GB News to axe 40 jobs weeks after revealing heavy losses

GB News is to cut 40 jobs as the opinionated broadcaster battles to stem losses.

Staff were informed of the cuts at a company-wide meeting on Friday afternoon following previous warnings that a restructuring would lead to some employees losing their jobs.

Bosses are offering up to two months’ salary and a possible payment in lieu of notice to any workers willing to take voluntary redundancy.

The cutbacks, which represent roughly 14pc of GB News’s workforce, come after the company revealed its losses ballooned to £42.2m last year.

GB News’s wage bill surged from £12.7m to £21.2m in 2023 as it splashed out on salaries for high-profile presenters such as Nigel Farage and Sir Jacob Rees-Mogg. Overall headcount jumped from 175 to 295 last year.

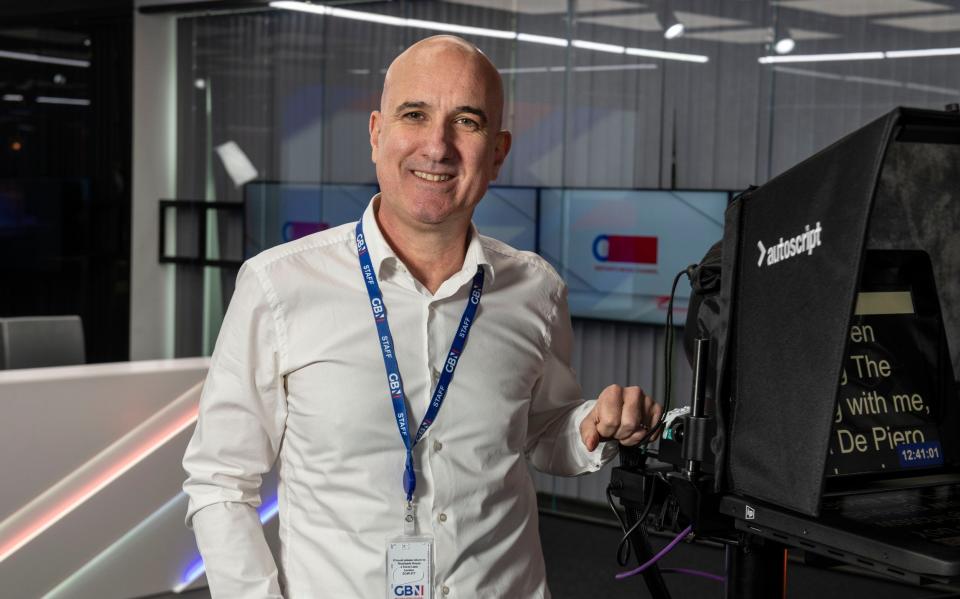

Angelos Frangopoulos, chief executive of GB News, has admitted the channel is facing challenges to stem its growing losses, saying it needed to find “smarter routes to sustainability and profit”.

Appearing in front of MPs last month, the GB News boss said: “We’re very confident about the future of being self-sufficient financially, but we have a lot of work to do.”

GB News has been rocked by an advertising boycott since its launch in 2021, forcing it to explore ways to diversify its revenues away from ads.

The broadcaster last year launched a paid membership scheme, while it has also expanded into the US and increased the number of live events it hosts with presenters such as Sir Jacob Rees-Mogg.

However, the start-up channel has been forced to deepen its reliance on billionaire hedge fund investor Sir Paul Marshall and Dubai-based hedge fund Legatum, who own GB News through holding company All Perspectives.

GB News’s most recent filings show that the amount owed to its parent company almost doubled from £42.8m to £83.8m in the last year alone.

The company said All Perspectives had an “ongoing commitment to funding the operations” of the channel.

Sir Paul is reportedly preparing to step down from the board of All Perspectives ahead of a renewed bid to buy the Telegraph.

The tycoon, who co-founded the hedge fund Marshall Wace, is expected to hand over his board seat to Lord Agnew, the chairman of UnHerd Ventures, Sky News reported.

Sir Paul is also a major investor in UnHerd, which owns the online magazine of the same name.

GB News declined to comment.

Read the latest updates below.

06:06 PM BST

Signing off...

Thanks for joining us today. The live blog covering financial markets and the world of business will be back on Monday, but I’ll leave you with a photo of a SpaceX Falcon 9 rocket pictured with the moon. It was launched from Cape Canaveral late last night containing Starlink satellites.

05:57 PM BST

Unilever gives up on ‘saving the world’ after ‘virtue-signalling’ backlash

Unilever has abandoned efforts to “save the world” after a backlash from investors over “virtue-signalling” that included giving Hellmann’s mayonnaise a social purpose. Daniel Woolfson and Lucy Burton have the details:

The consumer goods giant, which owns Marmite, Dove, Magnum and Ben & Jerry’s, has watered down green targets and scrapped some diversity pledges after investors told it to focus more on profits and less on social and environmental issues.

Chief executive Hein Schumacher, who took charge last July, told Bloomberg: “I’m not going to shout that ‘we’re saving the world’, but I want to make sure that in everything that we do, that it is indeed better.”

Unilever has softened targets to reduce its use of plastic, improve the health of the land in its supply chain and ensure all the people in its supply chain are paid the living wage.

