General Dynamics' (GD) Q4 Earnings Top, Revenues Rise Y/Y

General Dynamics Corporation GD reported its fourth-quarter 2022 earnings per share (EPS) of $3.58, which beat the Zacks Consensus Estimate of $3.53 by 1.4%. Quarterly earnings increased 5.6% from $3.39 per share in the year-ago quarter.

For full-year 2022, the company reported earnings of $12.19 per share, which came in 5.5% higher than the year-ago figure of $11.55. The full-year bottom line also surpassed the Zacks Consensus Estimate for earnings of $12.14 per share by 0.4%.

Our model projected adjusted earnings of $3.44 per share for the fourth quarter and $12.06 per share for full-year 2022.

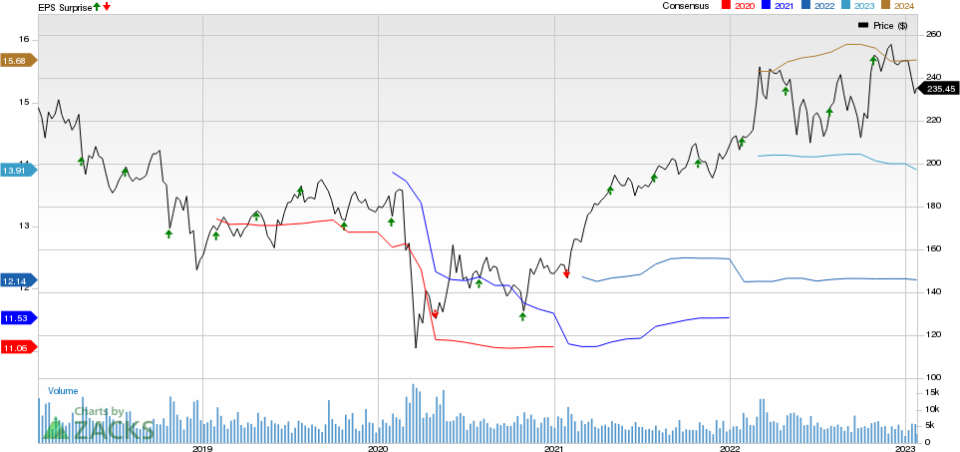

General Dynamics Corporation Price, Consensus and EPS Surprise

General Dynamics Corporation price-consensus-eps-surprise-chart | General Dynamics Corporation Quote

Total Revenues

General Dynamics’ fourth-quarter revenues of $10,851 million beat the Zacks Consensus Estimate of $10,674 million by 1.7%. Revenues also improved 5.4% from the year-ago quarter.

For full-year 2022, the company recorded revenues worth $39.41 billion, up 2.4% from 2021’s reported figure. The full-year revenues also beat the Zacks Consensus Estimate of $39.22 billion.

Our model projected net sales of $10.60 billion for the fourth quarter and $39.16 billion for 2022.

Segmental Performance

Aerospace: The segment reported revenues of $2,450 million, down 4.3% year over year. Operating earnings of $337 million declined 4.8% from the prior-year quarter’s $354 million.

Marine Systems: This segment’s revenues rose 3.4% from the prior-year quarter to $2,969 million. Operating earnings were up 0.9% from the year-ago quarter to $237 million.

Technologies: The segment’s reported revenues of $3,253 million improved 9.3% year over year. Operating earnings of $340 million increased 1.8% from the prior-year quarter’s $334 million.

Combat Systems: The segment’s revenues of $2,179 million were up 15.5% from the year-ago quarter’s $1,887 million. Operating earnings also improved 18.1% year over year to $332 million.

Operational Highlights

For the reported quarter, GD’s operating margin contracted 20 basis points from the year-ago quarter’s reported figure to 11.3%.

For the quarter under review, General Dynamics’ operating costs and expenses went up 5.7% from the year-ago period to $9.6 million.

Interest expenses for the reported quarter declined 8.6% year over year to $85 million.

Backlog

General Dynamics recorded a total backlog of $91.10 billion, up 2.6% from third-quarter 2022’s backlog of $88.80 billion. The funded backlog at fourth-quarter end was $67.15 billion.

Financial Condition

As of Dec 31, 2022, General Dynamics’ cash and cash equivalents were $1,242 million compared with $1,603 million as of Dec 31, 2021.

Long-term debt as of Dec 31, 2022 was $9,243 million, down from the 2021-end level of $10,490 million.

As of Dec 31, 2022, GD generated cash from operating activities of $4,579 million, up from $4,271 million generated in the year-ago period.

Zacks Rank

General Dynamics currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Recent Defense Releases

Lockheed Martin Corporation LMT reported its fourth-quarter 2022 adjusted earnings of $7.79 per share, which surpassed the Zacks Consensus Estimate of $7.41 by 5.1%. The bottom line also improved 7.9% year over year.

In the reported quarter, net sales amounted to $19 billion, which surpassed the Zacks Consensus Estimate of $18.25 billion by 4.1%. The top line rose 7.3% from the year-ago quarter’s reported figure of $17.7 billion.

Raytheon Technologies Corporation’s RTX fourth-quarter 2022 adjusted earnings per share (EPS) of $1.27 beat the Zacks Consensus Estimate of $1.24 per share by 2.4%. Moreover, the bottom line improved 18% from the year-ago quarter’s tally.

Raytheon Technologies’ fourth-quarter sales of $18,093 million missed the Zacks Consensus Estimate of $18,196 million by 0.6%. The sales figure, however, rose 6% from $17,044 million recorded in the year-ago quarter.

An Upcoming Defense Release

Spirit AeroSystems SPR: It is scheduled to release its fourth-quarter results on Feb 7.

SPR delivered a four-quarter average negative earnings surprise of 73.24%.

The Zacks Consensus Estimate for Spirit AeroSystem’s fourth-quarter bottom line is pegged at a loss of 48 cents per share, which implies a solid improvement from a loss of 84 cents per share incurred in the fourth quarter of 2021.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Spirit Aerosystems Holdings, Inc. (SPR) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance