Garmin (GRMN) Solidifies Aviation Footprint Across Europe

Garmin GRMN recently expanded its Garmin Navigation Database coverage to Europe, enabling European customers to integrate the latest aviation navigation information into their Garmin avionics products seamlessly.

The database also offers comprehensive GPS navigation information for European travelers, including single updates, annual bundle options and OnePak subscriptions.

Garmin Navigation Database offers coverage in 35 countries and over 3,400 airports, providing en route and airspace data, instrument procedures, frequencies and airport information. Customers can choose from flexible purchase options.

Garmin is expected to gain solid traction across European aircraft owners and operators on the back of its latest move. This, in turn, will strengthen its footprint across European aviation space.

The European aviation market presents a significant growth opportunity for the company. Per a Mordor Intelligence report, the Europe aviation market size is expected to hit $67.8 billion in 2024 and reach $78.5 billion by 2029, exhibiting a CAGR of 3% between 2024 and 2029.

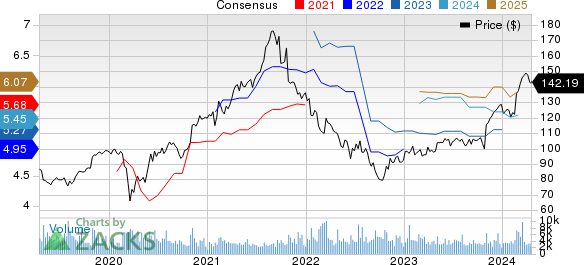

Garmin Ltd. Price and Consensus

Garmin Ltd. price-consensus-chart | Garmin Ltd. Quote

Strength in Aviation Portfolio Aids Growth

The latest move bodes well for Garmin’s growing endeavors to bolster its Aviation business.

The company’s portfolio of avionic solutions includes integrated flight decks, navigation and communication products, automatic flight control systems and safety-enhancing technologies, among others.

This apart, Garmin provides aviation services through FltPlan.com, Garmin Pilot, and AeroData solutions. These help pilots plan, file, fly and log flights, as well as safety management systems and databases. The company also offers training products, extended warranties and subscription services for all aviation segments.

All the above-mentioned solutions are expected to continue driving its momentum among aircraft owners and pilots across the globe.

Notably, the company entered into a long-term agreement to provide the state-of-the-art Garmin G3000 integrated flight deck to BETA Technologies.

G3000 will be deployed in BETA’s CX300 electric fixed-wing aircraft and A250 electric vertical takeoff and landing aircraft.

Garmin’s growing customer momentum in the aviation space will allow the company to capitalize on growth opportunities present in the global aviation market. Per a Mordor Intelligence report, the global aviation market is expected to hit $333.96 billion in 2024 and reach $396.15 billion by 2029, witnessing a CAGR of 2.9% during the forecast period of 2024-2029.

Solidifying prospects in this booming market will likely bolster the company’s overall top-line performance in the near term.

The Zacks Consensus Estimate for 2024 revenues is pegged at $5.77 billion, indicating year-over-year growth of 10.4%.

Garmin’s shares have rallied 11.2% in the year-to-date period compared with the Zacks Computer & Technology sector’s growth of 9.2%.

Zacks Rank & Other Stocks to Consider

Currently, Garmin carries a Zacks Rank #2 (Buy).

Some better-ranked stocks in the broader technology sector are Applied Materials AMAT, Dell Technologies DELL and Synopsys SNPS, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Applied Materials have gained 29.5% in the year-to-date period. The long-term earnings growth rate for AMAT is 8.32%.

Shares of Dell Technologies have gained 59% in the year-to-date period. The long-term earnings growth rate for DELL is currently projected at 12%.

Shares of Synopsys have gained 5.1% in the year-to-date period. The long-term earnings growth rate for SNPS is 17.51%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance