Google redesigns the Pay app to take on Venmo and Mint

Keep tabs on your financial activity all in one place.

Google is making major changes to its Pay app to make sending money to friends easier and help people better understand their finances. The new interface will focus on your relationships rather than transactions, meaning it groups your activity by the people and businesses you’ve interacted with. You’ll also be able to use Pay to make purchases in restaurants, gas stations and parking services within the app in select cities starting today. The updated app is available to download on Android and iOS today.

In contrast to the way Venmo is currently laid out, Pay’s new home page will show your favorite friends and businesses. You can tap your partner or roommate to send a payment to them instead of having to search their name. If you’re grabbing your daily Panera order, for example, you can hit the icon for that business from the home page. Your money transfers will be seen only by you and your recipient, which is probably sad news for those who like stalking their friends’ Venmo activity. To make splitting bills easier, Pay also offers a group payment feature.

Since Pay’s launch in 2015, it now sees more than 150 million monthly users in 30 countries. “But there’s so much more we can do,” general manager for Google Pay Caesar Sengupta said. Managing our finances is too difficult for most Americans today. A new Insights section of the app can help ease that stress, Google said. This page will show all your spending and pull information from connected bank accounts, credit and debit cards. It will remind you when bills are due, alert you to large purchases (in case of suspicious activity) and show you your weekly expenditure.

This sounds a lot like finance app Mint, but since it’s a Google product, Pay also integrates a powerful search tool to make the app easier to use. “Google Pay has a semantic understanding of the word food and it also understands places where I’ve bought food,” said director of product management Josh Woodward.

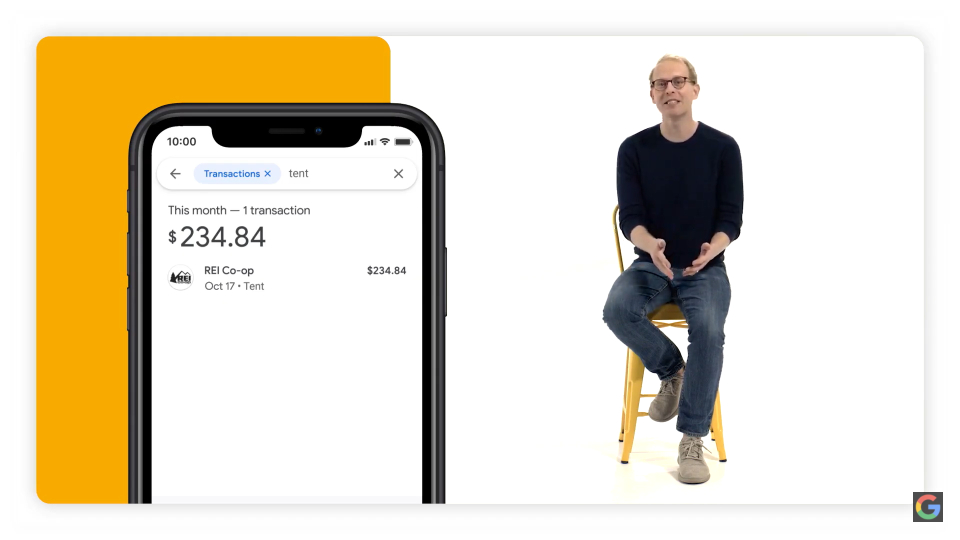

You can search for food or “gas last month” and find those specific transactions. You can even get more nitty gritty, especially if you’ve linked your cards and photos. If you took a picture of your receipt at REI, for instance, you can search for the word “tent” and Google will even scan your Photos to find that word and pull up that transaction. You can enable Pay to pull in receipts from Gmail, too. Woodward explained in a roundtable after the event that this is to help reduce the need to tag every transaction for you to be able to find it later.

Google will also send you reports on your activity. At the start of the week, for example, Pay will show things like “here’s what you spent on this weekend,’ Woodward said. It will also present pages of information it feels is useful, like a list of services you’re subscribed to, for example.

With all that sensitive data saved in one spot, privacy and security are obviously important. Sengupta said in a roundtable after the event that the app features a privacy-forward approach. Google Pay exec Venkat Rapaka said you should see this throughout your experience with the new app, from setup to months after. First, your transactions and money transfers are only visible to you (and the person you’re sending money to). The app will require authentication each time you open it and before transactions. Transaction data will not be shared with the rest of Google when it comes to targeting ads, Rapaka said.

Google also announced Plex accounts today in collaboration with financial institutions to give more users a mobile-friendly banking app experience. You can join a waitlist via the Pay app today, and the first of these accounts will be available next year.

Yahoo Finance

Yahoo Finance