Globus Medical (GMED) Misses on Q1 Earnings and Revenues

Globus Medical, Inc. GMED reported first-quarter 2020 adjusted earnings per share (EPS) of 29 cents, which missed the Zacks Consensus Estimate by 27.5%. The metric also declined 18.9% from the year-ago figure.

The adjusted EPS excludes certain non-recurring expenses like amortization of intangibles and acquisition-related costs.

Without the adjustments, the company registered GAAP earnings of 25 cents per share, reflecting 24.2% decline from the year-ago quarter.

First-quarter 2020 worldwide sales totaled $190.6 million, up 4.2% (up 4.4% at constant exchange rate or CER) year on year. The reported figure, however, missed the Zacks Consensus Estimate by 4.7%.

The company had estimated around $20 million of COVID-19-related adverse impact on the quarter’s sales.

Quarterly Details

Sales generated in the United States, including robotic, improved 7.4% year over year on continued growth in Musculoskeletal business.

Meanwhile, international sales declined 9.3% from the year-earlier quarter (down 8.3% at CER).

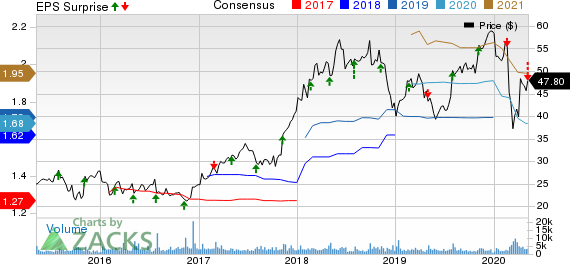

Globus Medical Inc Price, Consensus and EPS Surprise

Globus Medical Inc price-consensus-eps-surprise-chart | Globus Medical Inc Quote

Moreover, Musculoskeletal Solutions products generated revenues of $182.5 million, up 3.8% year over year. Enabling Technologies product revenues of $8.04 million in the quarter reflect an 11.8% improvement from the prior-year figure.

Margin

Gross profit in the reported quarter edged up 0.4% year over year to $141.7 million. Gross margin however, contracted 277 basis points (bps) to 74.4% on a 16.8% rise in cost of goods sold to $48.9 million.

Selling, general and administrative expenses in the reported quarter were $93.5 million, up 9% from the year-ago quarter. Research and development expenses rose 7.5% to $15.4 million.

Operating profit declined 20% year over year to $32.8 million, while operating margin shrunk 522 bps to 17.2% in the quarter.

Cash Position

Globus Medical exited the first quarter with cash and cash equivalents, and short-term marketable securities of $276.9 million compared with $311.5 million at the end of 2019. First-quarter net cash provided by operating activities was $42.3 million compared with the year-ago period figure of $39.2 million.

2020 Guidance

Globus Medical is currently unable to predict the specific extent or duration of the pandemic’s impact on the company’s financial and operating results. Accordingly, on Apr 16, Globus Medical withdrew its previously announced 2020 guidance.

Our Take

Globus Medical posted lower-than-expected results for the quarter ended March. COVID-19 impact dented the quarter’s sales by more than 10%. However, on a year-over-year basis, Musculoskeletal Solutions and Enabling Technologies both registered growth.

Margin contractions pose concern.

Zacks Rank & Key Picks

Currently, Globus Medical carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are Aphria Inc. APHA, Biogen Inc. BIIB and Eli Lilly and Company LLY.

Aphria carries a Zacks Rank #2 (Buy) at present. It reported third-quarter fiscal 2020 adjusted earnings per share (EPS) of 2 cents in contrast to the Zacks Consensus Estimate of a loss of 4 cents. Net revenues of $64.4 million outpaced the consensus estimate by 14.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biogen currently carries a Zacks Rank #2. It reported first-quarter 2020 adjusted EPS of $9.14, surpassing the Zacks Consensus Estimate by 18.1%. Revenues of $3.53 billion outpaced the consensus mark by 3.2%.

Eli Lilly sports a Zacks Rank #1. It delivered first-quarter 2020 EPS of $1.75, outpacing the Zacks Consensus Estimate by 12.9%. Revenues of $145.3 million surpassed the consensus estimate by 6.3%.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc (BIIB) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Globus Medical Inc (GMED) : Free Stock Analysis Report

Aphria Inc (APHA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance