FUJIFILM's (FUJIY) Q4 Earnings and Revenues Increase Y/Y

FUJIFILM Holdings Corporation FUJIY reported a fourth-quarter fiscal 2023 (ended Mar 31, 2024) net income of ¥69.7 billion compared with ¥65.7 billion in the year-ago quarter.

Revenues of ¥805.5 billion increased 5.3% year over year. The uptick was led by solid momentum in the revenue categories of Materials, Business Innovation and Imaging Solutions.

For the fiscal year, the company reported revenues of ¥2,960.9 billion, up 3.6% year over year. Net income was ¥243.5 billion compared with ¥219.4 billion a year ago.

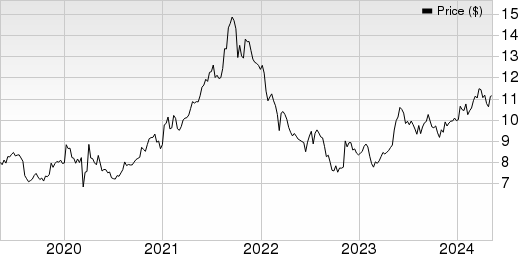

Fujifilm Holdings Corp. Price, Consensus and EPS Surprise

Fujifilm Holdings Corp. price-consensus-eps-surprise-chart | Fujifilm Holdings Corp. Quote

Segment Details

For the fiscal fourth quarter, Healthcare segment revenues came in at ¥284.4 billion, down 1% from the year-ago quarter.

Within Healthcare, Medical Systems revenues rose 6.2% year over year to ¥190.2 billion. Bio CDMO revenues were down 10.9% to ¥61.8 billion. Life sciences revenues were ¥32.4 billion, down 16.3% year over year.

The Materials segment's revenues increased 16.8% to ¥195.3 billion. Electronic Materials, Graphic communication and Display Materials revenues increased 48.9%, 4.9% and 35.1% on a year-over-year basis, respectively. Revenues from other advanced materials fell 5.4% year over year.

The Business Innovation Solutions segment’s revenues were ¥224.7 billion, up 0.4% from the year-ago quarter’s figure. Office solutions revenues declined 0.7% and Business solutions revenues moved up 2.1% on a year-over-year basis.

The Imaging Solutions segment’s revenues were ¥101.1 billion, up 16.8% from the year-ago quarter’s levels. Consumer Imaging and Professional Imaging revenues rose 11.5% and 25.3% on a year-over-year basis, respectively.

Operating Details

In the fiscal fourth quarter, selling, general and administrative expenses increased 7.5% to ¥200.3 billion. Research and development jumped 0.5% to ¥39.4 billion.

Operating income increased 1.9% year over year to ¥71.8 billion.

Balance Sheet & Cash Flow

As of Mar 31, 2024, cash and cash equivalents were ¥179.7 billion, down from ¥268.6 billion as of Mar 31, 2023.

Total debt was ¥502.8 billion as of Mar 31, 2024, compared with ¥376.2 billion as of Mar 31, 2023.

Guidance

FUJIFILM expects revenues of ¥3,100 billion for fiscal 2024, indicating growth of 4.7% year over year. The operating income is projected to be ¥300 billion, suggesting 8.4% growth. The net income is expected to decrease 1.4% year over year to ¥240 billion.

Zacks Rank

Currently, FUJIFILM has a Zacks Rank #4 (Sell).

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Performance of Other Stocks

BlackBerry’s BB fourth-quarter fiscal 2024 adjusted earnings of 3 cents per share beat the Zacks Consensus Estimate by 200%. The bottom line improved from the prior-year quarter’s non-GAAP loss of 2 cents per share.

BB has lost 45.3% in the past year against the sub-industry’s’ growth of 30.7%. In the last quarter, it delivered an earnings surprise of 200%.

Blackbaud BLKB reported first-quarter 2024 non-GAAP earnings per share of 93 cents, which surpassed the Zacks Consensus Estimate by 9.4%. The bottom line increased 29.2% year over year.

Shares of BLKB have gained 10.2% compared with the sub-industry’s’s growth of 30.7% in the past year. In the last quarter, it delivered an earnings surprise of 9.4%.

Cadence Design Systems CDNS reported first-quarter 2024 non-GAAP earnings per share of $1.17, which beat the Zacks Consensus Estimate by 3.5%. However, it decreased 9.3% year over year.

In the past year, CDNS has gained 38.4% compared with the Zacks sub-industry’s growth of 30.7%. It currently has a long-term growth expectation of 17.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fujifilm Holdings Corp. (FUJIY) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance