Some GNC Holdings (NYSE:GNC) Shareholders Have Taken A Painful 94% Share Price Drop

While it may not be enough for some shareholders, we think it is good to see the GNC Holdings, Inc. (NYSE:GNC) share price up 18% in a single quarter. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Five years have seen the share price descend precipitously, down a full 94%. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The real question is whether the business can leave its past behind and improve itself over the years ahead.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for GNC Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

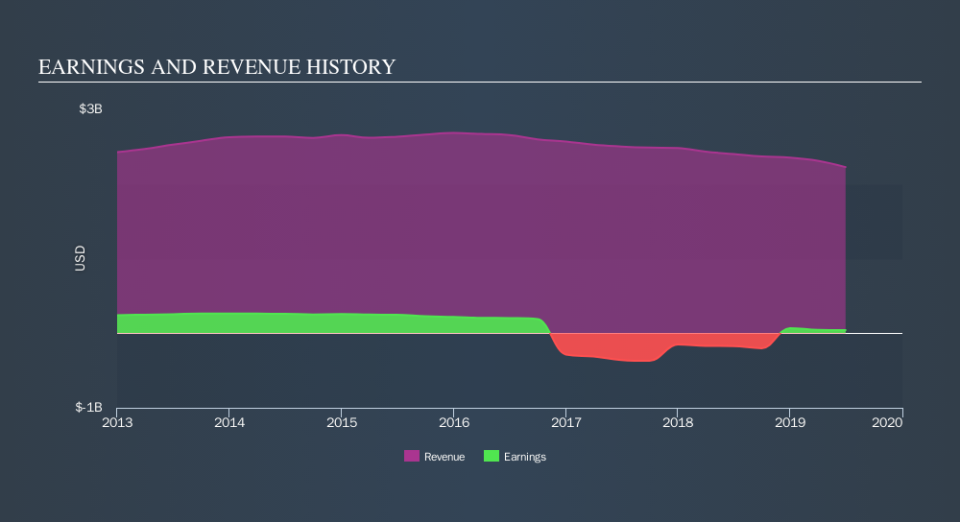

During five years of share price growth, GNC Holdings moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

It could be that the revenue decline of 3.1% per year is viewed as evidence that GNC Holdings is shrinking. This has probably encouraged some shareholders to sell down the stock.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that GNC Holdings has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling GNC Holdings stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

GNC Holdings shareholders are down 31% for the year, but the market itself is up 14%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 43% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Before spending more time on GNC Holdings it might be wise to click here to see if insiders have been buying or selling shares.

But note: GNC Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance