Prepare now for Putin to cut off gas supply, Europe warned

The three charts that show inflation is only going to get worse

Union barons blasted for 'sense of entitlement' as rail strike talks resume

FTSE 100 falls 0.9pc as inflation rises again

Jeremy Warner: Strike chaos and high inflation, yes, but this is not the 1970s in redux

Europe has been urged to prepare for a complete cutting off of Russian gas supplies as the continent’s energy crisis deepens.

The International Energy Agency warned Putin’s decision to curtail flows through the Nord Stream pipeline over the last week could be a precursor to a full shutdown this winter.

Fatih Birol, head of the IEA, told the Financial Times: “Europe should be ready in case Russian gas is completely cut off.”

He said European countries should take measures to reduce demand ahead of the key winter period. This included firing up old coal-fired power stations despite concerns about emissions.

Bloomberg reported that Germany was preparing to trigger the second phase of its emergency gas plan – known as the “alarm” stage – amid rising fears that Putin could turn off the taps.

06:13 PM

Wrapping up

That's all from the blog today, thank you for following! Before you go, check out the latest stories from our reporters:

Sir Jim Ratcliffe to bring gas to Europe as bloc scrambles for supplies

Unilever secretly fought ban on plastic sachets it branded ‘evil’

Union barons blasted for 'sense of entitlement' as rail strike talks resume

The three charts that show inflation is only going to get worse

06:07 PM

High taxes could halve number of London new-builds, warns developer Berkeley

Inflation and rising taxes on developers risk making Britain’s home shortage worse, according to the boss of London's largest housebuilder. Helen Cahill has more:

Berkeley Group's chief executive Rob Perrins said the number of new properties built in the capital could halve unless more was done to lessen the burden on builders.

"The last year has seen increases in taxation for all businesses and our sector in particular which has also faced further regulatory changes,” he said.

The housing industry faces a new 4pc tax on profits made from residential properties. The so-called Residential Property Developer Tax was introduced in the aftermath of the Grenfell fire to fund the restoration of buildings with unsafe cladding. Mr Perrins also complained about new carbon-related taxes.

05:46 PM

FTSE 100 ends lower

The FTSE 100 closed in the red after traders digested another 40-year-high for UK inflation levels.

A consumer price index inflation reading of 9.1pc was in line with expectations for May, but rocketing producer prices showed inflationary woes are not likely to reverse any time soon.

The FTSE 100 ended the day down 0.9pc at 7,089.

Michael Hewson, chief market analyst at CMC Markets UK, said: "The fragile nature of this week's rebound has been laid bare today, with a sharp slide in oil prices in Asia, spilling over into broader market weakness, with the Dax sliding below last week's lows, before rebounding, while the FTSE has also slipped back sharply.

"Today's inflation numbers from the UK came across as rather mixed in the same way as the US inflation numbers a couple of weeks ago, with core prices softening, however PPI prices continued to push higher, suggesting that there is still a lot of price pressure still in the pipeline."

05:26 PM

Time Out London to publish its last print magazine tomorrow

Time Out London is publishing its last print magazine tomorrow, 54 years from its launch, after announcing plans to go digital-only earlier this year.

The publication will focus on revamping its Instagram profile, producing video content and a daily newsletter for people in London.

It will still publish a cover digitally every two weeks. The first one will celebrate Pride and feature trailblazing Black trans supermodel Munroe Bergdorf, who bounced back from a high-profile controversy to become a celebrated spokesperson with a global following.

Chris Ohlund, chief of Time Out Group, said: “Our new digital initiatives across social and video especially will enable us to deliver deeper, engaging storytelling that we know our audience will love and our advertising clients are seeking. It is a strategy that has already been hugely successful for us in the US and will be key to further drive our growth and profitability.

“Time Out is a global brand with a national footprint and a local voice; we are constantly and quickly innovating to reach, engage and grow our audience across the right channels with the right content that delivers our brand’s core purpose – we do this via an impactful combination of digital and ‘in real life’ that no other brand can offer.”

04:59 PM

De Beers posts higher diamond sales as demand in China picks up

Miner De Beers has posted an uptick in sales in the past two weeks as demand in China picked up following the end of Covid lockdowns, while the US market continues to perform well.

The group said sales in the period between June 6 and 21 came in at $650m (£528m), compared to $604 in the previous sales cycle, which was between May 2 and 17.

Chief Bruce Cleaver said: “Diamond jewellery demand continues to perform well in the key US market, and this was reinforced by positive sentiment following the influential JCK Las Vegas jewellery trade show held in mid-June.

"The continued strength of US demand for diamond jewellery and the gradual reopening of retail outlets in China following Covid-19-related lockdowns have supported the sales momentum of De Beers Group’s rough diamonds in the fifth sales cycle of the year.”

04:30 PM

Sir Jim Ratcliffe to bring gas to Europe as bloc scrambles for supplies

Sir Jim Ratcliffe’s chemicals giant is to supply Europe with American liquified natural gas (LNG) as concerns mount over supplies following EU sanctions on Russia. Matt Oliver writes:

Ineos said the two-decade agreement with California-based Sempra Infrastructure will allow it to import as much as 1.4 million tonnes of LNG per year.

The company then plans to trade the gas on European markets, while using some to meet its own industrial needs.

It marks Ineos’s first foray into the LNG market and comes amid fears that Russian president Vladimir Putin could cut off gas supplies to the Continent next winter, owing to tensions over Ukraine.

04:08 PM

US regulator prepares to ban Juul's e-cigarettes

The US Food and Drug Administration is getting ready to order Juul’s e-cigarettes off the market, the Wall Street Journal has reported.

The decision could be announced as early as today.

The FDA has already banned the sale of fruity and sweet flavours for e-cigarettes. The agency allowed some products made by Juul rival NJOY to remain on the market earlier this year, and last year authorised British American Tobaccos e-cigarette Vuse.

03:53 PM

Handing over

That's all from me for today – thanks for following! Giulia Bottaro is in the hot seat for the rest of the day.

03:44 PM

Nasdaq turns positive after Powell's remarks

Wall Street is staging something of a comeback after Fed chair Jay Powell said the US central bank was "strongly committed" to bringing down inflation.

In his prepared remarks before the Senate Banking Committee, Mr Powell reiterated that ongoing increases in the policy rate would be appropriate, but the pace of the changes will continue to depend on the incoming data and the evolving outlook for the economy.

The comments come a week after the Fed raised interest rates by 75 basis points – the biggest increase since 1994.

The S&P 500 and Dow Jones pared early losses, while the tech-heavy Nasdaq turned positive with gains of 0.4pc.

03:33 PM

String of scandals force JD Sports to toughen governance

JD Sports is overhauling its business after a string of run-ins with the City watchdog led to the exit of its long-serving boss, writes Lucy Burton.

The clothing and trainer retailer has told investors that a "number of regulatory issues" have led it to conclude that more board experience is needed alongside better risk controls.

The company announced a major rejig in governance that could take 18 months. The decision comes after former executive chairman Peter Cowgill stepped down in May "as a consequence of an ongoing review of its internal governance and controls".

The company was last year hit with a £5m fine by the competition watchdog after Cowgill was filmed talking to Footasylum's boss in a car park despite the pair being told to stay separate while the regulator investigated JD's takeover of Footasylum.

Earlier this month JD was also accused of fixing the price of Rangers FC shirts in "cartel activity" with Elite Sports.

03:14 PM

UK food price inflation to hit 20pc, warns Citi

UK food price inflation looks set to surge to 20pc in the first quarter of next year, according to dire forecasts from US bank Citi.

The predictions come after the latest official data showed consumer prices jumped to a new 40-year high of 9.1pc in May, as rising food costs took over from energy as the main driver of inflation.

While Russia's invasion of Ukraine is disrupting supplies of grain and vegetable oil, food prices more broadly have been pushed up by poor weather and rising energy prices, which increase the cost of fuel, shipping and fertiliser.

Food and non-alcoholic drinks prices paid by consumers in May were 8.7pc higher than a year ago – their biggest increase since March 2009 – and manufacturers' ingredient costs are rising even more rapidly.

The prices manufacturers paid for domestic food materials is up 10.3pc, while imported food costs – which account for almost half Britain's consumption – were 20.5pc higher, the largest rise since December 2008.

Benjamin Nabarro, economist at Citi, said: "Food inflation overshot our forecasts. We now expect price growth here to peak at a little over 20pc in the first quarter of 2023, with producer price inflation here continuing to accelerate."

The predictions are even steeper than forecasts from the Institute for Grocery Distribution, which last week said food price inflation would peak at 15pc over the summer and said some households were already skipping meals.

02:53 PM

Fed chair Powell warns more interest rate rises coming

Federal Reserve chair Jay Powell has said the US central bank will keep raising interest rates to tackle inflation, but said policy makers must be "nimble" amid the risk of a recession.

In text of his testimony to the Senate Banking Committee, Mr Powell said: "We anticipate that ongoing rate increases will be appropriate.

"Inflation has obviously surprised to the upside over the past year, and further surprises could be in store. We therefore need to be nimble in responding to incoming data and the evolving outlook."

His prepared remarks largely mirror comments made last week after the Fed raises interest rates by 75 basis points – the biggest increase since 1994.

He added: "We understand the hardship high inflation is causing. We are strongly committed to bringing inflation back down, and we are moving expeditiously to do so."

02:41 PM

Wall Street drops amid recession fears

Wall Street's main indices dropped at the opening bell as traders turned their attention to testimony from Fed chair Jerome Powell amid jitters about inflation and a potential recession.

The S&P 500 fell 0.8pc, while the Dow Jones was down 0.6pc. The tech-heavy Nasdaq shed 1.2pc.

02:25 PM

Mark Carney fund raises $15bn for energy transition

Mark Carney's Brookfield Asset Management has raised $15bn (£12.2bn) for a fund dedicated to investing in the global transition away from fossil fuels.

The cash injection will be used to create Brookfield Global Transition Fund, which the company described as the largest private vehicle of its kind.

The fund, led by Brookfield vice chair Mark Carney and its renewables chief Connor Teskey, will invest in solar power and other technologies that reduce greenhouse gas emissions.

Mr Carney said: "With the global carbon budget being rapidly run down, now is the time for comprehensive, determined actions.

"That means deploying capital across the economic spectrum from scaling clean energy generation, to transforming traditional utilities and to providing sustainable solutions for heavy industries like steel and cement."

02:13 PM

Network Rail boss ‘not wildly optimistic’ as strike talks resume

Rail chiefs are “not wildly optimistic” of a breakthrough to avoid strikes on Thursday as they criticised a “sense of entitlement” among trade union leaders.

Oliver Gill reports:

Talks restarted on Wednesday over an industrial dispute that led to the biggest shutdown of Britain’s train network in a generation this week.

But Network Rail chief executive Andrew Haines said he was not hopeful that a deal could be struck before the next day of industrial action on Thursday.

He told The Telegraph: “Are we wildly optimistic? No. Are we fighting to find a way through this? Absolutely.”

Industry sources have claimed that union leaders are clinging onto archaic working practices that mean tasks such as “changing a plug socket” would take a team of nine workers.

Among the other working practices union chiefs are determined to defend are rail workers being entitled to “walking time allowance” of 12 minutes for a one minute walk and engineers being unable to stray 500 yards from their dedicated patch, sources said.

01:48 PM

Canadian inflation hits highest since 1983

Canadian inflation has surged to its highest level in four decades in a further sign price rises are setting in across the globe.

Consumer price inflation rose to 7.7pc last month, up from 6.8pc in April, according to official data. That's well above forecasts and the highest since January 1983.

The inflation gauge rose 1.4pc from a month earlier with fuel, hotel rates and cars among the biggest contributors.

The figures highlight the pressure on the Bank of Canada to continue with aggressive interest rate rises in the coming weeks.

Prime Minister Justin Trudeau's government has also come under pressure from opposition parties and economists to do more to ease the strain of soaring inflation on households.

01:15 PM

Joe Biden pushes fuel tax cut ahead of midterm elections

Joe Biden will on Wednesday urge US lawmakers to suspend federal taxes on petrol and diesel for three months to help drivers facing surging costs at the pumps, writes Matt Oliver.

In an intervention ahead of November’s midterm elections, the American president will also call on states to suspend their own individual petrol taxes or hand voters other kinds of relief.

The average cost of a gallon of petrol has hit about $4.96 in the US, according to the American Automobile Association. That is slightly down from the recent all-time high of $5 but represents an $1.89 increase compared to just a year ago.

Petrol prices are a key issue in the US ahead of the midterm elections, with polls currently suggesting that Mr Biden’s Democrats face heavy losses.

However, the President’s call for a tax cut may get a lukewarm reception in Congress, where lawmakers have already cast doubt on the usefulness of a holiday.

The driver of a Ford Focus, for example, would only save about $2.34 each time they filled up their tank under Mr Biden’s proposed relief. The federal tax on petrol is currently 18.4 cents a gallon, while the tax on diesel stands at 24.4 cents.

12:30 PM

IEA: Europe faces 'scramble' to wean itself off Russian energy

Europe must double down on energy efficiency and renewables as it faces a "scramble" to wean itself off Russian energy.

That's according to the International Energy Agency, which has issued its latest grim warnings over the continent's energy crisis.

Gas prices have hit record levels as a slowdown in flows from Russia in recent days has deepened worries over supply in higher-demand winter months.

The IEA said: "In the near term, the scramble for alternative sources of fossil fuels creates clear openings for non-Russian suppliers."

It added that Europe must react to the crisis "with a determined acceleration of investment in efficiency, renewables and other clean technologies".

12:05 PM

Wall Street set to drop on recession fears

Wall Street looks set to follow the FTSE 100 into the red this afternoon as investors get increasingly worried about the risk of a recession.

Aggressive interest rate rises by central banks around the world are fuelling fears of a slowdown in economic growth.

Citigroup now reckons there's almost a 50pc chance of the global economy being tipped into a recession.

Futures tracking the S&P 500 fell 1.6pc, while the Dow Jones was down 1.4pc. The tech-heavy Nasdaq slumped 1.8pc.

11:50 AM

Petrol prices hit fresh record on first day of strikes

Petrol prices soared to a fresh record yesterday, just as the biggest rail strike in 30 years forced more workers to get behind the wheel.

The average cost of petrol rose to 189.33p a litre, pushing the cost of filling an average family car above £104, according to the RAC. Diesel climbed to 197.11p a litre – also a new high.

A recent fall in wholesale prices means petrol may have reached its peak. However, diesel keeps moving closer to £2 a litre.

11:39 AM

JD Sports posts record profits but warns on cost-of-living hit

JD Sports has unveiled a record profit for the full year, but warned earnings will remain flat in the months ahead as the cost-of-living crisis bites.

The scandal-hit retailer posted pre-tax profits of almost £950m – more than double the previous year.

But JD said profit growth was expected to be held back in the year to next January, due to pressures of the cost-of-living crisis in the UK and wider economic woes.

Helen Ashton, interim chair of JD Sports, said: "Whilst we are encouraged by the resilient nature of the consumer demand in the current year to date, we remain conscious of the headwinds that prevail at this time, including the general global macro-economic and geopolitical situation."

It comes weeks after Peter Cowgill resigned as executive chairman after 18 years in the role.

That followed a storm of negative publicity and a fine from the competition watchdog over his clandestine meeting in a car park with the boss of Footasylum, which it had agreed to buy for £90m.

11:24 AM

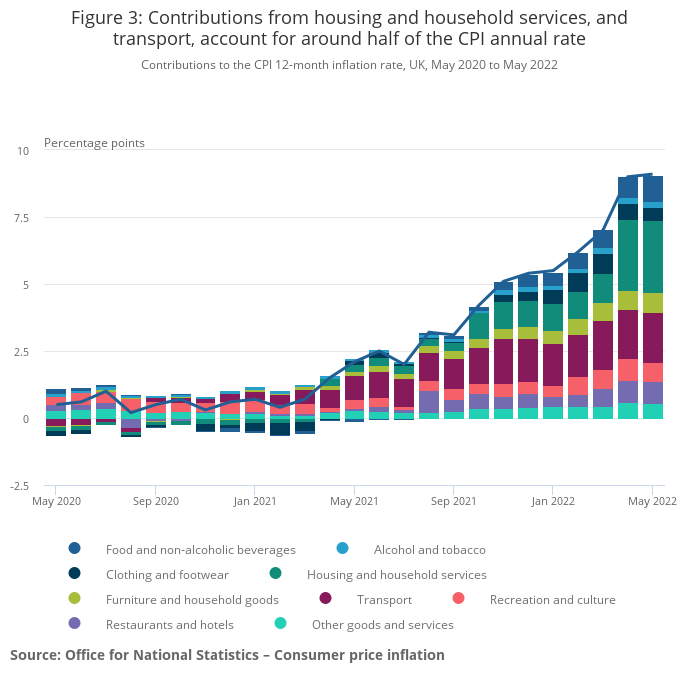

The three charts that show inflation is only going to get worse

UK consumer prices rose by 9.1pc in the year to May, a fresh 40-year high, amid soaring costs for energy, transport and food.

Inflation is expected to pick up further as the year goes on hitting double digits in the autumn when an increase in the energy price cap kicks in.

Some price categories are easing, but there are signs that companies are still soaking up inflationary pressures into their margins.

Louis Ashworth and the production team have put together three charts showing the dangers ahead.

11:16 AM

Harrods delays summer sale amid supply troubles

There's only one sale, but it's not happening yet.

Harrods has delayed its famous summer sale by two weeks as the new season's goods have been caught up in supply chain troubles.

Michael Ward, the luxury department store's managing director, told Bloomberg: "Our supply chain is running two to three weeks behind where it should be.

"A good example of that is we've just delayed the summer sale for two weeks because I need another 10pc of new-season stock to allow me to function into the new year."

Businesses have been battling with supply snags, which have been exacerbated by the war in Ukraine and China's zero-Covid strategy. Labour shortages have also hit industries ranging from retailers to airlines.

11:00 AM

Germany prepares next stage of emergency gas plan

Germany is preparing to trigger the next stage of its emergency gas plan – a decision that may mean passing higher prices on to industry and households.

Talks over the move show there are serious concerns that the supply situation may deteriorate further after Moscow slashed flows through the Nord Stream pipeline last week.

The Government may soon move to its second "alarm" phase, Bloomberg reports. It enacted the "early warning" phase at the end of March, when the Kremlin first demanded gas payments in roubles.

If Germany moves to its highest "emergency level", the state would seize control of the country's entire distribution network.

10:46 AM

UK extends NatWest share sales

The UK is extending a plan to sell more of its £11.3bn stake in NatWest for another year.

The Government currently owns about 48.5pc of the high street bank – a hangover from the costly bailout of RBS during the financial crisis.

UK Government Investments, which oversees state holdings, said its trading plan will now terminate in August 2023 as it looks to further reduce its stake in the lender. Shares were up more than 3pc.

Since the plan was established in 2021, the Government has sold about 703.5m shares in NatWest for around £1.6bn.

Ministers have pledged to cut the holding, which once stood at 80pc. However, the Treasury is likely to take a hefty loss after a drop in the bank's share price.

10:38 AM

Sunak: BoE will act 'forcefully' to stem inflation

Rishi Sunk has said the Bank of England will "act forcefully" to combat rising prices as inflation hit a new 40-year high of 9.1pc.

The Chancellor told reporters: "I want people to be reassured that we have all the tools we need and the determination to reduce inflation and bring it back down."

He added that the Government would be responsible for borrowing and debt, and work to improve productivity.

10:31 AM

Motorists pay extra £500 a year to fill up

Drivers are now paying an extra £500 a year to fill up as record inflation piles further pressure on household budgets.

This morning's ONS figures showed fuel prices have surged 32.8pc over the latest year – the fastest rate in records going back to 1989 – as Russia's war in Ukraine sparks supply fears.

This has driven up prices at the pumps, with a full tank now costing more than £100 on average, and fuelled demand for electric vehicles.

Erin Baker at Auto Trader, which compiled the figures, said:

With the average family petrol and diesel car costing over £100 to fill up there’s been a surge in interest for more cost-efficient alternatives.

And whilst the up-front cost of a new or used EV will place them out of reach for many buyers, the potential saving of around £176 per every 1,000 miles, which is only set to increase over the coming months, will ensure electric demand will only head in one direction.

10:21 AM

Pioneering vaccine maker Moderna to open first factory in Britain

ICYMI – Jab maker Moderna plans to open first vaccine factory in Britain, as it hailed the UK’s “world-class life sciences and research community” which came to the fore during the pandemic.

Hannah Boland has more:

Moderna, whose Covid-19 mRNA jabs played a key role in vaccinating Britain last year, said it had struck a deal with the Government to establish a new vaccine innovation and technology centre in the UK.

The US biotech company is yet to lay out plans for how large the facility will be or where it will be built, although reports have suggested it was considering between Oxford, Cambridge and London.

It follows talks between Moderna chief executive Stéphane Bancel and Health Secretary Sajid Javid in Boston earlier this year.

Moderna, which is also setting up a factory in Canada, said it would use the facility in Britain to manufacture mRNA vaccines for Covid and flu. Its work would be in collaboration with the Government.

It added that the site would allow a rapid response to future pandemics, if vaccine makers once again had to quickly develop and produce new jabs to tackle viruses.

Read Hannah's full story here

10:04 AM

Mike Ashley increases stake in Hugo Boss again

Mike Ashley's Frasers Group has increased its stake in Hugo Boss once again.

Frasers said it now has 3.4m shares – a 4.9pc stake – in the luxury German fashion chain and holds buy options over another 26pc shareholding.

The company said its investment is now worth around €900m (£770m).

Frasers, which owns chains including Sports Direct and House of Fraser, has been building up its holding in Hugo Boss for the past two years, having first bought a holding in the fashion firm in 2020.

It also owns a stake in British luxury handbag maker Mulberry and has been leading a push into the upmarket retail sector.

That's alongside an aggressive acquisition spree in the retail sector, with the latest deal seeing it buy fast fashion retailer Missguided out of administration.

09:48 AM

Reaction: Rising jitters in the housing market

Jeremy Leaf, former RICS residential chairman, says the slowdown in demand in the housing market is not yet showing in the data.

Price changes can reflect stock shortages as well as regional and house type variations, as reflected in this, the most comprehensive of all the market surveys.

But its inevitable historic nature means it is not yet showing the softening in demand picked up by other reports over the past few weeks.

We are seeing increasing nervousness about taking on debt at a time when buyers and sellers have no real clue as to when and how the rising cost of living will start to level out.

Nevertheless, continuing lack of choice and strong employment prospects means there is still little chance of significant price changes over the next few months at least.

09:43 AM

House prices rise at second fastest rate on record

UK house prices rose 12.4pc in the year to April to new record highs, with growth surging to the second-highest on record as people tried to secure purchases ahead of interest rate rises.

The average UK house price was £281,000 in April, marking a £31,000 increase on this time last year. The pace of growth was the second highest (after April 2021) in data going back to 2006.

Chris Jenkins at the ONS said:

While annual growth nudged up again in April, this was mainly due to falls seen at this time last year from changes in the previous stamp duty holiday.

Wales and Scotland saw the highest growth with London, again, growing the slowest.

Rental prices continued to grow steadily overall. However, while still lagging other nations and regions, growth in London continues to pick up.

09:25 AM

We're 'far' from stagflation, insists ECB

Experts on the European economy don't expect the region to suffer 1970s-era stagflation, according to the European Central Bank.

While growth forecasts were cut and inflation expectations raised after Russia's invasion of Ukraine, economic activity is still expected to increase next year. Inflation is set to drop blow 2pc in the second half of 2023.

The ECB said: "Current expert forecasts remain far from a stagflation scenario". But it admitted there was greater uncertainty, leading to a greater range of forecasts.

The central bank also pointed to differences between now and the 1970s. Dependence on oil has decreases since then, workers have become less unionised and the economy is still benefiting from a post-pandemic boost.

09:14 AM

Rail companies to hold talks with union as strikes drag on

Rail operators and union bosses will meet for talks today to try to resolve the impasse that’s fuelling the biggest strike in three decades.

While around 40,000 rail workers are due back after yesterday’s initial walkout, further strikes planned for tomorrow and Saturday mean only 60pc of trains are expected to run, according to the BBC.

Further negotiations between companies and the RMT are set to take place today, though any agreement is unlikely to come soon enough to call off the next strike.

It's worth noting that RMT chief Mick Lynch has called for pay rises to be pegged to the retail price index. After today's data, that would mean an increase of 11.7pc.

09:04 AM

Oil prices tumble on recession fears

Oil prices have gone into reverse this morning as traders grow increasingly jittery about a global recession.

Benchmark Brent crude slumped more than 5pc to below $109 a barrel – its lowest level since mid-May. West Texas Intermediate to below $104.

Crude prices have soared in recent months amid concerns about the war in Ukraine and a rapid rebound in demand as the world emerges from the pandemic.

But central banks are now ramping up interest rates to tackle soaring inflation, fuelling concerns of a global recession that would dent demand for fuel.

08:59 AM

50pc chance of global recession, warns Citigroup

There are more dire warnings this morning as Citigroup said the probability of the global economy falling into a recession is now nearly 50pc.

Economists said supply shocks were pushing up inflation and stunting growth, while central banks are now raising interest rates aggressively and consumer demand is waning.

They wrote: “The experience of history indicates that disinflation often carries meaningful costs for growth and we see the aggregate probability of recession as now approaching 50pc.

“Central banks may yet engineer the soft – or softish – landings embodied in their forecasts (and in ours), but this will require supply shocks to ebb and demand to remain resilient.”

Citigroup now expects the world economy to grow 3pc this year and 2.8pc in 2023.

08:30 AM

FTSE risers and fallers

It's a torrid start to the day for the FTSE 100, which is feeling the heat from the latest inflation figures and recession fears.

The blue-chip index is down 1.3pc, dragged lower by energy and commodity shares.

BP and Shell tumbled 2.7pc and 3.5pc respectively as oil prices dropped sharply amid concerns about a global economic slowdown.

Glencore, Rio Tinto and Anglo American all shed around 3pc.

NatWest was one of only four blue-chip companies that escaped the red. It rose more than 2pc after the Government extended a plan to sell more of its £11.3bn stake.

The domestically-focused FTSE 250 fell 1.4pc, with software company Micro Focus slumping 12pc after it first-half results.

08:25 AM

Factory prices jump by most since 1977

Let's take another look at those factory gate prices, which spell trouble for consumers in the month ahead.

The producer price index, which measures the cost of goods leaving factory, jumped 15.7pc in May, according to the ONS figures.

That's well ahead of forecasts of 14.7pc and marks the biggest rise since 1977.

It comes as manufacturers grapple with soaring input costs for raw material and labour as Russia's war in Ukraine and Covid-related staff issues take their toll.

Factory gate prices reflect the costs that have to be shouldered by retailers, but these are usually passed on to consumers in the form of higher shop prices.

The British Chambers of Commerce said the number of businesses reporting that they plan to raise prices was "far beyond anything we've seen since our records began in 1989".

08:15 AM

More reaction: UK flirting with recession

Hussain Mehdi at HSBC Asset Management also sounds the alarm over a looming recession.

The worst is yet to come with October’s energy price cap increase. With services inflation remaining bolstered by a very tight labour market, and a weak pound resulting in higher import prices, the Bank of England will be forced to remain in tightening mode.

Indeed, there is a risk of 50bp hikes at the next couple of meetings – action not seen since the mid- 90s.

Overall, the intense income squeeze, weak consumer confidence, and housing market vulnerability to rising rates – especially given the UK’s relatively high share of variable rate mortgages – means the economy is on the brink of recession.

Nevertheless, despite the most elevated recession risk among major developed markets, UK equities continue to outperform given their high weight to value, defensive and commodity names, as well as limited tech sector exposure.

08:13 AM

Reaction: A recession looks increasingly likely

Tom Stevenson at Fidelity International warns the Bank's efforts to curb inflation could tip Britain into a recession.

The Bank of England is battling a toxic combination of high inflation and stagnant growth. It means policymakers are pulled in two opposing directions, an impossible balancing act for rate-setters.

Rates look likely to rise to 3pc next year but, while this may take the heat out of inflation, it will come at a heavy cost. A recession looks increasingly likely.

It’s a difficult time for households. Earnings are rising but not as fast as prices. And that mismatch looks like continuing for some time yet.

For investors, the outlook is better. UK-based investors are benefiting from the relative immunity of our domestic stock market to the woes of the British economy. Exposure to buoyant sectors such as commodities and oil & gas provides some protection from the chill winds blowing through global markets.

More generally, investors should resist the temptation to become more bearish as markets drift lower. The bear market may not be over just yet but the odds of a decent return are improving.

08:09 AM

Traders scale back interest rate bets

Traders are scaling back their bets on future Bank of England interest rate rises after the latest inflation figures matched estimates.

Money markets are now pricing in 147 basis points of rate rises by November, which suggests they're no longer betting on three aggressive 50 basis-point increases.

By the end of the year, though, 177 basis points of rate rises are priced in. This would take the base rate to 3pc.

08:05 AM

IoD: Half of bosses expect two-year inflation surge

Kitty Ussher, chief economist at the Institute of Directors, warns bosses are pessimistic about the outlook for inflation.

This is a story that has little changed since April, with the recent rise in household energy and transport prices explaining most of the high rate of inflation.

The 0.1 percentage point increase in May is due primarily to the mathematical effect of having had a fall in food prices this time last year.

Although there will be some reassurance that the rate of increase has temporarily steadied following last month’s rise, we will have a long wait before it gets anywhere near back to the Bank of England’s 2pc target.

Our own surveys of IoD members show almost half of business leaders (46pc) think inflation will still be above the Bank of England’s target two years from now.

Policymakers would be well advised to start talking publicly about when inflation might be expected to peak and start falling back, to help expectations re-anchor at a lower level.

08:02 AM

FTSE 100 slumps after inflation figures

The FTSE 100 has fallen sharply at the open after the latest data showed another increase in inflation to a new 40-year high.

The blue-chip index dropped 1.3pc to 7,059 points.

07:55 AM

Reaction: BoE stuck between rock and hard place

Mike Bell at JP Morgan Asset Management says sky-high inflation leaves the Bank of England facing a dilemma.

On the one hand, real wages are already being squeezed by higher prices. Increasing borrowing costs further, on top of rising food and energy prices, could feel like rubbing salt in the wound for some households and increases the risk of a recession.

However, there is also the risk that without further rate rises a wage price spiral could develop.

The Bank of England are therefore stuck between a rock and a hard place. Nevertheless, we expect them to keep raising rates until there are clear signs that the labour market is weakening.

07:50 AM

Reaction: Inflation not at its peak yet

Thomas Pugh, economist at RSM UK, warns UK inflation has further to run.

Another tick up in inflation to 9.1pc means prices are rising at the fastest rate in more than 40 years and will pile on pressure on the Monetary Policy Committee to raise interest rates by a more aggressive 50 bps at its next meeting in August.

What’s more, inflation has further to go. It may hit 10.5pc in October when Ofgem increases its energy price cap again and as food price rises continue to filter through. This will leave annual inflation at more than 8pc, its highest rate since the early 1980s.

However, inflation should fall sharply in the second half of 2023 as the recent rises in energy prices fall out of the annual comparison. This, combined with a much weaker economy over the rest of the year may be enough to let the MPC press pause on its tightening cycle at the start of 2023.

It’s not all bad though, oil prices have fallen by 10pc over the last two weeks, which should feed into lower fuel inflation over the next month.

Nevertheless, the huge rise in inflation will mean there is likely to be very little growth in GDP in the second half of the year. Indeed, our forecasts suggest the economy will be no bigger this time next year than it is now – so while we aren’t forecasting a recession at the minute, it would not take much of a rise in oil prices or a disruption in supply chains to push the UK into one.

07:48 AM

What's driving inflation?

The latest figures once again showed how surging energy costs are driving inflation.

Housing and household services, which includes gas and electricity prices, and transport, which includes petrol and diesel, together made up around half the annual consumer price index.

Food and non-alcoholic beverages were another big driving force as Russia's war in Ukraine continues to drive up grocery prices.

One positive note, however, came from clothing and footwear, which posted a slightly smaller increase in May.

07:41 AM

Is demand starting to flag?

Samuel Tombs at Pantheon Macroeconomics points to the fall in core CPI, which strips out volatile food and energy components from the headline inflation figure.

This is an encouraging sign, he says, as it shows the squeeze on household budgets may be hitting demand, which in turn should cool surging prices.

While the headline rate of CPI inflation ticked up in May, core CPI inflation fell to 5.9%, from 6.2% in April, slightly undershooting the consensus and the MPC's f'cast. This is an encouraging sign that retailers are starting to accept tighter margins now demand is flagging: pic.twitter.com/RbivQzwoId

— Samuel Tombs (@samueltombs) June 22, 2022

07:38 AM

Capital Economics: Not enough to seal bigger interest rate rise

Paul Dales, chief economist at Capital Economics, says the modest rise in inflation may encourage the Bank of England to raise interest by just 0.25pc again at its next meeting.

CPI inflation is not yet close to its peak. With two-thirds of the observation period for the Ofgem price cap having now passed, something like a 40pc rise in utility prices is pretty much baked in the cake for October.

We think that will raise CPI inflation to 10-11pc.