A promise to increase the number of disabled employees to 5pc of its workforce by 2025 has been scrapped altogether, as have plans to spend almost £2bn with “diverse businesses” across the world by 2025, and to halve food waste in its operations by 2025, Bloomberg reported.

Mr Schumacher said Unilever would focus on doing “fewer things and with greater impact”, adding that the company’s new Climate Action Plan was “very stretching, but they are also intentionally and, unashamedly, realistic”.

05:44 PM BST

Tax cuts could fuel worklessness, warns IMF

The International Monetary Fund has suggested Jeremy Hunt’s tax cutting drive could limit the government’s ability to tackle the worklessness crisis.

The deputy director at the IMF’s European Department, Helge Berger, warned there was already “significant pressure” to spend more on healthcare in the next few years. Our economics editor Szu Ping Chan reports:

“One area to think about is the quality of healthcare that is being provided to people,” said Mr Berger.

Mr Berger suggested the government may have to raise taxes or cut spending even further to pay for higher health spending.

“There’s significant pressure in the medium term on the budget coming both from the expenditure side and spending on health services,” he said.

“And so with all these things on the table, there’s a need to look for that fiscal space and I think we’re going to have to look at both revenue measures and expenditure measures going forward.”

05:40 PM BST

Britain’s worklessness crisis risks permanently damaging growth, warns IMF

Britain’s worklessness crisis is hurting the economy and risks permanently damaging growth, the International Monetary Fund (IMF) has warned. Our economics editor Szu Ping Chan reports:

The Fund said economic growth in the UK over the last decade had almost solely been driven by an expanding workforce, and that the post-pandemic increase in the number of people neither in work nor looking for a job was putting that in jeopardy.

Helge Berger, deputy director at the IMF’s European Department, said it was right that Rishi Sunak was making economic inactivity and a rise in sickness benefits a “focus point” in government.

“If you have an increase in inactivity rates, there’s also a concern for growth,” he told reporters at the IMF Spring Meetings in Washington.

A record 2.8m people are now economically inactive because they are too ill to work. The number has jumped since lockdown, with the increase now the longest sustained rise on record.

In total, 9.4m people aged between 16 and 64-years old are economically inactive, according to the Office for National Statistics (ONS).

Mr Berger said there were two ways the rise in people claiming they are too sick to work was hurting the economy: “One is the number of people that could be working. The other element is productivity. If people are ill but have to work then maybe they’re less productive than otherwise. So I think this is an area that deserves the attention of policymakers so we’re happy that this is a focus point.”

05:27 PM BST

GB News to axe 40 jobs weeks after revealing heavy losses

GB News is to cut 40 jobs as the opinionated broadcaster battles to keep down costs amid mounting losses.

Staff were informed of the redundancies at a company-wide meeting on Friday afternoon following previous warnings that a restructuring would lead to some employees losing their jobs.

Bosses are offering up to two months’ salary and a possible payment in lieu of notice to any workers willing to take voluntary redundancy.

The cutbacks, first reported by Press Gazette, come after GB News revealed its losses ballooned to £42.2m as it splashed out on salaries for high-profile presenters such as Nigel Farage and Jacob Rees-Mogg.

The start-up channel has also deepened its reliance on its owners, the billionaire hedge fund investor Sir Paul Marshall and Dubai-based hedge fund Legatum.

04:54 PM BST

FTSE 100 closes up after earlier sell-off

The FTSE 100 lost as much as 0.9pc in trading today in worries about conflict in the Middle East. But shares rebounded this afternoon, closing up 0.2pc.

The biggest riser was Mondi, up 9.3pc, after saying it wouldn’t pursue a bidding war for rival DS Smith. The second-highest riser was Rentokil Initial, up 2.4pc. The biggest faller was DS Smith, dropping 10.3pc, which JD Sports dropped 2.8pc.

Meanwhile, the FTSE 250, which fell as much as 1pc in trading, closed down 0.3pc. The biggest riser was cyber security firm Darktrade, up 3.9pc, followed by oil and gas exploration company Energean, up 3.9pc. The biggest faller was hedge fund Man Group, down 6.6pc, followed by landscaping products group Marshalls, down 3.1pc.

04:33 PM BST

Giorgio Armani does not ‘rule anything out’ in succession plan

Giorgio Armani, the 89-year-old Italian fashion designer, has long protected his eponymous brand’s independence. Now he will not rule anything out, according to comments made in an interview with Bloomberg. He said:

Independence from large groups could still be a driving value for the Armani Group in the future, but I don’t feel I can rule anything out. What has always characterized the success of my work is an ability to adapt to changing times ...

I don’t currently envisage a takeover by a large luxury conglomerate. But as I said, I don’t want to exclude anything a priori because that would be an ‘unentrepreneurial’ course of action ...

Listing is something we have not yet discussed, but it is an option that may be considered, hopefully in the distant

future.

04:22 PM BST

Tesla recalls Cybertrucks as faulty accelerator pedals blamed on soap

Tesla has recalled thousands of Cybertrucks to fix faulty accelerator pedals that have been blamed on employees using soap when assembling the cars. Our technology editor James Titcomb reports:

The US National Highway Traffic Safety Administration (NHTSA) said Tesla had recalled the 3,878 Cybertrucks that the company has sold to date and that the carmaker would fix the pedals free of charge.

It said a fault with the pedal’s footpad meant it was at risk of becoming dislodged from the pedal itself, leading the pedal to get stuck and causing the car to accelerate and potentially crash.

The regulator said the problem occurred because Tesla workers had started using soap when assembling the pedal.

04:18 PM BST

Germany to raise its growth forecast amid lower-than-expected inflation

The German government will raise its economic growth forecast for this year to 0.3pc, from 0.2pc previously given, and lower its forecast for inflation by 0.4 percentage points, a source told Reuters on Friday.

The forecasts are part of the government’s draft spring projections, which economy minister Robert Habeck is due to present next Wednesday.

In 2025, the government expects gross domestic product to grow by 1.0pc, according to the source.

Inflation is expected to fall to 2.4pc this year, versus a previous projection of 2.8pc. For 2025, the government sees inflation falling further, to 1.8pc.

04:07 PM BST

Hedge fund giant shares drop after customers take out cash

Shares in the listed hedge fund manager Man Group dropped as much as 8.8pc in trading today after a trading update caused some concern in the City.

On the one hand, the firm reported that total assets under management had increased to $175.7bn (£141bn) by March 31 compared with $167.5bn at the end of December.

On the other, it also released “outflow” figures showing that clients took out $1.6bn.

Investment bank Jefferies said in a note:

Occasional roadbumps are not unexpected at Man, but the fact that AUM [assets under management] ... driven by strong performance and despite the outflows - is at record highs demonstrates the enduring and more consistent growth in management fee profitability.

Shares are currently down 5.4pc.

03:35 PM BST

Footsie rebounds after drop

The FTSE 100 has mostly recovered after a big drop of 0.86pc in earlier trading on worries of mounting tensions in the Middle East.

The blue-chip index is currently flat compared with this morning’s open.

03:22 PM BST

Risks of persistent inflation receeding, says Bank of England deputy governor

A deputy governor of the Bank of England, Dave Ramsden, has given a speech today in Washington in which he said that Britain is being aided by “improved inflation dynamics”. He said:

Throughout much of 2023 I was worried that the UK was an outlier among advanced economies, diverging in terms of inflation performance and the degree of persistence ...

But over the last few months I have become more confident in the evidence that risks to persistence in domestic inflation pressures are receding, helped by improved inflation dynamics.

As we set out in our March 2024 minutes there is a range of views among the MPC [Monetary Policy Committee] on these risks.

For me the balance of domestic risks to the outlook for UK inflation, relative to the February MPR forecasts, is now tilted to the downside, with a scenario where inflation stays close to the 2pc target over the whole forecast period at least as likely.

This leaves the UK as less of an outlier and more of a laggard in terms of recent inflation performance, and one that is now catching up quickly.

03:17 PM BST

IMF warns that copying US and Chinese ‘subsidy race’ would harm growth

Europe would harm its economy if it entered a “subsidy race” with America and China, a top International Monetary Fund official has said.

Alfred Kammer, European director of the IMF, told the Financial Times that trying to protect national champions from global competition would backfire. He said:

There is always a tendency to look to help national champions. But it leads to a misallocation of capital if you favour one company over others...

As a very open economy, our number-one advice to Europe is, don’t become protectionist. Protectionism is going to be damaging globally and a subsidy race is not in Europe’s interest.

03:05 PM BST

China imposes tariff after accusing America of dumping

China on Friday slapped an anti-dumping levy on imports of an acid from the US widely used in food, feed, pesticides and medical fields, amid heightened tensions with Washington over trade.

From Saturday, imports of propionic acid from the United States will be subject to a levy of 43.5pc, the Ministry of Commerce said in a statement, after a July investigation found the Chinese domestic propionic acid industry was “materially damaged”.

A trade dispute between the world’s two biggest economies has been intensifying despite recent diplomatic visits.

In a recent salvo, the US threatened to hike its tariffs on Chinese steel imports, and is pressuring Mexico to prohibit China from selling its metal products to the US indirectly from there.

China’s commerce ministry on Thursday said it firmly objects to the US raising tariffs and will take all necessary measures to protect its rights and interests.

02:58 PM BST

Netflix drops amid investor worry over future growth

Netflix shares are down 6.6pc in trading today. Its forecasts for second-quarter revenues were slightly below market expectations, while its surprise move to stop sharing subscriber additions and average revenue per member from 2025 sowed doubts in investor minds about growth peaking in some markets for the streaming pioneer.

The decision to hold back crucial metrics that have moved the stock market comes as Wall Street analysts suspect subscriber growth for Netflix in North America and Europe could stagnate.

Russ Mould, investment director at AJ Bell, said:

Investors like transparency and the market has judged Netflix on its subscriber success ever since it has been on the stock market.

To many, it is a valuable metric and hiding it comes at a time when many people are wondering if Netflix has reached maturity in many regions.

02:50 PM BST

HSBC-backed fintech app plans breakup

An banking app that counts HSBC as an investor is to break itself up after racking up big losses, according to a report.

Monese is intending to split apart its consumer and technology business, Sky News reported.

The app is understood to have two million customers, while the technology side of Monese reportedly powers HSBC’s retail banking app.

HSBC invested $35m (£28m) in Monese in 2022.

The Telegraph has approached Monese for comment. A Monese spokesman reportedly told Sky: “The business has developed in two different directions: the original B2C business and now the new and fast-growing B2B PaaS (Platform as a Service) business.

“We are exploring the best organisational and capital structure for the company should be to maximise shareholder value.”

Monese’s consumer app targets people wanting to build their credit score or who struggle to pass traditional banks’ identity checks.

02:34 PM BST

Wall Street mixed as trading begins

US stock markets were mixed at the opening bell amid the tensions in the Middle East.

The Dow Jones Industrial Average was up 0.2pc to 37,855.61 while the S&P 500 fell 0.1pc to 5,007.99.

The tech-heavy Nasdaq Composite was down 0.3pc to 15,552.89.

With that, my colleague Alex Singleton will take over the reins and keep you updated from here.

02:24 PM BST

Lagarde: Inflation faces two main risks

Christine Lagarde has warned that inflation faces risks from geopolitical tensions and higher growth as traders forecast a first eurozone interest rate cut in June.

The President of the European Central Bank said the risks to the inflation outlook “are two-sided”.

Speaking at the IMF spring meeting in Washington, she said:

Upside risks include heightened geopolitical tensions, as well as higher wage growth and more resilient profit margins than anticipated.

Downside risks include monetary policy dampening demand more than expected, and an unexpected deterioration in the economic environment in the rest of the world.

02:14 PM BST

American Express profits jump as customers spend more

Credit card giant American Express posted a 34pc jump in its first quarter profits as it was helped by more customers spending on its namesake cards.

The New York-based company said it earned $2.4bn (£2bn) in the first three months of the year, or $3.33 a share, up from $1.8bn (£1.5bn), or $2.40 a share, a year earlier.

The results exceeded Wall Street’s expectations, who were looking for roughly $2.95 a share in profits for the quarter.

The jump in profits for AmEx came largely from higher cardmember spending on their accounts as well as more balances collecting interest. The company had $15.8bn in revenue in the quarter, up 11pc from a year earlier.

AmEx customers spent $419.2bn on their cards in the quarter, up 5pc from a year earlier. AmEx takes a small percentage of each transaction spent on their cards as a fee from merchants, which was its primary business model for decades.

But AmEx is now also bringing hefty amounts of interest income, earned on customers who keep a balance and revolve on their accounts now.

The company earned $5.06bn in interest income last quarter on loans to cardmembers, up 28pc from a year earlier. Roughly a third of AmEx’s revenue now comes from interest income.

01:48 PM BST

Train drivers to strike over the weekend

Rail services between London, the North and Scotland will be disrupted on Saturday because of a strike by train drivers.

Members of Aslef at LNER will walk out for the day in a dispute over terms and conditions.

The company said it will run a reduced service between London King’s Cross and Edinburgh Waverley, and King’s Cross and Leeds.

The first train from London to Edinburgh will run at 7.30am and the last one at 4pm, while the first direct service to Leeds will depart at 10.30am.

Aslef members at the company are also refusing to work overtime this weekend.

Mick Whelan, general secretary of Aslef, said:

Train drivers are fed up with the bad faith shown by this company, probably at the behest of the Transport Secretary, Mark Harper, and the rail minister, Huw Merriman, and we are not prepared to put up with being bullied and pushed about by a company that thinks it can break agreements whenever it feels like it.

We honour the agreements we make, because we are honourable people. Train companies should do the same.

It’s two years since P&O sacked its workforce in a disgusting and disgraceful action that the Government allowed, but train companies in this country are not going to change our terms and conditions on a whim.

The dispute is separate to the long running pay row between Aslef and 16 train operators, including LNER.

01:32 PM BST

Morrisons workers vote on strike action

Hundreds of workers at supermarket giant Morrisons are being balloted for industrial action in a dispute over pensions.

Unite said the company had made changes to pensions that would leave workers worse off by around £500 a year.

Around 1,000 Unite members working as warehouse stock controllers, cooks, canteen staff and administrators are being balloted for strike action.

Unite general secretary Sharon Graham said:

Unite is focused on our members’ jobs, pay and conditions and these unmerited changes to workers’ pensions will leave our members worse off every month.

Unite will not stand for such behaviour from any employer, let alone one like Morrisons who is raking in massive profits in the midst of a cost-of-living crisis. Its flagrant profiteering and then cutting our members’ take-home pay is a disgrace.

Morrisons declined to comment.

01:19 PM BST

Zuber Issa to split with brother Mohsin by offloading Asda stake

One of Asda’s billionaire owners is close to selling his stake in the supermarket amid an alleged rift with his brother.

Zuber Issa is reportedly close to agreeing a deal to offload his 22.5pc share in the retailer to TDR Capital, according to Bloomberg News, which would hand majority control of the chain to the US private equity giant.

The deal would increase TDR’s holding in Asda to about two-thirds, while the transaction would further dismantle the relationship between brothers Zuber and Mohsin Issa.

It comes as Zuber is trying to buy his brother Mohsin out of parts of the EG Group petrol station empire they built together.

Details of the proposed EG Group deal were laid out to investors last month, who were told that the business is in “active discussions with Zuber Issa regarding the sale” of UK assets.

The potential changes at EG Group come as Mohsin, who remains on the board at the business, embarks on a new phase in his personal life.

Earlier this year, following a report by The Telegraph, Mohsin confirmed that he is in a romantic relationship with Victoria Price, a former partner at EY, which was Asda’s auditor until it quit in July last year.

01:06 PM BST

China launches new crackdown on Whatsapp as Xi stifles dissent

China has ordered Apple to block WhatsApp and Threads in the country amid a fresh crackdown on dissent by leader Xi Jinping.

Our senior technology reporter Matthew Field has the details:

Officials from China’s Cyberspace Administration told Apple to remove the messaging services from its domestic App Store based on “national security concerns,” a spokesman for the company said.

The apps were already largely inaccessible from within China, which operates a so-called Great Firewall to lock out thousands of websites and services offering global news and the opportunity to exercise free speech.

However, tech-savvy consumers have been able to bypass these blocks with software that hides their location. The new crackdown will add further friction to accessing the apps, developed by Facebook owner Meta, in the first place, and make it difficult to update them.

Read how Apple has previously been forced to ban other apps in China.

12:43 PM BST

Lufthansa cancels flights to Israel and Iraq

German airline group Lufthansa has cancelled flights to Israel and Iraq until early Saturday after Israel carried out retaliatory strikes against Iran.

Services by airlines of the group to Tel Aviv in Israel and Erbil in Iraqi Kurdistan were suspended until 6pm UK time tomorrow due to the “current situation”.

12:38 PM BST

DS Smith tumbles as Mondi rules out takeover bid

Packaging company DS Smith sank to the bottom of the FTSE 100 after rival Mondi said it would not make a further takeover bid.

Shares in DS Smith fell 11pc after Mondi said the deal would not be in the best interests of its shareholders, propelling its shares to the top of the index, up 8.4pc.

A bidding war had broken out for the Amazon’s cardboard box supplier after US rival International Papers muscled in on a proposed £5.1bn tie-up between the London-listed companies.

DS Smith agreed a £7.8bn takeover Memphis-based International Papers earlier this week.

12:00 PM BST

Oil prices fall as intelligence indicates missile attacks are ‘over’

Global oil benchmark Brent crude is now down on the day after G7 foreign ministers have urged “all parties” to “work to prevent further escalation” in the Middle East.

Direct attacks between Israel and Iran on each other’s soil are “over”, a regional intelligence source has said.

The unnamed source, who has knowledge of Tehran’s potential reaction, said that Iran was not expected to respond to the strikes, CNN reported.

It comes as Iranian government officials have so far sought to downplay the impact of Friday’s attack.

Iran has no plans to immediately retaliate against Israel, senior Iranian official tells Reuters.

Good morning. Following a tense night as Israel retaliated against Iran the price of Brent crude which briefly surged above $90 last night now stands at $86.55 which is below the $87.11 close on Thursday. Risk off & safe haven moves like to characterize action across global asset… pic.twitter.com/IphCX8tXDn

— Joseph Brusuelas (@joebrusuelas) April 19, 2024

11:53 AM BST

Nike sum to lure German football team ‘inexplicable,’ says Adidas boss

The sum reportedly paid by Nike to lure the German football team was “inexplicable”, the chief executive of beaten rival Adidas has said.

Germany’s national side broke away from a partnership with Adidas that stretched back more than 70 years to before its first World Cup triumph in 1954.

Nike is reported to have offered €100m (£85.6m) a year to the German Football Association to end the historic partnership.

Adidas chief executive Bjorn Gulden told AFP:

Nike won with, by all accounts, a huge offer.

If the numbers are right for what Nike paid the (German Football Association), they are inexplicable for us.

11:36 AM BST

Cocoa hits new record high as chocolate makers keep up production

The price of cocoa has hit a new record high as chocolate factories kept up productions despite a global crunch in supplies.

Futures in New York surged as much as 5pc to touch an all-time high of $11,578 a metric ton.

It comes after data on Thursday showed so-called grinds — where cocoa is turned into butter and powder used in confectionery — rose nearly 4pc in North America during the three months of the year compared to the same period a year ago.

Meanwhile, processing in Europe fell only about 2pc and inched lower in Asia despite record prices, which have more than doubled since the start of 2024.

Cocoa crops in West Africa have been decimated over the last season by poor weather and disease.

11:09 AM BST

Wall Street on track to fall at the opening bell

US stock indexes have fallen in premarket trading as investors turned risk-averse following an escalation in the Middle East conflict.

Israel launched an attack on Iranian soil on Friday in the latest tit-for-tat exchange between the two arch foes, whose decades of shadow war broke out into the open and threatened to drag the region deeper into conflict.

Hasnain Malik, head of equity research at Tellimer, said: “The intention does not appear to inflict large-scale damage, including on nearby military bases, and trigger a full inter-state war, which we continue to regard as very unlikely.”

The CBOE Volatility index, also known as Wall Street’s “fear gauge”, was up 1.83 points at 19.83, its highest level in more than five months.

On the corporate front, Netflix slumped 6.3pc in premarket trading after giving a lacklustre second-quarter forecast.

Ahead of the opening bell, the Dow Jones Industrial Average was down 0.3pc, the S&P 500 fell 0.4pc and the Nasdaq 100 had dropped 0.6pc.

10:55 AM BST

FTSE on track for worst week in six months after Israel strike on Iran

The FTSE 100 is on track for its worst week in six months amid fears that a retaliatory strike by Israel against Iran could trigger a war in the Middle East.

Britain’s flagship stock market has fallen as much as 0.9pc today in a Europe-wide sell-off after Israel launched a retaliatory strike against Iran

The decline has put the market on track for its worst week since October, falling nearly 2.2pc.

10:44 AM BST

Pound rebounds after hitting five-month low

The pound has risen after falling to a five-month low against the dollar in Asian trading hours as investors responded to the Israeli attack on Iran.

Safe-haven currencies such as the Swiss franc, yen and dollar initially spiked after the assault, helping push down the pound and the euro.

Yet the market reaction has since unwound somewhat after Iran played the incident down and said it did not plan a new response.

Sterling was last up 0.1pc at $1.245, after dropping to $1.2388 in Asia.

The pound is down marginally for the week but off by 1.5pc for the month so far after a jump in the dollar caused by strong US economic data. The dollar index was 0.1pc higher.

The euro was little changed against the pound at 85p, having traded around that level since February.

Traders broadly expect the Bank of England to lower interest rates once or twice this year, likely starting in August or September, according to pricing in derivatives markets.

Markets were expecting four or more rate cuts at the start of the year but the strength of US growth and price pressures, and a slight tick-up in UK growth, have raised doubts about whether inflation has been conquered.

10:30 AM BST

Gas prices fall despite strikes on Iran

Gas prices have fallen despite Israel’s attack on Iran overnight.

Dutch front-month futures, Europe’s benchmark contract, rose as much as 4.7pc following the strikes, but have since erased those gains and are down 2.3pc.

Prices remain on track for a second weekly advance. The UK’s equivalent contract has fallen 2.3pc today after rising as much as 4.1pc.

The strike on Iran comes after Tehran fired 300 missiles on Israel at the weekend. Iran has described last night’s attack as a failure.

10:19 AM BST

PM expects Rwanda plan to be approved next week

Rishi Sunak said he expected his plan to send asylum seekers to Rwanda to be approved on Monday, hoping to bring to a close a protracted parliamentary battle over the scheme.

“No more prevarication, no more delay,” the Prime Minister said today.

“We are going to get this done on Monday, and we will sit there and vote until it’s done.”

10:02 AM BST

Markets to remain jittery into the weekend, warn economists

European stock markets remain heavily in the red amid the heightened tensions in the Middle East.

The FTSE 100 has fallen 0.8pc, the Dax in Frankfurt has dropped 1pc, the Cac 40 in Paris is down 0.9pc and the FTSE MIB in Milan was down 1.1pc.

Mohit Kumar, chief Europe economist at Jefferies, said:

Give that today is a Friday and market will be jittery over any developments over the weekend, we are likely to see a push towards risk aversion and degrossing as investors try to reduce risk before the weekend.

Geopolitical premium is here to stay for the near term. We remain still hopeful that the current conflict will not escalate further and the broader impact can be contained.

09:45 AM BST

Sunak announces measures to end Britain’s ‘sick note culture’ - watch live

Rishi Sunak is unveiling his plan to end the UK’s “sick note culture” in a major speech on welfare reform.

You can watch it below and follow updates in our politics live blog.

09:34 AM BST

Oil prices rally after Israel attack on Iran

The spike in the price of oil following Israel’s retaliatory attack on Iran has been nearly completely wiped out.

Global benchmark Brent crude was last up 0.3pc on the day at just over $87 a barrel, having jumped by as much as 4.2pc higher to more than $90 a barrel after explosions were reported near an Iranian military base early this morning.

US-produced West Texas Intermediate has gained 0.4pc to just over $83.

Analysts at Saxo Bank said: Overall, most of the five-dollar range [in oil prices] seen this past week has been driven traders attempt to quantify the level of risk premium needed to reflect heightened tensions but with no impact on supply. Expect prices to bid ahead of the weekend.”

09:23 AM BST

Thames Water ‘plans to raise bills by 56pc’

Thames Water bills will need to rise by 56pc over the next five years under its renewed business plan which it is understood to have submitted to the regulator, it has been reported.

The utility company was plunged into crisis last month when shareholders refused to inject another £500m into the ailing supplier, which is struggling under the weight of an £18bn debt pile.

Thames had originally envisaged raising bills by 40pc in an effort to put it back on a sustainable footing but it has now raised its demand to increase water bills, according to the Times.

Lenders to the company face losing up to 40pc of their money in the event of the troubled supplier being nationalised.

Details of the Government’s contingency plans have laid out the potential impact on creditors in Thames Water, which serves 16m people.

The proposal, dubbed “Project Timber”, indicates that some bondholders in Thames could see the value of their loans slashed by between 35 and 40pc if Thames fails, as first reported by The Guardian.

09:07 AM BST

Global stocks slump amid worries of no US interest rates cuts this year

The mood among traders was already downbeat as they contemplated the prospect of the Federal Reserve leaving US interest rates unchanged this year.

Several Fed officials indicated there would be no rush to reduce borrowing costs following data showing jobless claims came in below expectations while a gauge of business activity hit a two-year high.

Atlanta Fed boss Raphael Bostic said inflation is “too high” and he felt there was no need to cut borrowing costs until later in the year.

“I’m comfortable being patient,” he added.

New York Fed chief John Williams and governor Michelle Bowman also said they saw fewer reductions than expected, if at all, this year.

Michael Landsberg, of Landsberg Bennett Private Wealth Management, said:

We are firmly in the camp of no rate cuts in 2024.

We believe investors should prepare for a higher-for-longer regime when it comes to both inflation and interest rates.

09:03 AM BST

Markets fear ‘glaring light of open conflict’

Amid the European markets sell-off, Stephen Innes of SPI Asset Management said:

It is now clear that the escalating shadow warfare between Israel and Iran... has finally ignited the powder keg in the Middle East, and we have moved decisively out of the shadows and into the glaring light of open conflict.

It should be noted that this is not a staged response to an Iranian drone attack but rather an indication that we have entered a new phase of this conflict, one that is likely to have significant and far-reaching consequences for Middle East peace and least of all risk markets.

08:48 AM BST

Retail sales slump adds to FTSE 100 sell-off

As well as the conflict in the Middle East, the decline in the FTSE 100 comes amid worse than expected retail sales in Britain.

The amount British retailers sold remained unchanged last month, as a rise in petrol and diesel sales helped offset falls at department stores and food shops.

The latest ONS data showed that sales growth stood at 0pc across the retail sector, with food store sales declining 0.7pc.

There was a 1.5pc drop in sales for non-store retailers, which include online shops and market stalls among others.

Lisa Hooker, an expert at consultancy PwC, warned that the March figures should be “taken with a pinch of salt” because Easter fell earlier than normal this year. The ONS tries to adjust for that.

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, warned the retail data “doesn’t bode too well for some names in the grocery industry, with corporate updates expected next week”.

She added: “The data also speaks to growing concerns about resilience in the wider retail sector. Mid-market names are in a very difficult position and pressure isn’t abating.”

Never the less, retail sales grew 1.9pc in the first quarter of 2023, which some economists took as a sign the UK is on its way out of recession:

More evidence that the UK economy returned to growth in Q1... 👇#Retail sales were flat in March, but the rebound in January and small upward revision to February mean that sales volumes rose by 1.9% in Q1 compared to Q4 2023.

(My guess: #GDP rose by at least 0.4% q/q) pic.twitter.com/rfUOHsiJCY— Julian Jessop (@julianHjessop) April 19, 2024

08:40 AM BST

FTSE slumps amid Middle East fears and weak retail sales

British stocks opened lower amid caution over the escalating tensions in the Middle East, while official figures showed retails sales stagnated in March.

The globally-focused FTSE 100 has fallen 0.7pc in early trading and is on track for its biggest weekly decline in three months.

The mid-cap FTSE 250 lost 0.9pc and is poised for a third consecutive week of declines.

Travel and leisure stocks lead the declines, falling 1.2pc as airlines scrambled to divert flights over Iran as tensions in the Middle East escalated.

Meanwhile, data showed UK retail sales stagnated in March, indicating cautious consumer spending.

888 gained 2.8pc after the bookmaker reported first-quarter revenue slightly ahead of its expectations, helped by strong customer volumes and expects revenue to return to growth from the second quarter.

08:28 AM BST

European stocks tumble in early trading

European stock markets slid at the open following heavy losses for Tokyo after Israel carried out retaliatory attacks on Israel, causing a brief surge in oil prices.

In the eurozone, the Dax in Germany fell as much as 1.1pc while the Cac 40 in France was down 0.8pc and the FTSE MIB in Italy dropped as much as 1pc.

08:09 AM BST

Asian shares tumble after Israel retaliation

To recap, Asian stocks tumbled overnight, with Japan’s Nikkei suffering its worst slump in three years after Israel’s strikes on Iran.

The strikes added to investor concerns after a fall in Japan’s headline inflation rate to 2.7pc in March.

Markets are waiting for the Japanese central bank’s next move after it raised its benchmark interest rate last month for the first time in 17 years, ending a longstanding policy of negative rates meant to boost the economy. But the rate remains near zero.

Elsewhere, Australia’s S&P/ASX 200 dipped 1.1pc to 7,561.60.

South Korea’s Kospi dropped 1.7pc to 2,589.65. Hong Kong’s Hang Seng declined 1.4pc to 16,149.44, while the Shanghai Composite was 0.5pc lower to 3,059.30.

Taiwan’s Taiex slumped 3.8pc, with Taiwan Semiconductor Manufacturing Co shares tumbling 6.7pc.

08:04 AM BST

UK markets slump after Iran explosions

The FTSE 100 slumped as trading began following the attacks in Iran overnight.

The UK’s benchmark stock index was down 0.5pc to 7,841.50 while the midcap FTSE 250 fell 0.5pc to 19,360.24.

07:52 AM BST

Iran nuclear sites undamaged by strikes

There has been no damage to Iranian nuclear sites following the explosions in the centre of Iran overnight, the International Atomic Energy Agency (IAEA) said:

IAEA can confirm that there is no damage to #Iran's nuclear sites. DG @rafaelmgrossi continues to call for extreme restraint from everybody and reiterates that nuclear facilities should never be a target in military conflicts. IAEA is monitoring the situation very closely. pic.twitter.com/4F7pAlNjWM

— IAEA - International Atomic Energy Agency ⚛️ (@iaeaorg) April 19, 2024

07:50 AM BST

William Hill owner reveals rising revenues

In corporate news, gambling company 888 has revealed revenues for the first quarter of 2024 were “slightly ahead” of expectations.

The group, which also runs the William Hill brand, said it has seen revenues of £431m for the three months to March 31, which was up 2pc on the previous quarter.

It previously forecast a range of £420m to £430m.

Per Widerstrom, chief executive of 888, said:

I am pleased to report that Q1 2024 revenue was slightly ahead of our guidance, with strong player volumes converting into improved revenue run rates.

Having lapped various regulatory and compliance changes during the quarter, and with increased marketing investment supported by an exciting product pipeline, we remain confident in a return to growth from Q2 2024.

We are moving decisively and at pace to position our company for long-term success, and I look forward to providing further updates about our progress in the coming months.

07:39 AM BST

European markets on track to slump at the open

European markets are on track to open lower when trading begins shortly following Israel’s retaliatory strikes on Iran.

The FTSE 100 is down 0.7pc in premarket trading, while the Dax in Germany is on course to open 1.2pc lower.

The Cac 40 in France is down 0.6pc and the FTSE MIB in Italy is expected to fall 1.3pc when markets open.

07:33 AM BST

Japan stocks suffer largest fall in three years

Tokyo’s key Nikkei index suffered its largest drop in more than three years following reports that Israel carried out strikes on Iran and after US tech stocks fell.

The benchmark Nikkei 225 index ended down 2.7pc, or 1,011.35 points, to 37,068.35, marking its largest fall in points since February 2021.

07:28 AM BST

Retailers blame higher prices for poor trading, says ONS

After disappointing retail sales figures in March, the Office for National Statistics’ deputy director for surveys and economic indicators Heather Bovill said:

Retail sales registered no growth in March. Hardware stores, furniture shops, petrol stations and clothing stores all reported a rise in sales.

However, these gains were offset by falling food sales and in department stores where retailers say higher prices hit trading.

Looking at the longer term picture, across the latest three months retail sales increased after a poor Christmas.

07:21 AM BST

Retail sales stall as shoppers cut back food spending

Retail sales volumes were flat last month as rises in sales at non-food stores helped offset falls for food shops.

The Office for National Statistics (ONS) said sales growth was recorded at 0pc, down from 0.1pc growth in February and less than the 0.3pc growth expected by analysts.

February’s data has been revised up from a previous estimate of 0.0pc.

The ONS said sales of automotive fuel had risen 3.2pc while non-food store sales rose 0.5pc.

Food stores had seen their sales drop 0.7pc and there was a 1.5pc fall in non-store retailing.

Retail sales showed no growth in March 2024, following a revised increase of 0.1% in February 2024.

➡️ https://t.co/65yQJqIxlh pic.twitter.com/xIwzMNwnVm— Office for National Statistics (ONS) (@ONS) April 19, 2024

07:17 AM BST

Market tensions ease as Iran downplays strikes

Oil remains 1.8pc higher but is now closer to $89 a barrel after Iranian media appeared to downplay Israel’s retaliatory strikes.

Brent crude had earlier soared above $90 a barrel amid concerns over the potential for a wider regional conflict that could endanger crude supplies.

Israel launched a strike on Iran, according to two US officials, but the Islamic Republic’s semi-official Tasnim news agency denied the reports and said that the Isfahan nuclear facility was safe.

Haven assets also rose as tensions ratcheted higher. Gold spiked toward a record, before giving back some of its gains, while the US dollar climbed 0.2pc against the pound, which is worth $1.242.

07:12 AM BST

Good morning

Thanks for joining me. Global markets have been disrupted after Israel launched a retaliatory strike against Iran.

Brent crude oil jumped as much as 4.2pc to more than $90 a barrel in the wake of the strike, while Asian stocks sank.

5 things to start your day

1) Petrol price poised to rise in blow for millions of drivers | Fears cost of filling up could increase further as oil hits six-month high

2) Netflix password crackdown drives up subscriber numbers | Netflix has adopted a renewed emphasis on profits after years of focusing on subscribers

3) Thames Water lenders face 40pc losses under nationalisation plan | Bosses at Thames Water are currently racing to secure its future in the private sector

4) Senior women leave BP in first management shakeup since Looney misconduct claims | Both departing BP executives are to be replaced by male colleagues

5) Ambrose Evans Pritchard: New Malthusians are wrong: a rich world needs less energy than once feared | An untruth has led us to believe net zero is near impossible

What happened overnight

Tensions in the Middle East were weighing on sentiment across the region, and US futures were sharply lower.

Oil prices jumped about $3 after Iran fired air defence batteries early on Friday morning after reports of explosions near the city of Isfahan.

Japan’s benchmark Nikkei 225 plunged as much as 3.5pc to 36,742.05.

US stock indexes drifted to a mixed finish on Thursday in a quiet day of trading.

The S&P 500 fell 0.2pc, to 5,011.12, after flipping between small gains and losses through the day. The drop was slight, but it was still enough to send the index to a fifth straight loss. That’s its longest losing streak since October, and it’s sitting 4.6pc below its record set late last month.

The Dow Jones Industrial Average of 30 leading American companies edged up by 0.1pc, to 37,775.38, and the Nasdaq Composite index slipped 0.5pc, to 15,601.50.

Yahoo Finance

Yahoo Finance