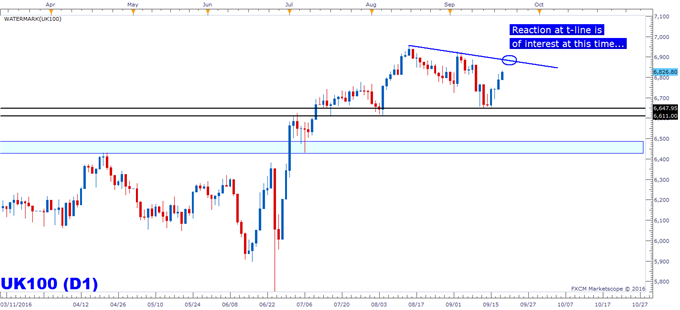

FTSE 100: Rebounding Towards Resistance

DailyFX.com -

What’ inside:

The FTSE 100 continues to push higher

Resistance soon at top-side trend-line

No significant UK data this week, BoJ and FOMC up tomorrow

So far in today’s session the FTSE 100 is adding to yesterday’s strong 1.5%+ gains, overall having risen strongly in recent days.

The recovery doesn’t have any initial resistance until a top-side trend-line running off the 8/15 peak, passing over the early September highs; at this time that level comes in around the 6880 mark.

Should the FTSE rise to this point, how the market reacts will provide indications on how it will likely proceed from there. Another lower high in a sequence of a lower highs, lower lows, or a shallow pullback before breaking out to new heights are potential paths Or, the market could altogether continue to rally on through. It's wait and see at the moment.

At this juncture, the FTSE is neither here nor there from a tactical standpoint beyond day-trades. Intra-day traders can look to continue to go with the current upward trend until resistance, however; swing traders are not offered much at this juncture with risk/reward in neither direction looking favorable without further price action.

There isn’t any scheduled data of significance out of the UK this week. The market will take interest in the outcome of Wednesday’s BoJ meeting and even more so the FOMC outcome tomorrow as well. No predictions will be made on this end regarding any policy changes (although none are expected) nor the tone of the language from the CBs, but that, as per usual, expect the unexpected and keep risk wrangled.

Follow trader sentiment in real-time via FXCM’s SSI indicator.

---Written by Paul Robinson, Market Analyst

If you would like to receive articles directly to your inbox, SIGN UP HERE.

You can follow Paul on Twitter at @PaulRobinonFX.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance