GBP/USD – British Pound in Holding Pattern Ahead of GDP Releases

GBP/USD is steady in the Tuesday session. The pair is currently trading at 1.2903, down 0.10% on the day.

Will GDP Shake Up Sleep Pound?

Investors are keeping an eye on two key releases at 9:30 GMT – Preliminary GDP for Q4 and Manufacturing Production. Preliminary GDP rose 0.3% in Q3, shy of the forecast of 0.4%. Still, this was higher than the Q2 release of -0.2%. The estimate for the fourth quarter stands at a flat 0.0%. The monthly GDP report came in at -0.3% in November, short of the forecast of 0.0%. This indicator has not shown a gain since July, but the forecast for December is 0.2%.

The British manufacturing sector has struggled, and Manufacturing Production has managed only one gain in the past four months. In November, manufacturing production fell by 1.7%, its sharpest decline since April 2019. Analysts expect a rebound to 0.5% in December.

Technical Analysis

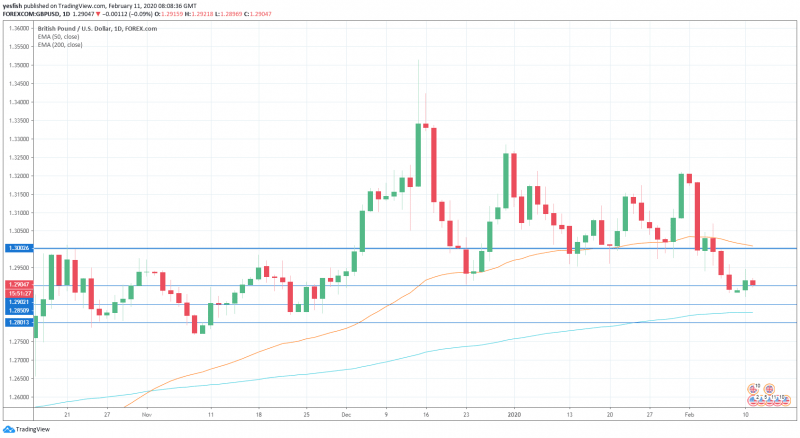

GBP/USD continues to drift this week. We find resistance at the key level of 1.300. The 50-EMA line follows closely at 1.3009. On the downside, there is strong pressure on support at 1.2902 and this line could break during the day. Lower, there is support at 1.2850. Below, The 200-day EMA is situated at 1.2830.

Pacific Currencies – Daily Summary

USD/CNY

USD/CNY has lost ground for a second straight day. Currently, the pair is trading at 6.9749, down 0.10% on the day. There are no Chinese events on the calendar. Investors are looking ahead to Wednesday, with the release of New Loans, which is expected to improve sharply to 3100 billion yuan in January.

AUD/USD

AUD/USD has posted slight gains for a second successive day. Currently, the pair is trading at 0.6708, up 0.32% on the day. In economic news, Australian NAB Business Confidence remained in negative territory, as it ticked higher to -1, up from -2 points. This points to pessimism on the part of the business sector.

NZD/USD

NZD/USD is trading sideways on Tuesday. Currently, the pair is trading at 0.6390, up 0.07% on the day. There are no New Zealand releases on the schedule. On Wednesday, the New Zealand central bank will release its interest rate decision. The bank is expected to maintain rates at an even 1.00%.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance