GE HealthCare (GEHC) Q1 Earnings In Line, Sales Volume Decline

GE HealthCare GEHC reported first-quarter 2024 adjusted earnings per share (EPS) of 90 cents, which aligned with the Zacks Consensus Estimate. However, the bottom line improved 5.9% year over year.

GAAP EPS in the quarter was 81 cents, up 97.6% from the year-ago quarter’s level.

Revenue Details

This Zacks Rank #3 (Hold) company reported revenues of $4.7 billion, down 1.3%, on a reported basis from the prior-year quarter’s recorded number and flat, organically. The decrease in sale volumes was partially offset by positive pricing. The top line missed the Zacks Consensus Estimate by 2.3%.

Although the company’s revenues declined in the first quarter, it is expected to improve in the second half of 2024 on the back of a healthy backlog, orders growth, and positive book-to-bill.

However, lower-than-expected revenues coupled with lower volume raised apprehension among investors, leading to a 9.2% decline in GEHC stock in pre-market trading. However, shares of the company have gained 10.1% against the industry’s 17.9% decline in the past year.

Image Source: Zacks Investment Research

Segmental Details

Imaging

Revenues from this segment totaled $2.47 billion, indicating a year-over-year decline of 1%, reportedly. Organically, revenues remained flat.

Segment EBIT was $240 million, up 26% year over year.

Ultrasound

This segment’s revenues totaled $824 million, down 4% year over year, reportedly as well as organically.

Segment EBIT was $182 million, down 12% year over year.

Patient Care Solutions

Revenues from this segment amounted to $747 million, down 4% from the year-ago quarter’s level, reportedly as well as organically.

Segment EBIT was $81 million, down 25% year over year.

Pharmaceutical Diagnostics

Revenues from this segment amounted to $599 million, up 7% from the year-ago quarter’s level. Organically, revenues improved 8%.

Segment EBIT was $178 million, up 15% year over year.

Margins

Net income margin was 8%, up 10 basis points from the prior-year period’s level, primarily due to benefits from productivity and pricing.

Cash flow from operating activities was $419 million compared with $468 million in the year-ago period.

Financial Position

GEHC exited the first quarter with cash, cash equivalents and investments of $2.56 billion compared with $2.5 billion in the prior quarter.

Total assets declined to $32.21 billion from $32.45 billion in the prior quarter.

The company repaid $150 million of debt in the first quarter of 2024.

2024 Guidance

GE HealthCare reaffirmed its earnings and revenue guidance for 2024.

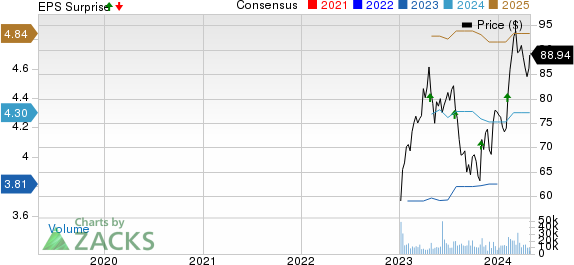

For 2024, the company expects adjusted EPS in the range of $4.20-$4.35, indicating an estimated growth of 7-11%. Revenues are anticipated to improve 4% organically. The Zacks Consensus Estimate for EPS and sales is pegged at $4.30 and $20.34 billion, respectively.

GE HealthCare Technologies Inc. Price, Consensus and EPS Surprise

GE HealthCare Technologies Inc. price-consensus-eps-surprise-chart | GE HealthCare Technologies Inc. Quote

Zacks Rank and Stocks to Consider

GEHC carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the broader medical space are Align Technologies, Inc. ALGN, Becton, Dickinson and Company BDX, popularly known as BD, and Ecolab Inc. ECL.

ALGN, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 9.4%. ALGN’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 5.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ALGN’s shares have gained 2.9% compared with the industry’s 3.9% rise in the past year.

BD, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 9.4%. BDX’s earnings surpassed estimates in three of the trailing four quarters and broke even once, with the average being 4.6%.

BD has lost 11.1% against the industry’s 4.9% rise in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.7%.

Ecolab’s shares have rallied 33.8% against the industry’s 9.3% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

GE HealthCare Technologies Inc. (GEHC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance