Gold is eyeing its best week since March after the jobs report disappoints

Gold prices rose 1% Friday, and were on track to post their best week since March.

A weaker-than-expected jobs report renewed expectations the Fed would embark on a slower rate path.

Gold was headed for its best weekly gain in nine months on Friday after the jobs report showed hiring slowed in November, renewing expectations for the Federal Reserve to pursue a slower rate path next year.

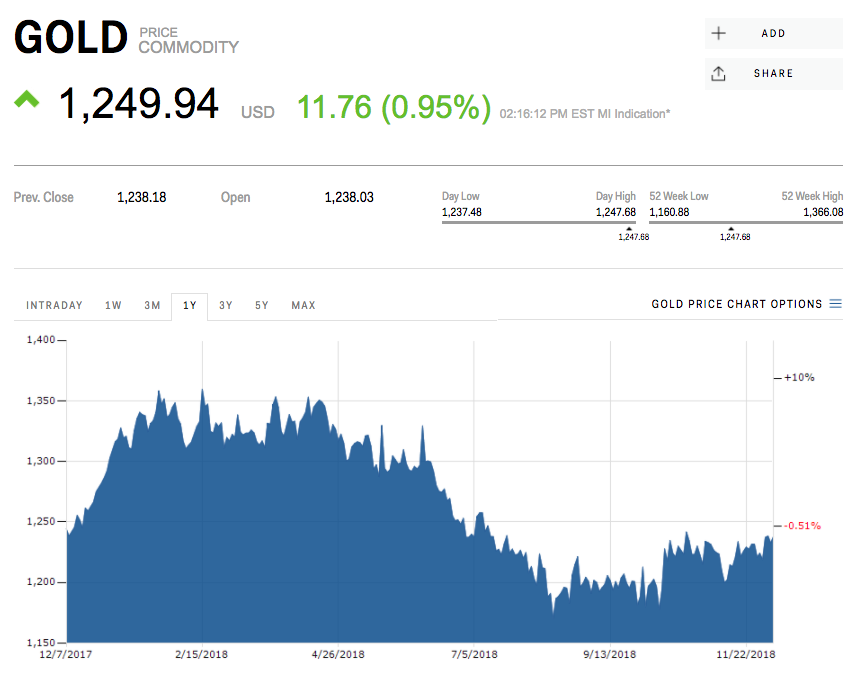

Spot prices of the yellow metal climbed 1% at 2:15 p.m. ET to around $US1,250 per ounce, the highest since July. Meanwhile, the greenback fell against a basket of peers.

"Dollar is down and gold is up slightly - both expected reactions to more dovish expectations for 2019," said Chris Gaffney, president of World Markets. "Jobs data was slightly weaker than expected, alleviating some of the investor anxiety over the future of interest rates."

The Labour Department said early Thursday the economy added 155,000 jobs in November, well below expectations of 198,000, and the unemployment rate held near historic lows at 3.7%. Wages grew at a slightly slower-than-expected pace, rising 0.2% for a second month.

Gaining about 2% this week, gold prices are on track for the best seven-day stretch since March, according to Reuters.

Gold prices was down 0.5% over the past year.

Now Read:

Yahoo Finance

Yahoo Finance