GBP/JPY Technical Analysis: Looking to Confirm Key Reversal

DailyFX.com -

To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

GBP/JPY Technical Strategy: Flat

Pound in Consolidation Mode After Dropping to 4-Month Low vs. Yen

Waiting to Enter Short on Confirmation of 3-Year Rising Trend Break

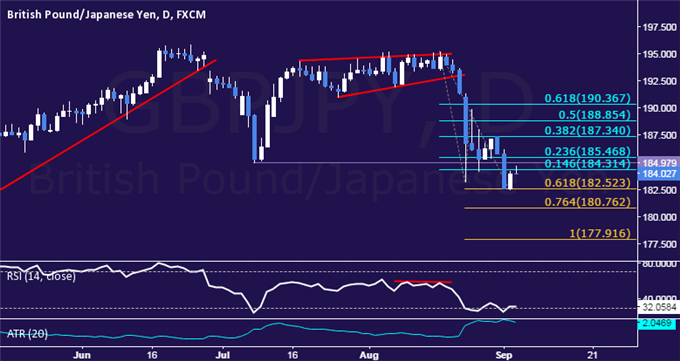

The British Pound paused to consolidate losses after dropping to the lowest level in four months against the Japanese Yen. As we discussed previously, prices may be in the process of carving out a top in the multi-year uptrend established from June 2012.Confirmation of the structural reversal is absent for now however.

Near-term support is now at 182.52, the 61.8% Fibonacci expansion. A daily close below this boundary opens the door for a test of the next downside inflection point at 180.76, the 76.4% level. Alternatively, a push above the 14.6% Fib retracement at 184.31 clears the way for a challenge of the 184.98-185.47 area. This is marked by the July 8 low and the 23.6% retracement.

Current positioning does not offer an actionable trading opportunity. On one hand, prices are too close to resistance to justify a long position from a risk/reward perspective. On the other, the absence of a defined bearish reversal signal warns that jumping in short is premature, particularly with top-tier event risk by way of the ECB policy announcement and US jobs report still ahead. We will remain flat for now.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance