GBP/USD Declines on Missed Retail Sales Data

DailyFX.com -

Talking Points:

GBP/USD Declines on Missed Retail Sales Data

The GBP/USD Remains Below the 200 Day MVA at 1.2717

Looking for additional trade ideas for the Cable and US Dollar Pairs? Read Our Market Forecast

The GBP/USD is trading lower to close the week, as GBP Retail Sales figures have come in under expectations. Expectations for today’s news were set at 3.9% (YoY) (Jan) but were released at an actual 2.6%. Next week traders will again be looking towards data to guide the GBP/USD. Wednesday we will see the release of UK GDP figures (YoY) (4Q P) which are expected in at 2.2%.

Technically the GBP/USD is now trending lower in the short term. Today’s decline on missed Retail Sales figures has now placed the pair back below its 10 Day EMA (exponential moving average). As the pair declines, this average which now resides at 1.2479 may be seen as a value of resistance. Traders should note that today’s decline has the GBP/USD trading back in the direction of its long term downtrend. For reference, the 200 Day MVA (simple moving average) can be found at 1.2717.

GBP/USD, Daily Chart with Averages

(Created Using IG Charts)

Intraday the GBP/USD has fallen significantly below today’s central pivot found at 1.2488. Not only has bearish momentum significantly increased from this point, but the GBP/USD has now broken through the first value of intraday support at 1.2451. If the pair continues to fall, traders will next look for the pair to be supported at the S2 and S3 pivots found at 1.2418 and 1.2382 respectfully. If prices reach 1.2381, it should be noted that the GBP/USD will be trading at new weekly lows.

While prices are trading well below our first value of intraday resistance, it should be mentioned that today’s R1 pivot is found at 1.2522. A rebound to this point would place the GBP/USD back towards yesterday’s close, and may suggest that the pair is consolidating before a larger potential breakout next week.

GBP/USD 30 Minute Chart & Pivots

(Created Using IG Charts)

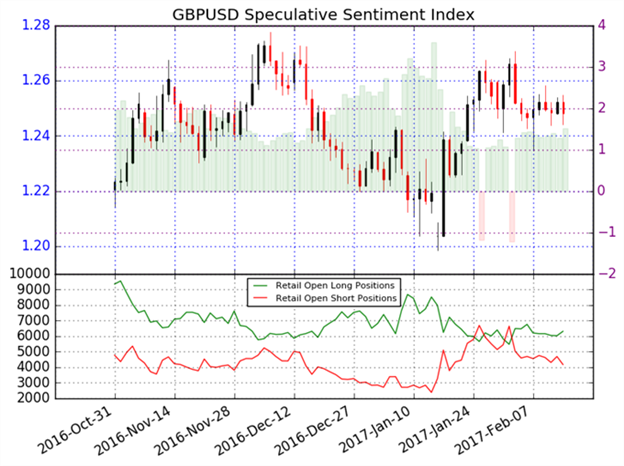

Sentiment totals for the GBP/USD remain off of extremes with current SSI readings at +1.64. At its current reading, this implies that 62% of traders are long the GBP/USD, while 38% remain short. When read as a contrarian indicator, this value suggests that the GBP/USD may continue to trend lower. In the event of a further bearish decline next week, traders should look for SSI totals to reach extremes of +2.00 or greater. Alternatively in the event of a bullish reversal, it would be expected to see SSI figures move back towards more neutral readings.

--- Written by Walker, Analyst for DailyFX.com

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance