GoDaddy (GDDY) Q3 Earnings Beat, Revenues Match Estimates

GoDaddy Inc. (GDDY reported third-quarter 2019 adjusted earnings of 42 cents per share, surpassing the Zacks Consensus Estimate of 22 cents. Also, the bottom line was up from 8 cents in the year-ago quarter.

The company generated revenues of $760.5 million, up 11.9% year over year or 13.3% on a constant-currency basis. The reported figure was in line with the Zacks Consensus Estimate. The revenue growth was driven by strong performance of its product segments.

Following better-than-expected third-quarter results, its share price was up more than 9%.

Segmental Revenues

GoDaddy generates revenues from three segments — Domain, Hosting and Presence, & Business Applications.

Domain: The company generated revenues of $345.3 million (45.4% of total revenues) from this segment. The figure improved 11.6% from the year-ago quarter driven by strong liquid domain aftermarket and renewals.

Hosting and Presence: This segment generated revenues of $285 million (37.5% of revenues), increasing 8.3% on a year-over-year basis. The revenue growth can be primarily attributed to robust feature engagements, bookings and appointments within this segment. Further, well-performing GoCentral remained a major positive.

Business Applications: Revenues from this segment came in at $130.2 million (17.1% of revenues), increasing 21.9% year over year.

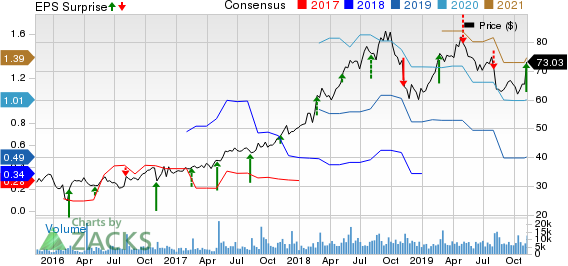

GoDaddy Inc. Price, Consensus and EPS Surprise

GoDaddy Inc. price-consensus-eps-surprise-chart | GoDaddy Inc. Quote

Other Details

The company’s customer base reached 19.1 million at the end of the third quarter. Notably, the figure was up 4.6% from the prior-year quarter. Growing website adoption in emerging markets aided the growth of its customer base. Average revenue per user was $155 in the reported quarter, up 7.1% on a year-over-year basis, attributable to solid momentum across international markets served by the company.

International revenues were $254.3 million in the third quarter, up 7.8% year over year or approximately 11.7% on a constant-currency basis.

Booking

GoDaddy uses total bookings as a performance measure, since payment is usually collected at the time of sale, and recognizes revenues ratably over the term of customer contracts. In the third quarter, total bookings of $851 million increased 14.7% year over year or 15.7% on a constant-currency basis.

Operating Results

Gross margin was 65.2%, down 140 basis points from the prior-year quarter.

Operating expenses (technology and development, marketing and advertising, & general and administrative) of $268.2 million decreased 1.4% year over year.

Balance Sheet & Cash Flow

At the end of the third quarter, total cash and cash equivalents, along with short-term investments were $990.2 million compared with $1.2 billion in second-quarter 2019. Accounts and other receivables were $29 million compared with $24.8 million in the second quarter.

Total debt was $2.4 billion and net debt was $1.4 billion at the end of the third quarter.

Net cash provided by operating activities was $200.2 million compared with $161.3 million in the second quarter.

Additionally, adjusted free cash flow was $191.3 million during the reported quarter.

Guidance

For full-year 2019, management expects revenues within $2.98-$2.99 billion, indicating year-over-year growth of approximately 12%. The Zacks Consensus Estimate for full-year revenues is pegged at $2.99 billion.

Additionally, free cash flow in 2019 is projected between $730 million and $740 million, suggesting year-over-year growth of 18-19%.

Zacks Rank and Stocks to Consider

GoDaddy currently carries a Zacks Rank #4 (Sell). Some better-ranked stocks in the broader technology sector include Stamps.com Inc. STMP, AMETEK, Inc. AME, and Carvana Co. CVNA. While Stamps.com sports a Zacks Rank #1 (Strong Buy), AMETEK and Carvana carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Stamps.com, AMETEK and Carvana is currently projected at 15%, 10.91% and 9%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stamps.com Inc. (STMP) : Free Stock Analysis Report

GoDaddy Inc. (GDDY) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance