General Motors (GM) to Post Q4 Earnings: What's in the Cards?

General Motors GM is slated to release fourth-quarter 2019 results on Feb 5, before the opening bell. The Zacks Consensus Estimate for the quarter is a loss of 11 cents on revenues of $35.25 billion.

The automaker delivered better-than-anticipated results in the last reported quarter on higher-than-expected profits in the North American segment. The company has an impressive record of surpassing estimates in each of the trailing four quarters, the average beat being 27%.

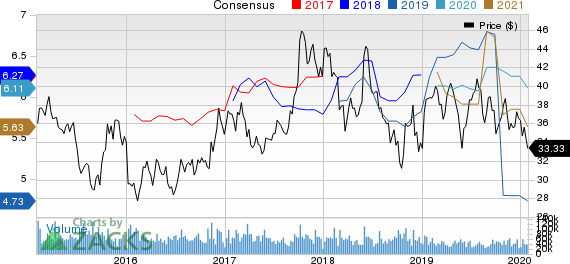

General Motors Company Price and Consensus

General Motors Company price-consensus-chart | General Motors Company Quote

Investors expect General Motors to top earnings estimates this season as well. However, our model does not indicate an earnings beat for the company for the to-be-reported quarter.

Which Way are the Estimates Headed?

The Zacks Consensus Estimate for a loss of 11 cents a share has been widened by 5 cents in the last seven days. This compares unfavorably with the year ago earnings of $1.43 a share. The Zacks Consensus Estimate for fourth-quarter revenues is pegged at $35.25 billion, suggesting a fall of 8.20% year on year.

Factors that Might Have Influenced Q4 Performance

General Motors’ customer deliveries in the United States in the fourth quarter decreased 6.3% from the prior-year period to 735,909 deliveries. The Zacks Consensus Estimate for vehicle sales in the International and North America segments are pegged at 290,000 and 612,000 units for the to-be-reported quarter, indicating a decline from the 316,000 and 896,000 units, respectively, reported in the year-ago period. While the six-week long UAW strike has likely affected North America sales, economic slowdown and trade tussle might have marred vehicle sales in China.

However, the consensus estimate for the Financial segment’s net sales is pegged at $3,604 million, suggesting an 0.14% year-over-year improvement.

Therefore, while increasing sales from the Financial segment is likely to have aided its earnings, weak performance of the GMI (General Motors International) and GMNA (General Motors North America) units may have dented the overall performance in the December-end quarter.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for General Motors in the quarter to be reported. This is because it doesn’t have the right combination of the two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: General Motors has an Earnings ESP of -9.09%. This is because the Most Accurate Estimate of a loss of 12 cents comes in a cent widerthan the Zacks Consensus Estimate.

Zacks Rank: General Motors currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks to Consider

Here are some companies, which according to our model have the right combination of elements to post an earnings beat in the fourth quarter.

LKQ Corporation LKQ is scheduled to report fourth-quarter figures on Feb 20. The stock has an Earnings ESP of +1.49% and carries a Zacks Rank #3, currently.

Visteon Corporation VC is set to release quarterly numbers on Feb 20. The company has an Earnings ESP of +2.63% and carries a Zacks Rank of 3, at present.

Agnico Eagle Mines Limited AEM has an Earnings ESP of +0.47% and is a Zacks #3 Ranked player. The company is slated to release earnings results on Feb 13.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Motors Company (GM) : Free Stock Analysis Report

Visteon Corporation (VC) : Free Stock Analysis Report

LKQ Corporation (LKQ) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance