GBP/USD Rebound Stalls at Former Support- Bearish RSI Break in Focus

DailyFX.com -

Talking Points:

- GBP/USD Struggles to Retain Bullish RSI Momentum Ahead of BoE Meeting.

- EUR/USD Retail Crowd Turns Net-Long Ahead of March Despite Bearish Break.

- USDOLLAR Holds Monthly Opening Range Ahead of Preliminary 4Q GDP Report.

For more updates, sign up for David's e-mail distribution list.

GBP/USD

Chart - Created Using FXCM Marketscope 2.0

Lack of momentum to break/close above former support zone around 1.5510-1.5550 may highlight a near-term top especially as the RSI struggles to retain the bullish momentum from earlier this year.

Despite expectations of seeing the Bank of England (BoE) retain its current policy at the March 5 meeting, may see a bullish reaction in sterling as Governor Mark Carney continues to prepare U.K. household and businesses for higher borrowing-costs.

A break back below 1.5300 (23.6% retracement) to 1.5320 (78.6% retracement) to negate bullish GBP/USD and raises the risk for a resumption of the bearish trend.

EUR/USD

DailyFX Speculative Sentiment Index (SSI) shows retail crowd has now turned net-long EUR/USD following the slew of U.S. data from earlier this morning; seeing higher opening interest going into the end of the month.

The break of the wedge/triangle favors the approach to ‘sell-bounces’ in EUR/USD as the RSI retains the bearish momentum; may see the European Central Bank (ECB) interest rate decision on March 5 act as a fundamental catalyst for a further decline in EUR/USD should President Mario Draghi show a greater willingness to further embark on the easing cycle.

Close below 1.1185 (23.6% expansion) to 1.1210 (61.8% retracement) raises the risk for fresh yearly lows in EUR/USD.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: USD/CAD On Shaky Ground?

Scalping AUD/USD Opening Range Break- 7850 Support

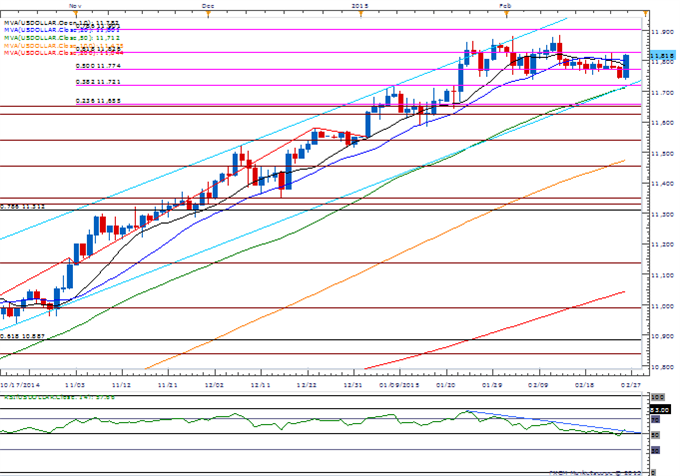

USDOLLAR(Ticker: USDollar):

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 11818.05 | 11823.54 | 11737.29 | 0.58 | 145.57% |

Chart - Created Using FXCM Marketscope 2.0

Dow Jones-FXCM U.S. Dollar looks poised to retain the bullish trend going into March as it holds the monthly opening range, while the RSI threatens the bearish momentum.

Despite the sticky CPI prints, a marked downward revision in the 4Q U.S. Gross Domestic Product (GDP) report may keep the greenback largely range-bound going into the end of the month.

Failure to test 11,721 (38.2%) keeps the bullish setup intact, but need a close below 11,826 (61.8% expansion) to expose the next level of interest around 11,901 (78.6% expansion).

Join DailyFX on Demand for Real-Time SSI Updates!

Release | GMT | Expected | Actual |

Consumer Price Index (MoM) (JAN) | 13:30 | -0.6% | -0.7% |

Consumer Price Index (YoY) (JAN) | 13:30 | -0.1% | -0.1% |

Consumer Price Index ex Food/Energy (MoM) (JAN) | 13:30 | 0.1% | 0.2% |

Consumer Price Index ex Food/Energy (YoY) (JAN) | 13:30 | 1.6% | 1.6% |

Consumer Price Index n.s.a. (JAN) | 13:30 | 233.680 | 233.707 |

Consumer Price Index Core s.a. (JAN) | 13:30 | 239.670 | 239.871 |

Durable Goods Orders (JAN) | 13:30 | 1.6% | 2.8% |

Durable Goods Orders ex Transportation (JAN) | 13:30 | 0.5% | 0.3% |

Non-Defense Capital Goods Orders ex Aircrafts (JAN) | 13:30 | 0.3% | 0.6% |

Non-Defense Capital Goods Shipments ex Aircrafts (JAN) | 13:30 | 0.2% | -0.3% |

Initial Jobless Claims (FEB 21) | 13:30 | 290K | 313K |

Continuing Claims (FEB 14) | 13:30 | 2395K | 2401K |

FHFA House Price Index (MoM) (DEC) | 14:00 | 0.5% | 0.8% |

House Price Purchase Index (QoQ) (4Q) | 14:00 | -- | 1.40% |

Kansas City Fed Manufacturing Activity (FEB) | 16:00 | 3 | 1 |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance