Geron (GERN) Wins FDA Approval for Blood Cancer Drug, Stock Up

Geron Corporation GERN obtained FDA approval for pipeline candidate imetelstat for the treatment of adult patients with low to intermediate-1 risk myelodysplastic syndromes (MDS) with transfusion-dependent anemia requiring four or more red blood cell units over eight weeks.

The agency approved the drug for patients who either did not respond or lost response to or are ineligible for erythropoiesis-stimulating agents (ESA).

Shares of the company rose 18% on Jun 7, on the news. The FDA approved imetelstat, a telomerase inhibitor, under the brand name Rytelo for the above-mentioned indication.

Lower-risk (LR) MDS is a blood cancer that often progresses to require increasingly intensified management of key symptoms such as anemia and resulting fatigue. Patients suffering from this cancer become dependent on red blood cell (RBC) transfusion.

Rytelo works by inhibiting telomerase enzymatic activity. Telomeres are protective caps at the end of chromosomes that naturally shorten each time a cell divides. Abnormal bone marrow cells often express the enzyme telomerase, which rebuilds those telomeres, allowing for uncontrolled cell division in LR MDS patients.

Current treatment options for those failing ESA are limited to select sub-populations. There is a great need for treatments that can provide extended and continuous RBC transfusion independence.

The FDA approval was based on results from the late-stage IMerge study wherein Rytelo demonstrated significantly higher rates of red blood cell transfusion independence (RBC-TI) versus placebo for at least eight consecutive weeks and 24 weeks. The IMerge trial met its primary and key secondary endpoints.

The results also showed that RBC-TI was durable and sustained in the Rytelo-treated population, with a median RBC-TI duration for eight-week responders and 24-week responders of approximately 1 year and 1.5 years, respectively. 28% of imetelstat-treated patients compared to 3% on placebo obtained a statistically significant improvement in the key secondary endpoint of at least 24-week RBC-TI.

The most common Grade 3/4 adverse reactions were thrombocytopenia and neutropenia, which were generally manageable and short-lived.

Investors also cheered the decision as the FDA approval did not come with any black box warnings.

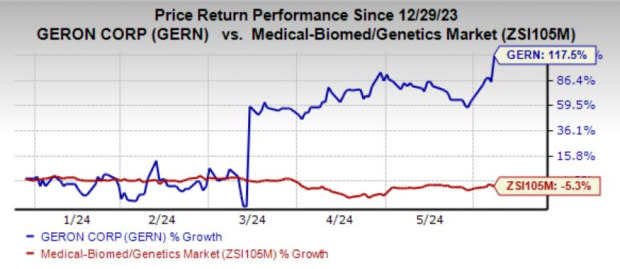

Shares of GERN have skyrocketed 117.5% year to date against the industry’s 5.3% decline.

Image Source: Zacks Investment Research

The stock surged significantly in March 2024, after the FDA’s Oncologic Drugs Advisory Committee voted in favor (12:2) of the clinical benefit/risk profile of imetelstat for the above-mentioned indication.

While the approval is a significant boost for the company, successful commercialization holds the key, given the complexity of the targeted population.

GERN is also conducting a phase III study on imetelstat in JAK-inhibitor relapsed/refractory myelofibrosis.

Please note that Bristol Myers Squibb’s BMY Reblozyl is also indicated in the United States for treating ESA-naïve anemia in adult patients with very low to intermediate-risk MDS who may require regular RBC transfusions.

The uptake of Reblozly, which is also approved for the treatment of anemia in adult patients with beta-thalassemia who require regular RBC transfusions, has been strong. Reblozyl is expected to be a strong contributor to BMY’s top line, which is currently facing the brunt of generic coemption for key drugs.

BMY expects new drugs like Reblozly and others to help offset this decline.

Zacks Rank and Stocks to Consider

GERN currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the biotech sector are Krystal Biotech, Inc. KRYS and ALX Oncology Holdings ALXO, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for KRYS’ earnings per share has increased 45 cents to $2.06. KRYS beat on earnings in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 21.46%. Shares of Krystal Biotech have surged 33.6% year to date.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73.

ALX Oncology beat on earnings in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 8.83%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Geron Corporation (GERN) : Free Stock Analysis Report

Krystal Biotech, Inc. (KRYS) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance