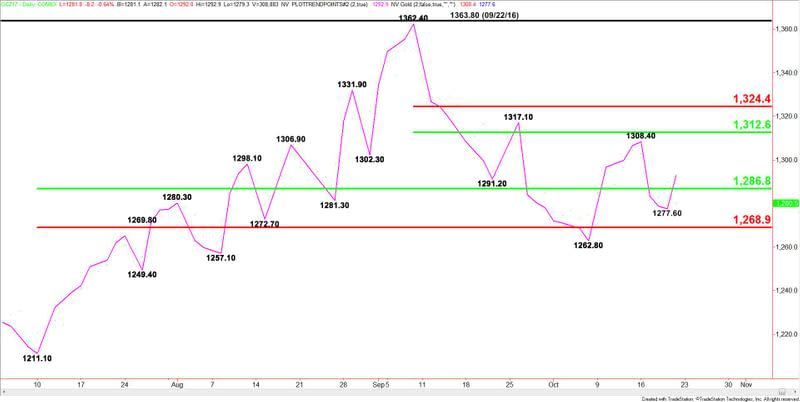

Gold Price Futures (GC) Technical Analysis – Trading on Bearish Side of Major 50% Level at $1286.80

December Comex Gold futures closed lower on Friday, pressured by rising U.S. Treasury yields. A firmer U.S. Dollar also weighed on gold prices because it made the dollar-denominated commodity a less-attractive investment.

Increased demand for higher risk assets also helped drive down demand for lower-yielding gold. Stocks were underpinned by the news that the Senate approved a budget blueprint. This essentially paves the way for tax cuts which could further extend the rally.

Daily Swing Chart Analysis

The longer-term daily chart clearly shows that gold is in a downtrend. However, upside momentum has been swinging higher if a shorter-term view is taken.

The last three main tops come in at $1362.40, $1317.10 and $1308.40. A trade though $1308.40 will change the main trend to up with $1317.40 being the trigger point for an acceleration to the upside.

A trade through $1277.60 will signal a shift in momentum to the downside. It will also reaffirm the downtrend. If the selling continues then look for the move to extend into the next main bottom at $1262.80. A trade through this level will indicate the selling is getting stronger.

Under $1262.80, additional targets come in at $1257.10 and $1249.40. Although the market is in a downtrend, the selling is likely to be labored until $1249.40 is taken out. This is the trigger point for an acceleration to the downside.

The main range is $1211.10 to $1362.40. Its retracement zone is $1286.80 to $1268.90. This zone is acting like support. It is essentially controlling the near-term direction of the market. A sustained move over $1286.80 will give the gold market an upside bias. A sustained move under $1268.90 will shift momentum and the bias to the downside.

The short-term range is $1362.40 to $1262.80. If gold can build a support base inside $1286.80 to $1268.90 and there is bullish news, we could see a rally into its retracement zone at $1312.60 to $1324.40.

The series of lower tops and lower bottoms as well as the bearish fundamentals are signaling lower prices to come. The selling is likely to pick up steam as long investors begin to liquidate positions. Only unexpected news can turn this market around.

This article was originally posted on FX Empire

More From FXEMPIRE:

FTSE 100 forecast for the week of October 23, 2017, Technical Analysis

USD/JPY forecast for the week of October 23, 2017, Technical Analysis

Crude Oil forecast for the week of October 23, 2017, Technical Analysis

Rising Yields, Upbeat Yellen Give U.S. Dollar Boost Last Week

Gold Price forecast for the week of October 23, 2017, Technical Analysis

Yahoo Finance

Yahoo Finance