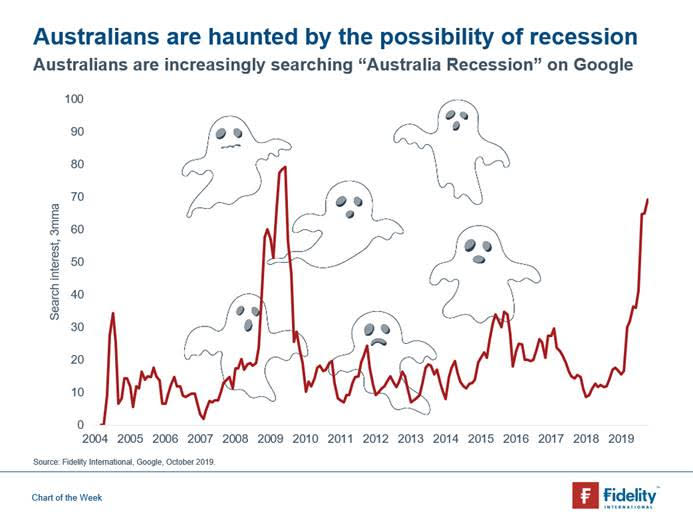

Google searches for 'Australia recession' have hit GFC levels

The number of Internet searches with the term "Australia recession" have hit the same levels as the global financial crisis ten years ago.

Investment management firm Fidelity International released a graph of Google search volumes that showed how Australians are spooked about their hip pockets at the moment:

"With consumer confidence at a four-year low, it appears that the RBA's three interest rate cuts have done little to boost the confidence of Australian households," said Fidelity International cross-asset investment expert Anthony Doyle.

"This is a concern in an economy where private consumption is the major driver of economic growth, accounting for around 55% of GDP."

Australia has enjoyed the longest streak in the developed world without suffering a recession, with the last economic depression ending in 1991.

There is now an entire generation that's never felt the pain of economic contraction and long unemployment queues – even as the rest of the world was hammered by the global financial crisis between 2007 and 2009.

The Reserve Bank of Australia this year has tried to encourage Australians to spend more to spark the economy, by making cuts to the cash rate three times in June, July and October.

But Doyle said this hasn't worked.

"With anecdotal evidence that the vast majority of Australian borrowers have kept their mortgage payments at pre-interest rate cut levels and are using higher household incomes to pay off debt, it suggests that the RBA’s hopes of a new housing and consumer boom may be misplaced."

However, economist Stephen Koukoulas told Yahoo Finance earlier this month that he didn't see a recession coming for Australia.

"When we look at things like infrastructure, spending, mining, export volumes – they’re all doing really well, and that’s why we’re not going to have a recession.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance