Gold’n Futures Launches Inaugural Drill Program at the Hercules Gold Project, Greenstone, Ontario

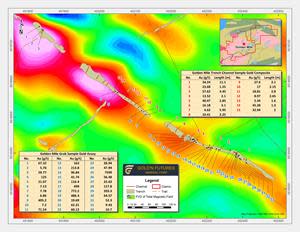

Figure 1

Plan of the central part of the Golden Mile vein trench showing associated magnetic anomaly and the corrected grab and channel sample sites. Sample analyses and widths of the channels are contained in the tables.

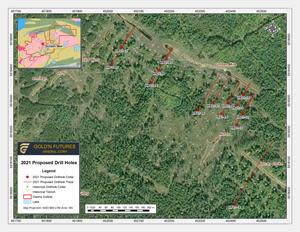

Figure 2

Plan of the central part of the Golden Mile vein and the Lucky Strike vein trenches showing the drill hole collars from the historical drilling and the layout of the 2021 drill program holes. Drilling was started on December 6, 2021 with DDH HR21-01.

VANCOUVER, British Columbia, Dec. 08, 2021 (GLOBE NEWSWIRE) -- Gold’n Futures Mineral Corp. (CSE: FUTR) (FSE: G6M), (OTC: GFTRF) (the "Company” or “Gold’n Futures”) is pleased to announce the commencement of its inaugural drill program for the Hercules gold project and to present its drill targets for the program.

“Gold’n Futures has conducted a thorough analyses of the historical work completed on the Hercules project in preparation of this inaugural drill program. During the summer and fall, the Company located and surveyed the trenches, the sample sites and the previous drill collars. The field team has also accurately mapped and plotted the principal gold zones, which, when combined with the remodeling of the historical drilling, has revealed significant new information. It is exciting to announce that we have strong evidence indicating the new structural controls of the gold zones. This new interpretation may be the key to defining the high-grade gold deposits.”

Commented, Stephen Wilkinson, President and CEO

The Hercules gold occurrences on the Property are exposed in the trenches completed in 2006 to 2008 by Kodiak Exploration Limited. The veins are well-known for high grades and lateral continuity. Figure 1 is a plan of the central trench area of the famous Golden Mile vein over a strike length of more than 700 metres (“m”). Within the trench, grab samples returned assays ranging from 5.76 grams per tonne gold (“g/t Au”) up to 7,599 g/t Au. Channel samples within the same trench area similarly ranged from 5.34 g/t Au over 1.6m up to 34.24 g/t Au over 11.1m. While surveying the trenches this summer, the Company’s geologists noted several instances of visible gold, confirming the tenor of the historical assay results.

The Gold’n Futures drill program is budgeted for approximately 2,200m and plans 14 drill holes to be completed in two phases. The Company expects the first round of drilling to comprise up to seven holes (1,000m) before the December holidays and resumption of the continuing program in mid-January. Figure 2 is a map of historical collars and the layout of the current drill program holes. The first holes, HR21-01 to HR21-05 are targeting gaps in the historical drilling and are intended to confirm the interpreted plunge of the high-grade vein system in the north-west part of the Golden Mile. The plunge of the high grade system appears to be in the order of 65o to the northwest, which if true, may be an important feature for the drill hole targeting later in 2022.

Around mid-January 2022, Gold’n Futures intends to resume the drilling and complete the inaugural program. Drill holes, HR21-06 to HR21-13 will be collared near the southeast end of the Golden Mile trench where a wide, high-grade channel sample returned 34.24 g/t Au over 11.1m. Approximately 100m of strike will be tested to depths ranging from 50m to 125m.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/299702eb-268e-473b-8d6b-c94e6ca9388f

The final hole for the inaugural program, HR21-14, will be the southernmost of the program and will target the deep potential of both the Golden Mile and Lucky Strike veins. Close to the expected pierce-points for HR21-14, historical drilling showed a cluster of significant gold grades in each of the Golden Mile and the Lucky Strike. Confirmation of the continuity of the deep high grade mineralization could have a positive impact on the expansion of the gold resources.

Qualified Person

The scientific and technical content of this press release has been prepared, reviewed and approved by Mr. Walter Hanych, P. Geo., who is a Qualified Person under NI 43-101 regulations and is a director of the Company.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/23565574-3d70-4774-b824-bb1f9bd36ab6

About Gold’n Futures Mineral Corp.

Gold’n Futures Mineral Corp. (CSE: FUTR) (FSE: G6M) (OTC: GFTRF) is a Canadian based exploration company focused on advancing its Hercules gold project. The Hercules is located 200 kilometres northeast of Thunder Bay, Ont., in the townships of Elmhirst and Rickaby, within the Thunder Bay North Mining District. The Project is in the heart of the Beardmore – Geraldton gold mining camp, the 4th largest gold camp in Canada and is 40 km west of the Hardrock-Greenstone gold mine development. The property lies within an Archean greenstone belt that extends from the Longlac area in the east to Lake Nipigon in the west, a distance of about 130 kilometres and consists of 475 contiguous claim cells (10,052 ha). From the historical work completed on the property, the Company has built an extensive database including reconnaissance grab samples; channel samples; a variety of geophysical surveys; and, a drill hole database that includes historical drilling totalling in the order of 537 holes with more than 107,000m of drill core. With surface grab samples grading up 10,374 g/t gold and channel samples up to 32.96 g/t gold across 11.6 m, the Hercules gold zones offer top tier targets for the expansion of its historical resources.

For more information, please visit our website at: www.goldnfuturesmineralcorp.com

For further information

Stephen Wilkinson,

President and CEO

Email: contact@goldnfutures.com

The Canadian Securities Exchange accepts no responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements based on assumptions and judgments of management regarding future events or results. Such statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking statements. There is no assurance the private placement, property option, change of board or reinstatement of trading referred to above will close on the terms as stated, or at all. The Company disclaims any intention or obligation to revise or update such statements.

Yahoo Finance

Yahoo Finance