The GBP/USD Breaks Lower on NFP Data

DailyFX.com -

Talking Points

The GBP/USD breaks lower on NFP

Potential bearish targets include 1.4434

SSI has shifted to read +1.69

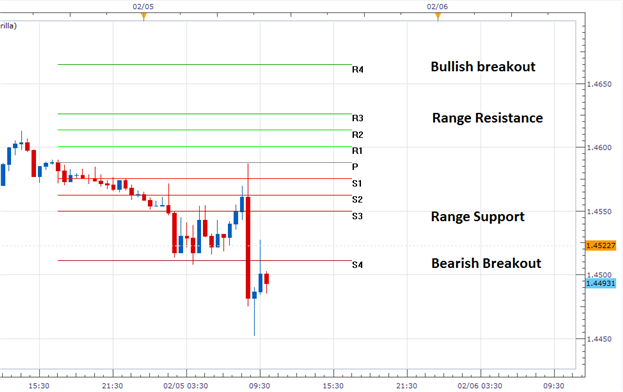

GBP/USD 30 Minute Chart

(Created using Marketscope 2.0 Charts)

What is in store for the US Dollar in 2016? See our Analyst forecast here!

The GBPUSD is currently rebounding off its daily lows after declining during today’s NFP (Non-Farm Payrolls) event. NFP figures were expected to be released at +190k; however, these expectations were missed with a total of 151k. Initially major pairs declined against the US Dollar. As seen above, the GBP/USD is still trading below todays S4 Camarilla pivot point at 1.4511. If the pair continues to fall, traders may extrapolate today’s 77 pip trading range to place initial bearish targets at 1.4434.

In the event of a bullish price reversal, the GBP/USD will first need to rebound above 1.4550. This area on the chart represents range support, and a move here would suggest a change in the present bearish market conditions. With today’s S3 pivot being found at 1.4550, range resistance is conversely found at the R3 pivot at a price of 1.4625.

SSI (Speculative Sentiment Index) for the GBP/USD currently reads +1.69. While this value is negative, it should be mentioned that this figure has declined from last week’s total of +2.13. If SSI continues to decline to a more natural figure, it may suggest a slowing of the pair’s current bearish momentum.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Do you know the biggest mistake traders make? More importantly, do you know how to overcome the biggest mistake? Read page 8 of the Traits of Successful Traders Guideto find out [free registration required].

Contact and Follow Walker on Twitter @WEnglandFX.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance