What’s Going to Happen to US Yields from Now on?

US yields have rocketed higher in early October, with the whole yield curve pushing to new multi-year highs. The 10-year yield flew to fresh 7-year highs, while the 30-year yield was at levels last seen in September 2014.

The economic momentum in the US seems to be accelerating further, despite some missing data and the latest ISM surveys, which show that managers are still overly optimistic about future economic prospects. Moreover, the Federal Reserve appears ready to hike rates in December and to continue to raise the rates at least three times in 2019.

The latest FOMC minutes show that some of the FOMC members want to bring the fed funds rate even higher than the projected neutral rate, which could mean that the Fed may want to have monetary policy slightly restrictive for some time. In addition, the central bank may continue to sell bonds and MBS from its balance sheet in the quantitative tightening process, with a monthly volume of around 50 bln. USD.

This may indicate that better times might be ahead of us, however, recent market development has two big issues.

Firstly, it’s the very oversold bond market, with aggregate treasury futures net speculative positions at record lows at around -1.84 million (although up from -2.0 million at the start of the month), which could be a big problem if bonds start to move higher (and yields lower). If the short squeeze does emerge, for example, when economic activity suddenly slows down, this could be a very big issue for all the people who are short US bonds, as prices might surge and yields may crash. Shorting bonds at current levels (and hoping for another leg higher in yields) might prove to be dangerous.

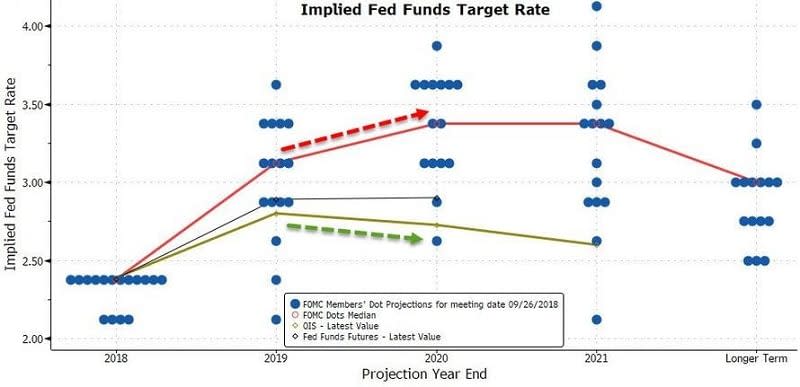

Moreover, the latest Fed dot plot projections imply that three more hikes could occur in the next year and therefore, the Fed funds rate could be at around 3.50 percent in a year from now. This is all very optimistic, once again, but the market – specifically the interest rate derivatives market – does not agree and it expects the Fed to not raise or cut rates in 2019.

Why? Well, the economic momentum is expected to slow down in 2019 – almost every economist has predicted this fact. The latest boost from tax cuts and fiscal stimulus may most likely fade and higher interest rates, along with the “running out of steam mantra” might lead to slower GDP growth, just like the situation the Eurozone is currently experiencing. Should this happen, US bonds could be once again the winning trade, especially after the unwinding of the record short positions.

One more thing – according to the latest inflation data from the US – inflation seems to be slowing down, which could be another signal that shows that bonds are promising at the current levels. Combined with the latest drop in industrial commodities, such as lumber, copper, and silver, the economic cycle might really be hitting its peak. That is, and always has been, very good for US bonds. Let’s wait and see how this situation will be resolved.

This article was written by Peter Bukov, one of TeleTrade’s leading analysts.

This article was originally posted on FX Empire

More From FXEMPIRE:

Precious Metals Erase Early Gains and is on Steady Decline over Strong US Greenback

Price of Gold Fundamental Daily Forecast – Prices Being Suppressed by Stock Market Strength

Chinese Stocks Soar on Stimulus Hopes; Italy, US-Saudi Tension and Oil Prices Remain in Focus

AUD/USD Forex Technical Analysis – October 22, 2018 Forecast

Yahoo Finance

Yahoo Finance