Even so, it is not obvious in this release that there are signs of the “more persistent inflationary pressures” that last week the Bank said would prompt it to “act forcefully”.

The rise in services inflation from 4.7pc to 4.9pc does take it to its highest rate since 1993 and suggests that domestic price pressures are still strengthening.

But core goods inflation, which more driven by global factors, did ease back from 8pc to 7.2pc. And overall core CPI inflation fell from 6.2pc to 5.9pc.

On its own, then, this release is probably not enough to seal the deal on a 50bps rate hike in August. Even so, we still think the Bank will raise rates from 1.25pc now to 3pc next year. That remains a higher forecast than the peak of 2pc envisaged by a consensus of analysts.

07:33 AM

Pound falls as inflation keeps rising

Sterling has extended its decline against the dollar this morning as traders digested the latest inflation data.

The consumer price index was in line with expectations at 9.1pc, while core prices were slightly below the forecast reading.

But the producer price index jumped to 15.7pc – the biggest rise in 45 years.

The figures are likely to fuel expectations of further interest rate rises by the Bank of England.

07:29 AM

ONS: Output prices surging at fastest pace in 45 years

Grant Fitzner, chief economist at the ONS, says:

Though still at historically high levels, the annual inflation rate was little changed in May.

Continued steep food price rises and record high petrol prices were offset by clothing costs rising by less than this time last year and a drop in often fluctuating computer games prices.

The price of goods leaving factories rose at their fastest rate in 45 years, driven by widespread food price rises, while the cost of raw materials leapt at their fastest rate on record.

07:21 AM

The worst is still to come

The producer price index, which tracks the price of goods leaving factories, surged to 15.7pc in May. That's up from 14pc the previous month and well ahead of forecasts.

The PPI measures inflation before it reaches consumers, so it's a grim warning that further price rises are in the pipeline.

The Bank of England now expects inflation to peak above 11pc this year, with matters expected to worsen when another rise in the energy price cap kicks in in October.

07:16 AM

Prices just keep rising

Here's a first take on the numbers from my colleague Louis Ashworth:

Inflation hit a fresh 40-year high of 9.1pc in May as Britain’s inflation nightmare deepened.

Consumer prices picked up at more than four times the Bank of England’s 2pc target, according to its preferred measure of consumer prices.

It is expected to reach double digits later this year, in the worst cost-of-living shock in a generation.

However, core inflation – which strips out volatile elements such as energy and food – cooled slightly, falling to 5.9pc from April’s 6.2pc.

The continued headline rise in prices puts pressure on the Bank’s Governor, Andrew Bailey, who has previously claimed the central bank has “helpless” to tackle inflation caused by soaring global commodity prices, spurred in part by the conflict in Ukraine.

Soaring inflation has prompted the Bank of England to rapidly raise interest rates, in an effort to cool demand by slowing the economy down.

07:11 AM

Inflation surges again

Good morning.

There's no let-up in the latest inflation figures, which hit a new 40-year high in May.

The consumer price index rose to 9.1pc last month, according to the ONS. That's up from 9pc a month earlier.

Prices rose 0.7pc in the month alone, which marks a slowdown from the 2.5pc pace recorded in April when the new energy price cap came into effect. Still, the numbers show prices are rising across the economy.

The retail price index, which is used to determine train ticket prices and to which some index-linked bonds are pegged, surged 11.7pc.

All eyes will now be on the Bank of England, which is under pressure to do more to stop runaway inflation.

5 things to start your day

1) Global spending on coal projects is expected to surge The IEA expects about $115bn to be invested on fossil fuel supply chains this year

2) Pioneering vaccine maker Moderna to open first factory in Britain The new site would allow a rapid response to future pandemics

3) Archaic rail rules mean it takes nine workers to 'change a plug socket' RMT accused of calling strike to defend host of outdated practices

4) Telecom chiefs summoned to Downing Street to discuss cost of living crisis Industry leaders will be asked for suggestions on how to help struggling customers with rising bills

5) Glencore executives could face charges after company pleads guilty to bribery How one of Britain's biggest bribery scandals engulfed the Glencore billionaires

What happened overnight

Equities struggled this morning after a brief respite from last week's painful rout across world markets, with recession fears continuing to build as central banks hike interest rates to combat decades-high inflation.

While Asia, Wall Street and Europe all enjoyed healthy gains on Tuesday, analysts warned the downbeat mood on trading floors means the selling is unlikely to end any time soon.

In early Asian trade, Hong Kong, Singapore, Sydney, Seoul, Taipei, Jakarta and Manila all fell, while Tokyo and Shanghai were barely moved. There were small gains in Wellington.

Coming up today

Corporate: Berkeley Group, Liontrust Asset Management (full-year results); Micro Focus (interims)

Economics: Consumer price index (UK), producer price index (UK), retail price index (UK), consumer confidence (EU)

Yahoo Finance

Yahoo Finance