Why gold, US stock market are in a 'bubble beyond doubt'

‘It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity…’

That, of course, is the famous introduction to Charles Dickens’ A Tale of Two Cities. The contrast was with France and England, just prior to the French Revolution.

What’s much less well known is Dickens commentary on France, just a little further in:

‘France, less favoured on the whole as to matters spiritual than her sister of the shield and trident [England], rolled with exceeding smoothness downhill, making paper money and spending it.’

What Dickens was alluding to was that the value of a nations’ currency flows into the behaviour of its society.

Debase the currency and you debase the moral codes that a society abides by.

That’s not a judgement. It’s a fact based on evidence.

Just look at how society has changed over the past 20 years. Not in terms of technology but in terms of accepted behaviour, standards of education etc.

In that time, the gold price has gone from roughly US$200 to US$2,000 an ounce. That’s some debasement.

Dickens’ opening lines could well be describing the markets today.

On the one hand, you have (particularly in the US) stock markets telling you it’s the best of times. It’s the age of wisdom and especially, the epoch of belief.

No matter that we’re in perhaps the deepest global recession in history. In the age of wisdom, central bankers can make things better. And we believe it. That’s why the NASDAQ and the S&P 500, held aloft by the tech giants, are at or near all-time highs despite the economic carnage lying all around.

The level of concentration (or lack or breadth or participation in this rally) is downright dangerous. If you’re not in Apple or Google or Facebook or Amazon or Netflix or Microsoft, you’re lagging behind. These giants are THE market.

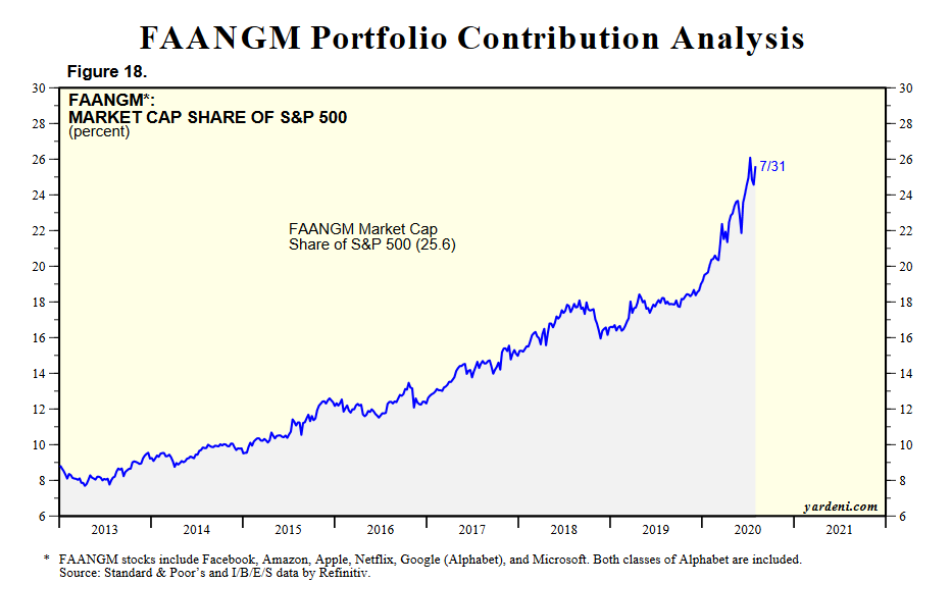

Take a look at how these stocks have grown to dominate the S&P 500 in 2020.

At the start of the year, the six stocks listed represented around 18% of the S&P 500. Now, these six stocks account for just over a quarter of the index.

That is a huge level of concentration.

And as more and more capital pours in, the NASDAQ goes vertical. It certainly is the best of times, the age of wisdom and the epoch of belief…

That the NASDAQ is a bubble is beyond doubt as far as I’m concerned.

The fact that I feel uneasy saying so reinforces this point. It’s always uncomfortable straying from the crowd. It’s OK being wrong when everyone else is too. But being wrong by yourself is socially humiliating.

Which is fine by me. I’ve made plenty of wrong calls in my career. And plenty of good ones too. So I’m quite comfortable in saying that the NASDAQ is in the process of inflating into a dangerous bubble, and it’s going to burst and cause a lot of pain and misery.

I just don’t know when. I just know the risk and reward equation in tech right now is firmly skewed to mostly risk and not much reward. At least it is when you look beyond a timeframe of a few months.

And don’t forget in all this, there’s a market telling you that this is the worst of times, the age of foolishness and the epoch of incredulity.

That market is the US treasury market, the largest and most liquid market in the world. The 10-year bond yield recently hit all-time lows…lower than that reached in March when the global economy shut down.

The bond market is telling you that there is no economic recovery coming. Or if it is, it will be extremely weak.

Gold is saying the same thing.

Gold and bonds have been trading in lockstep recently. As bond yields decline (and signify deflation and extreme preference for safety and liquidity), gold soars.

In my view, gold is rising because of a flight to safety bid. It has nothing to do with coming inflation, and everything to do with growing concern about the health of the global monetary system.

So, for those rejoicing about the gold bull market, don’t forget: gold is rising because all is not well in the world.

We’ve turned into pre-revolutionary France. Less spiritual and more material than ever. We’re rolling downhill with exceeding smoothness, making digital money and spending it on tech stocks.

Greg Canavan is Editorial Director at Port Phillip Publishing and founder of the Rum Rebellion.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, economy, property and work news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance