Glaxo (GSK) Lags Q4 Earnings & Revenue Estimates, Stock Down

GlaxoSmithKline plc GSK reported fourth-quarter 2019 adjusted earnings of 64 cents per American depositary share, which missed the Zacks Consensus Estimate of 68 cents. Adjusted earnings were down 21% reportedly and 16% at constant exchange rate (“CER”), year over year.

Shares of Glaxo were down almost 4.4% on Feb 5, following the earnings release. However, the stock has gained 11% in the past year compared with the industry’s 12.6% increase.

Quarterly revenues rose 9% on a reported basis and 11% at CER to $11.46 billion (£8.9 billion), driven by strong performance across Vaccines and Consumer Healthcare segments. However, the top line missed the Zacks Consensus Estimate of $11.77 billion.

Glaxo reports financial figures under three segments: Pharmaceuticals, Vaccines and Consumer Healthcare.

Full Year Results

The company’s adjusted earnings per ADS were $3.22 for the full year, up 1% at CER. Full-year revenues rose 8% at CER to approximately $43.9 billion.

All growth rates mentioned below are on a year-over-year basis and at CER.

Respiratory Drugs Drive Pharmaceuticals Segment Sales

Pharmaceuticals sales were down 4% at CER as Respiratory segment growth was offset by sales decline at Established Pharmaceuticals segment. Sales in the United States were down 6%. Sales in European markets were down 3% at CER while it remained flat in international markets.

Respiratory sales were up 9% at CER mainly driven by increase in sales of Trelegy Ellipta and Nucala across European and international markets. Nucala sales were up 28% at CER during the quarter. Sales of Nucala grew 24% and 32% in the United States and Europe, respectively. In the International markets, sales of Nucala increased 36%. Trelegy Ellipta sales more than doubled year over year driven by an increase in market share in the United States..

Relvar/Breo Ellipta registered a decline of 19% in sales during the fourth quarter driven by steep decline in U.S. sales. Sales of Relvar/Breo Ellipta decreased 41% in the United States due to impact of Advair generic and competitive pricing pressure. The launch of generic versions of Glaxo key respiratory drug, Advair, has created significant pricing pressure in inhaled corticosteroid (“ICS”)/long-acting beta-agonist (“LABA”) market in the United States. The pricing pressure is expected to continue in 2020. However, sales of Relvar/Breo Ellipta increased 6% and 14% in European and international markets, respectively.

HIV sales remained flat year over year at CER as growth in sales of Juluca and Dovato was completely offset by decline in sales of Tivicay. Sales of dolutegravir franchise were up 2%, while sales from remaining drugs, comprising 4% of HIV portfolio, declined 30% at CER. The company expects sales of HIV segment to remain flat in 2020 as well.

The dolutegravir franchise comprises two three-drug regimens — Triumeq and Tivicay — and two two-drug regimens — Juluca and Dovato. Dovato was launched in the United States in April followed by launch in Europe in the third quarter of 2019. The growth in sales of Juluca and Dovato in the fourth quarter was partially offset by decline in sales of Triumeq and Tivicay due to transition of patients from three-drug regimens to two-drug regimens.

Sales of the dolutegravir franchise were up 2% in the U.S. market as transition to the new two-drug portfolio was offset by a net price benefit. Sales of this franchise were down 1% in Europe as strong volume growth was more than offset by price erosion and couple of other factors. In international markets, sales were up 11% at CER mainly driven by Tivicay. Please note that Glaxo markets Juluca in collaboration with J&J JNJ.

Sales of Established Pharmaceuticals declined 14% due to lower sales of Advair, partially offset by strong uptake of authorized generic version of Ventolin. Advair lost 64% of sales year over year in the United States while Seretide sales were down 18% in Europe due to generic competition. Sales of Ventolin were up 8% during the quarter.

We remind investors that Mylan MYL launched the first generic version of Advair, Wixela Inhub, in the United States in February.

Immuno-inflammation drugs like Benlysta rose 24% in the quarter, with U.S. sales growing 25%. The company is planning to file regulatory application for label expansion of Benlysta in lupus nephritis in the first half of 2020.

Oncology sales were £66 million, comprising sales of PARP inhibitor, Zejula, which was acquired from TESARO in 2019, compared with £64 million in the third quarter.. During the quarter, the company submitted regulatory application for label expansion of Zejula as first-line maintenance treatment for ovarian cancer patients.

Consumer Healthcare Sales Up

Sales in the Consumer Healthcare segment increased 37% at CER, primarily driven by Pfizer’s (PFE) legacy brands. Glaxo formed a new joint venture (“JV”) with Pfizer PFE in August 2019 to create the world’s largest Consumer Healthcare business. Fourth-quarter sales of this segment include the first full quarter of legacy Pfizer brand sales, arising after the creation of the JV. Sales of Wellness, Oral health and Skin health categories increased 31%, 7% and 32%, respectively, in the quarter. Nutrition sales more than doubled in the fourth quarter.

On a pro-forma basis, sales in the Consumer Health segment were flat at CER The company may revise the category structure for this segment’s report from the first quarter of 2020.

Vaccines Segment Growth Continues

Sales from the Vaccines segment were impressive, up 21% at CER, primarily driven by strong growth of new shingles vaccine, Shingrix and impressive performance of meningitis vaccines, partially offset by decline in sales of influenza vaccines. Shingrix sales more than doubled to £532 million in the reported quarter, driven by strong uptake in the United States.

Although growth trend of Bexsero slowed down this quarter with sales increasing 5%, sales of another meningitis vaccine, Menveo were up 57% due to higher demand in international markets. However, sales of influenza vaccine Fluarix and Established vaccines were down 26% and 3%, respectively, year over year.

Operating Expenses Up

Selling, general and administration (SG&A) costs increased 23% (11% on pro-forma basis) year over year to £2.8 billion. The rise in SG&A costs was driven by increased commercial activities to support launches and costs related to the acquisition of TESARO, partly offset by cost-saving initiatives and benefits of restructuring in Pharmaceuticals segment.

Research and development (R&D) expenses were up 16% (13% on pro-forma basis) to £1.16 billion, reflecting increased investments to support progress of clinical studies, especially those on Zejula. Glaxo has 39 new medicines, including 15 vaccines, in different development stages.

2020 Guidance

Glaxo provided guidance for adjusted earnings in 2020. It currently expects adjusted EPS to decline 1% to 4% at CER, year over year, in 2020.

Key Developments

Glaxo initiated a two-year program to split itself into two standalone companies. The new Glaxo will be a biopharma company focusing on developing new treatments. The Consumer Healthcare segment will become a separate company.

The separation program is expected to generate £800 million in annual savings by 2022 and cost £2.4 billion.

Our Take

Glaxo missed on earnings and sales in the fourth quarter. Sales of the company’s established drugs continued to decline. However, the company’s new products from every segment performed well in the reported quarter, especially Shingrix. However, the company stated on its earnings release that it has limited opportunity for further growth in supply capacity for Shingrix, which may impact sales in the future quarters. Meanwhile, it expects new drug launches to boost sales of Pharmaceuticals unit in 2020.

The company boosted its oncology portfolio with the acquisition of TESARO and a collaboration agreement with Germany-based Merck KgaA in 2019. These transactions along with restructuring initiatives in the Consumer Health segment should help the company to offset slowdown in sales of legacy drugs. However, loss of Advair sales due to generic competition and competitive pricing will continue to hamper revenues.

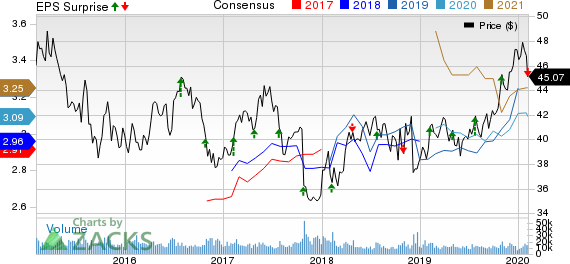

GlaxoSmithKline plc Price, Consensus and EPS Surprise

GlaxoSmithKline plc price-consensus-eps-surprise-chart | GlaxoSmithKline plc Quote

Zacks Rank

Glaxo currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

GlaxoSmithKline plc (GSK) : Free Stock Analysis Report

Mylan N.V. (MYL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance