Gartner (IT) to Report Q2 Earnings: What's in the Cards?

Gartner, Inc. IT) is scheduled to report second-quarter 2019 results on Jul 30, before market open.

So far this year, shares of Gartner have gained 32.2% compared with 32.6% rise of the industry it belongs to and 18.3% increase of the Zacks S&P 500 composite.

Let's check out how things are shaping up for the announcement.

Top Line to Benefit from Segmental Strength

Gartner’s revenues are likely to be driven by strength across each of the three business segments — Research, Conferences and Consulting. The Zacks Consensus Estimate for second-quarter 2019 revenues stands at $1.08 billion, indicating 7.6% growth from the year-ago reported figure. In first-quarter 2019, revenues of $970.44 million improved 1% year over year.

Going by segments, the consensus estimate for Research revenues is pegged at $858 million, indicating growth of 11.4% from the prior-year reported figure.

The consensus mark for Conferences revenues is pegged at $125 million, indicating 12.6% increase from the year-ago reported figure. Multiple investments made in support of the conference business is expected to aid the segment.

The consensus estimate for Consulting revenues is pegged at $102 million, indicating year-over-year growth of 6.3%. Solid performance of labor-based and contract optimization business should boost the segment.

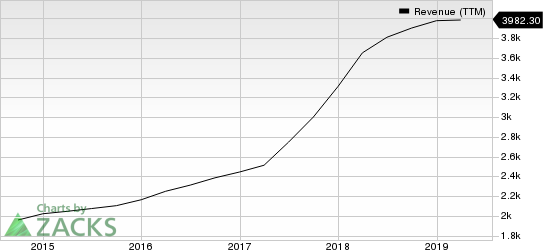

Gartner, Inc. Revenue (TTM)

Gartner, Inc. revenue-ttm | Gartner, Inc. Quote

Earnings Likely to Improve Year Over Year

The Zacks Consensus Estimate for Gartner’s earnings per share in the to-be-reported quarter is pegged at $1.18, indicating growth of 14.6% from the year-ago period reported figure. Notably, the consensus estimate lies within the guided adjusted EPS range of $1.15-$1.20.

In first-quarter 2019, adjusted earnings per share of 58 cents decreased 19% year over year.

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP . Zacks Rank #4 (Sell) or 5 (Strong Sell) stocks are best avoided, especially when the company is seeing negative estimate revisions. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter .

Gartner has a Zacks Rank #3 and an Earnings ESP of 0.00%, a combination that makes surprise prediction difficult.

Gartner, Inc. Price and EPS Surprise

Gartner, Inc. price-eps-surprise | Gartner, Inc. Quote

Stocks to Consider

Here are a few stocks from the broader Zacks Business Services sector that investors may consider as our model shows that these have the right combination of elements to beat on second-quarter 2019 earnings:

S&P Global SPGI has an Earnings ESP of +0.94% and a Zacks Rank #2. The company is slated to report results on Aug 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Clean Harbors CLH has an Earnings ESP of +6.77% and a Zacks Rank #3. The company is slated to report results on Jul 31.

Green Dot GDOT has an Earnings ESP of +0.89% and a Zacks Rank #3. The company is slated to release results on Aug 7.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

S&P Global Inc. (SPGI) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Clean Harbors, Inc. (CLH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance