Gold Price Forecast – Precious Metals & Mining Update

Mid-cycle consolidations are normal and part of every cycle. After rallying more than $165 from the November low, gold is taking a well-deserved breather. Bullish sentiment is waning, and the next advance should carry the uptrend into March.

-GOLD- Gold is in the midst of a natural mid-cycle consolidation. Once complete, prices should extend to the March target box and approximately $1700.

-SILVER- The current setup in silver is favorable and similar to that of last July. Prices should stabilize over the next few days and commence the next leg higher. Our forecast calls for an accelerated advance that exceeds the 2016 high of $21.25.

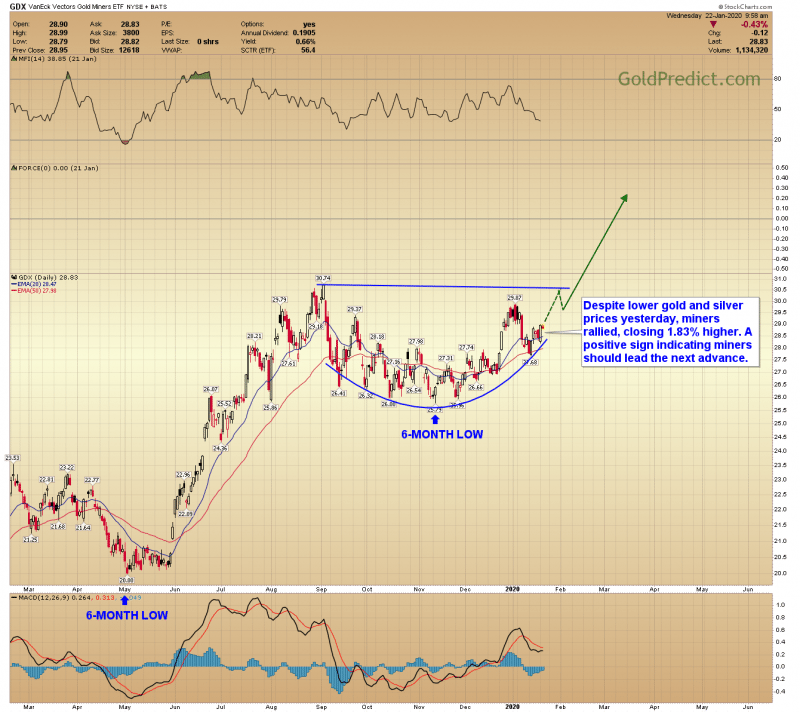

-GDX- Despite lower gold and silver prices yesterday, miners rallied, closing 1.83% higher. A positive sign indicating miners should lead the next advance.

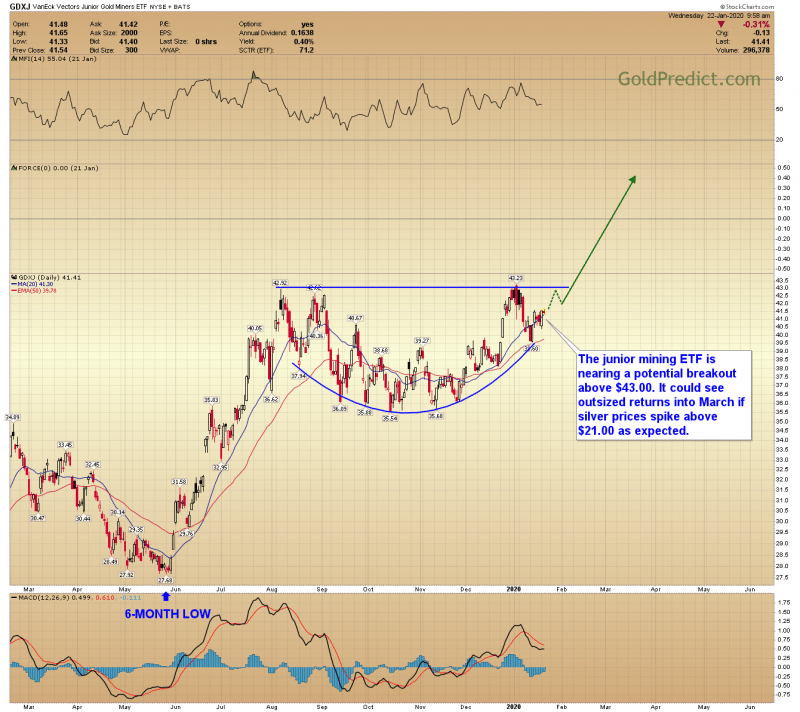

-GDXJ- The junior mining ETF is nearing a potential breakout above $43.00. It could see outsized returns into March if silver prices spike above $21.00 as expected.

Our precious metals and mining forecast expects a bullish surge into February and March. Our system is long NUGT and USLV.

AG Thorson is a registered CMT and expert in technical analysis. He believes we are in the final stages of a global debt super-cycle. For more information, please visit https://goldpredict.com/

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance