Global Payments (GPN) Beats on Q3 Earnings, Ups 2019 View

Global Payments, Inc. GPN came up with third-quarter 2019 adjusted earnings of $1.70 per share, beating the Zacks Consensus Estimate by 2.4% and improving 18.1% year over year.

The quarterly results reflect higher revenues, partly offset by increase in expenses.

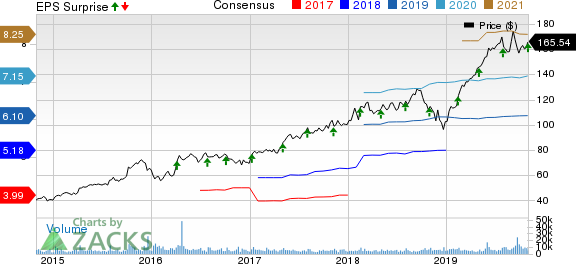

Global Payments Inc. Price, Consensus and EPS Surprise

Global Payments Inc. price-consensus-eps-surprise-chart | Global Payments Inc. Quote

Behind the Headlines

The company’s revenues of $1.11 billion were up 27% year over year. The top line beat the Zacks Consensus Estimate by 13%.

Total operating expenses of $931.9 million increased 47% year over year, led by higher cost of services as well as selling, general and administration expenses.

Adjusted operating margin expanded 80 basis points to 33.8%.

Growth Across Segments

North America: Adjusted net revenues plus network fees of $877.1 million increased 16% year over year. Operating income of $312.5 million was up 21% year over year.

Europe: Adjusted net revenues plus network fees of $204.7 million grew 5.6% year over year. Operating income of $99.4 million rose 7.9% year over year.

Asia-Pacific: Adjusted net revenues plus network fees of $79.1 million climbed 4.9% year over year. Operating income of $26.7 million improved 5.3% year over year.

Balance Sheet Position

Total cash and cash equivalents as of Sep 30, 2019 were $2.13 billion, up 75% from Dec 31, 2018.

Long-term debt as of Sep 30, 2019 was $9 billion, up 79% from year-end 2018 level.

Net cash provided by operating activities for the third quarter of 2019 was $1.35 billion, up 104% year over year.

Business Update

During the quarter, the company completed the acquisition of Total System Services. The company expects annual run-rate revenue synergies of at least $125 million and annual run-rate expense synergies of at least $325 million within three years.

Global Payments also forged partnership with Desjardins, one of Canada’s leading financial institutions, and Citi, one of the largest money center banks globally in the quarter.

2019 Outlook

The company raised its earnings outlook to the range of $6.12-$6.20, indicating growth of 18-20% over 2018 (compared with the earlier guidance of $6.00-$6.15). For 2019, it expects adjusted net revenues plus network fees in the band of $5.6-$5.63 billion, suggesting growth of 41-42%.

Zacks Rank and Performances of Other Industry Players

Global Payments carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other companies in the same space that have reported earnings for the quarter ending Sep 30, 2019 are Visa Inc. V, American Express Co. AXP and Discover Financial Services DFS, each beating their respective Zacks Consensus Estimate by 2.8%, 0.48% and 3.3%, respectively.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Discover Financial Services (DFS) : Free Stock Analysis Report

American Express Company (AXP) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

Global Payments Inc. (GPN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance