FTSE 100 Technical Update: Tiptoeing Trend-line

DailyFX.com -

What’s inside:

The FTSE 100 is lagging global markets in recent sessions

Post-Brexit trend-line and horizontal support keeps market pointed higher for now

A lower high scenario is on the table if the UK index doesn’t start rallying soon

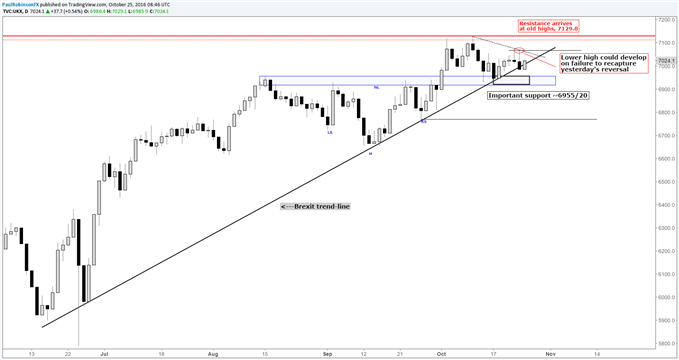

The FTSE 100 is holding the post-Brexit trend-line, barely. In recent sessions, UK stocks have not been the strongest when looking out across the global spectrum; Asia is rallying (Nikkei at 6-mo highs), other parts of Europe are rallying (DAX at yearly highs), and the U.S. is ‘sort of’ rallying (S&P stuck in range, but Nasdaq 100 new record highs yesterday). We will want to keep one eye on this dynamic for further clues as to whether this will become a theme of relative weakness we can key in on.

If the UK index should fail to hold on to the trend-line off the June lows, it should find support in the 6955/20 region where late summer peaks were created and the market held on a decline on 10/17.

Monday’s minor reversal day was a little concerning, giving rise to the notion of a lower high developing. Trade back above yesterday’s day high at 7067 will put those concerns to bed, while a break of before mentioned support will suggest further weakness will set in.

An advance above 7067 will quickly bring into play the old highs around 7130 and keep the trend firmly pointed higher. However, should the market break the June trend-line and horizontal support, confirming a lower high scenario, then we will need to roll down to the 9/27 pivot at 6769 for the next level of price support.

FTSE 100: Daily

Created in Tradingview

Find out where our team of analyst think various asset classes are headed for the remainder of Q4.

---Written by Paul Robinson, Market Analyst

To receive Paul’s analysis directly via email, please sign up here.

You can follow Paul on Twitter at @PaulRobinonFX.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance