GER30 Carves Outside Day, Threatens Bullish Momentum Ahead of ECB

DailyFX.com -

Talking Points:

- GER30 Bearish Outside Day May Force Larger Pullback Ahead of ECB Meeting.

- GBP/USD 1.5300 Support in Focus Ahead of BoE Interest Rate Decision.

- USDOLLAR Struggles Ahead of ADP Employment, ISM-Non Manufacturing.

For more updates, sign up for David's e-mail distribution list.

GER30

Chart - Created Using FXCM Marketscope 2.0

Bearish Outside Day (Engulfing) raises the risk of seeing a larger correction in GER30 especially as the Relative Strength Index (RSI) struggles to retain the bullish momentum.

Nevertheless, may see risk sentiment track higher following the European Central Bank (ECB) interest rate decision should President Mario Draghi highlight a dovish forward-guidance for monetary policy.

Break & close below 11,261 (23.6% retracement) will favor a move into the Fibonacci overlap from 11,122 (100% expansion) to 11,156 (38.2% expansion).

GBP/USD

GBP/USD may continue to track sideways following the failed attempt to push back above former support, while the Bank of England (BoE) is widely expected to retain its current policy in March.

Will retain a flat bias for GBP/USD amid the string of closes above 1.5300 (23.6% retracement) to 1.5320 (78.6% retracement), but may see the British Pound outperform against its non-USD counterparts as a growing number of BoE officials prepare U.K. households and businesses for higher borrowing-costs.

DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long GBP/USD since February 26, with the ratio currently standing at +1.31.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: GBP/USD Mixed Signals

Australian Dollar Spec Short Position is Largest Since January 2014

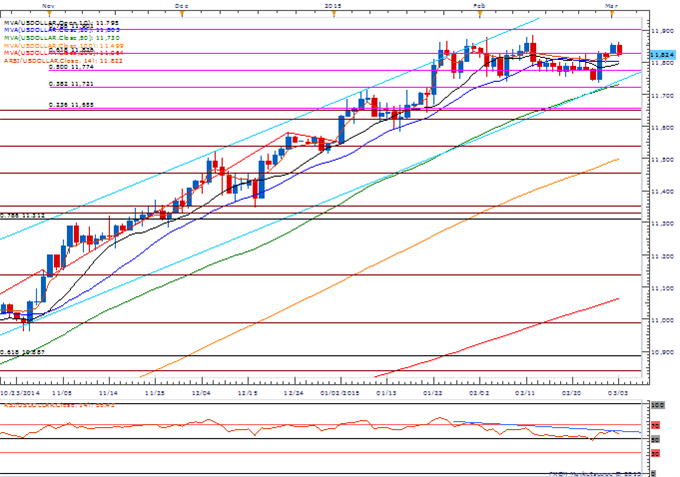

USDOLLAR(Ticker: USDollar):

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 11824.87 | 11862.27 | 11816.62 | -0.27 | 87.98% |

Chart - Created Using FXCM Marketscope 2.0

Dow Jones-FXCM U.S. Dollar may chop around in a larger range should it fail to close above 11,826 (61.8% expansion); still waiting for a break of the bearish RSI momentum to favor a larger advance.

Outcome of ADP Employment and the ISM Non-Manufacturing report may influence market expectations for Non-Farm Payrolls (NFP) as participants now see employment increasing 235K in February.

Lack of momentum to hold/close above 11,826 may spur another test of the range support/February low (11,736).

Join DailyFX on Demand for Real-Time SSI Updates!

Release | GMT | Expected | Actual |

ISM New York (FEB) | 9:45 | -- | 63.1 |

IBD/TIPP Economic Optimism Survey (MAR) | 15:00 | 47.8 | 49.1 |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance