Gartner (NYSE:IT) Seems To Use Debt Quite Sensibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Gartner, Inc. (NYSE:IT) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Gartner

What Is Gartner's Debt?

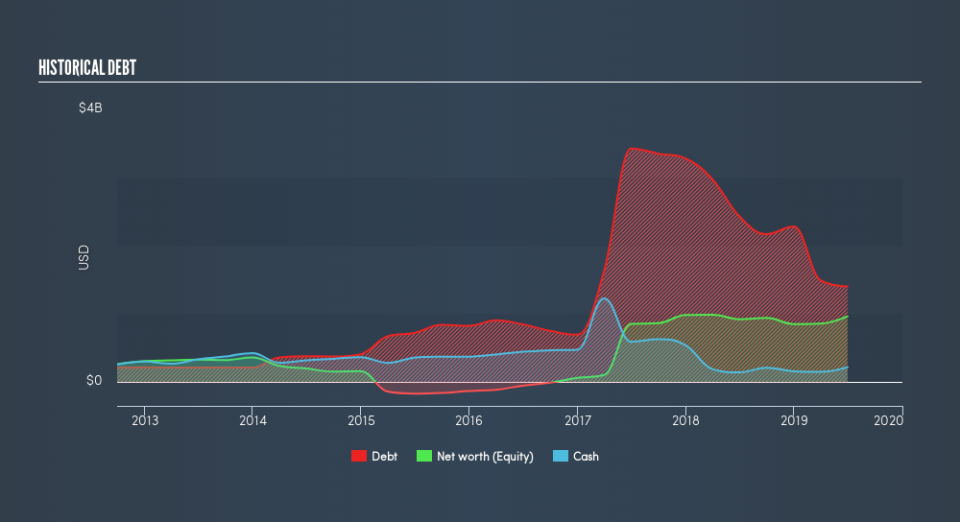

You can click the graphic below for the historical numbers, but it shows that Gartner had US$2.24b of debt in June 2019, down from US$2.43b, one year before. However, it also had US$218.5m in cash, and so its net debt is US$2.03b.

How Healthy Is Gartner's Balance Sheet?

The latest balance sheet data shows that Gartner had liabilities of US$2.48b due within a year, and liabilities of US$3.28b falling due after that. Offsetting these obligations, it had cash of US$218.5m as well as receivables valued at US$1.14b due within 12 months. So it has liabilities totalling US$4.41b more than its cash and near-term receivables, combined.

This deficit isn't so bad because Gartner is worth a massive US$12.2b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Gartner has a debt to EBITDA ratio of 3.4 and its EBIT covered its interest expense 3.7 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Looking on the bright side, Gartner boosted its EBIT by a silky 56% in the last year. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Gartner can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, Gartner actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Happily, Gartner's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its net debt to EBITDA. Taking all this data into account, it seems to us that Gartner takes a pretty sensible approach to debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Gartner insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance