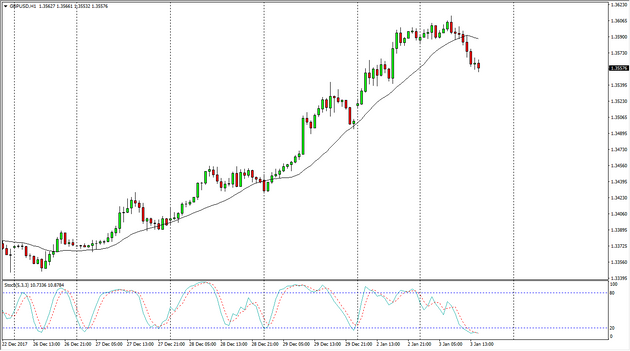

GBP/USD Price Forecast January 4, 2017, Technical Analysis

The British pound initially went sideways during the trading session on Wednesday, but then dropped a bit from there. The 1.3550 level appears to be supportive, and most certainly the 1.35 level will be, as we gapped above there at the open on Tuesday. That’s an area that I think will find plenty of buyers, so it’s only a matter of time before the buyers return as far as I can see. I believe that the uptrend continues, but we do have the jobs number coming on a Friday which of course can cause quite a bit of volatility. I think that the 1.3650 level above is the goal, and breaking above that signifies that the British pound is ready to go much higher. Ultimately, the market should offer a “buy-and-hold” trade, but I think we are trying to build up enough momentum to finally go towards that area.

I believe the 1.3333 level underneath is the “floor” of the uptrend, and if we can stay above there, the market will remain a “buy only” scenario as far as I can see. If we get some type of significant pullback after the jobs number on Friday, that should also offer value the people are willing to take advantage of. I think it’s going to be very volatile, but certainly it seems as if the buyers will return as the death of the British economy was a bit prematurely reported. The US dollar is more than likely going to continue to fall in general, and I think that should be one of the biggest drivers of this currency pair.

GBP/USD Video 03.01.18

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance