FTSE 100 Live 19 June: UK inflation hits Bank of England's 2% target, blue-chips slightly lower

The UK’s inflation rate today slowed to 2%, its lowest level in almost three years.

Despite the figure being in line with its target, the Bank of England is unlikely to cut interest rates from the 16-year high of 5.25% tomorrow.

On the corporate front, housebuilder Berkeley has upped its profits guidance alongside today’s annual results.

FTSE 100 Live Wednesday

Inflation rate back at BoE target

Berkeley ups 2025 guidance

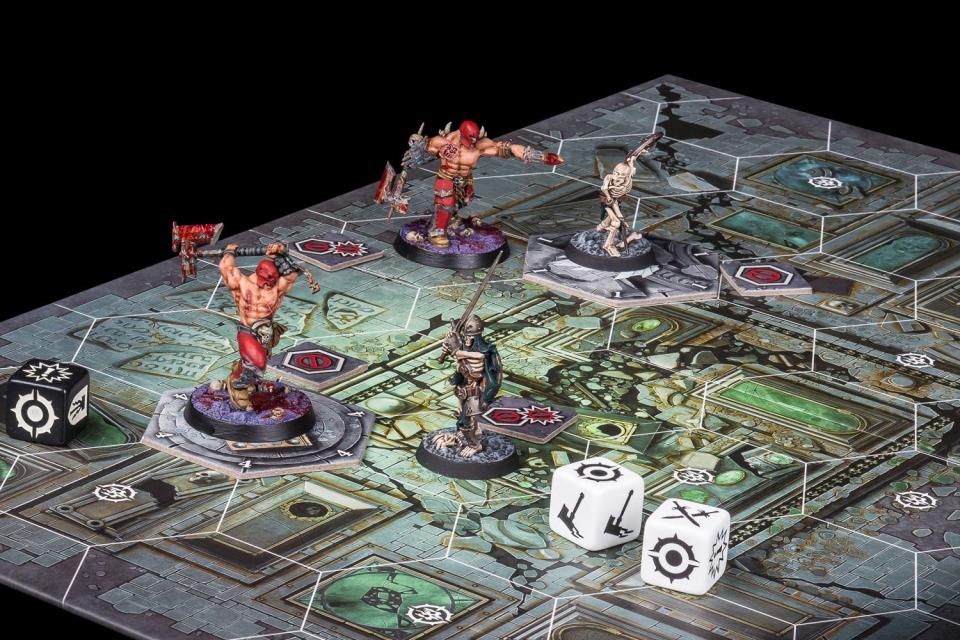

Games Workshop profits top £200m

Clarks 'to cut 150 head-office jobs' after 'discount hungry customers' blamed for losses

11:47 , Daniel O'Boyle

Footwear giant Clarks is to cut more than 150 office-based jobs, according to a report, after blaming “discount hungry customers” as it swung to a loss last year.

According to retail sector publication Drapers, Clarks is cutting head-office jobs, including at its headquarters in Somerset and its US HQ in Massachusetts.

It comes after the business made a £40 million loss in 2023, having made a profit a year earlier. Impairment charges weighed heavily on the results.

Market snapshot: FTSE 100 slightly lower

10:56 , Daniel O'Boyle

Take a look at the latest market snapshot, with the FSTE 100 slightly lower.

Zilch weighs London IPO as it secures £100 million debt financing

10:31 , Daniel O'Boyle

Zilch has secured £100 million in debt financing in signs the London business continues to hold off on a decision to list on the London Stock Exchange.

The Victoria-based fintech, which hit a $2 billion valuation in 2021, has mooted the prospect of an IPO for several months but has so far declined to confirm whether London will be its primary listing destination.

Zilch CEO Philip Belamant told the Standard: “We need pension funds investing in British businesses – if that’s not happening you just don’t get the liquidity and then you drive that decision away.”

AstraZeneca down 2% as stake sale boosts Vodafone shares

10:21 , Graeme Evans

The FTSE 100 today dipped 17.82 points to 8173.82 as AstraZeneca fell 2% or 226p to leave London’s biggest stock at 12,190p for a value near £190 billion.

Vodafone rallied near the top of the risers board after generating £1.4 billion from the sale of an 18% stake in Indus Towers.

Packaging firm Smurfit Kappa led the FTSE 100, rising 114p to 3692p ahead of next month’s merger with US-based WestRock.

The UK-focused FTSE 250 dipped 23.34 points to 20,386.59, with precision instrumentation firm Spectris among the worst performers.

Its shares fell 8% or 870p to 2938p as it warned that weaker China demand and other factors may leave annual profits short of City hopes. Fellow engineer Renishaw dropped 105p to 4020p.

Berkeley Homes chief backs Labour house building pledge

10:11 , Daniel O'Boyle

The boss of London’s biggest brownfield builder backed Labour’s manifesto pledge to make new homes a priority today, as he hit out at the complexity of the current planning system.

Rob Perrins, the long-serving chief executive of Berkeley Homes, said: “Getting the election out of the way is a really good thing for London.”

With a change of tenant looking likely in Downing Street, he told the Standard: “I am encouraged by Labour’s engagement with business and their commitment to work in partnership to deliver good, green homes”.

Young's says inflation falling into negative territory

09:29 , Simon Hunt

The boss of Young’s today said the firm was beginning to see food inflation fall into negative territory in the latest signs that cost-of-living pressures are abating.

The Wandsworth-based pub chain, which runs more than 200 pubs including the Lamb’s Tavern in Leadenhall Market and Dirty Dicks in Bishopsgate, also said drinks price rises were set to slow as contracts with suppliers were based on headline CPI rates.

Young’s CEO Simon Dodds told the Standard: “Food inflation was flat and has now moved into negative territory, we’re seeing it at about minute one per cent now.

“We are seeing back to a normalised trading environment in terms of cost pressures.”

The headline rate of inflation fell to 2% in May, figures released this morning show, hitting the Bank of England’s target for the first time in nearly three years.

Young’s today reported a 5.4% rise in revenues to £389 million in the year to April as it upped its total dividend for the year by 6% to 21.76p. The firm has added 60 pubs to its estate in the past year following the acquisition of rival City Pub Group.

Young’s shares fell 1.4% to 974p.

Inflation returns to target, but experts warn June rate cut ‘off the table’

09:25 , Daniel O'Boyle

The Prime Minister has hailed inflation falling back to target as “great news” as official figures showed a return to 2% for the first time in almost three years.

The Office for National Statistics (ONS) said Consumer Prices Index (CPI) inflation fell to 2% in May, down from 2.3% in April.

Rishi Sunak insisted the milestone shows the economy has “turned the corner”, ending nearly three years of above-target inflation.

Berkeley Group ups profit guidance for 2025 and plans its own "build-to-rent" offering

09:20 , Michael Hunter

Berkeley Group, one of London’s biggest house builders, has increased its profit guidance for next year and pledged to set up a “build-to-rent” platform.

The FTSE 100 company reported annual pre-tax profits of £557 million for down almost 8% for the year to the end of April, down almost 8%.

That drop came with the housing market stricken with increased mortgage costs in line with the 14 consecutive interest rate rises that took the benchmark cost of borrowing in the UK to the highest in 15 years by last August.

With the Bank of England expected to cut rates from 5.25% this summer, there are hopes for a revival in the house market. The BOE next meets tomorrow, but a cut is seen as unlikely during an election campaign.

Berkeley upped its profit guidance for 2025 by 5% to £525 million.

It said it had “identified 4,000 homes across 17 of its sustainable and well-connected brownfield regeneration sites” to be in “an initial portfolio” for the in house build-to-rent platform.

Rob Perrins, CEO, said the move recognised “the strong occupational and institutional investment demand for high quality, well-managed rental homes in London and the South East,”

The service will seek to maximise returns from the “long-term regeneration sites”, or brownfield developments which Berkeley is best known for, many of which are in and around London, including the Clarendon site in Hackney.

Perrins also repeated his criticism of the impact of planning procedures on the industry.

“Planning policy and public funding needs to prioritise the provision of affordable homes over the other significant financial demands placed upon the development industry through the planning, taxation and regulatory regimes”, he said.

AstraZeneca leads FTSE 100 lower, Games Workshop surges 8%

08:53 , Graeme Evans

The FTSE 100 index is 15.73 points lower at 8175.56, led by its largest company after AstraZeneca shares reversed 2% or 228p to 12,188p.

Other heavyweight stocks under pressure included Guinness and Smirnoff drinks group Diageo, which fell 29.5p to 2528.5p.

On the risers board, Vodafone lifted half a penny to 71.2p after it sold an 18% stake in Indus Towers for 1.7 billion euros (£1.4 billion).

The FTSE 250 index fell 31.64 points to 20,378.29, with precision instruments firm Spectris down 8% or 242p to 2966p after warning that operating profits may be slightly below the bottom end of City forecasts.

Games Workshop moved the other way, up 8% or 755p to 10,190p following its year-end trading update.

Games Workshop hands staff £18 million as profits grow

07:50 , Daniel O'Boyle

Warhammer maker Games Workshop handed £18 million to its staff in the past year, after its profits topped £200 million.

Profits were up from £171 million a year earlier, as revenue grew to £490 million.

The business paid its more than 2,500 staff around £6,500 each in profit share payments” in recognition of our staff's contribution to these results”. It also paid out £138 million in dividends.

'August rate cut prediction looking shakier'

07:40 , Daniel O'Boyle

Ruth Gregory, deputy chief UK economist at Capital Economics, says the stickier services inflation leaves an August rate cut in doubt.

She said: “The fall in CPI inflation from 2.3% in April to 2.0% in May (BoE 1.9%, consensus 2.0%, CE 1.8%) probably won’t be enough to persuade the Bank of England to cut interest rates from 5.25% tomorrow. And with services inflation nudging down only slightly, this leaves our forecast that the Bank will cut rates for the first time in August looking a little shakier.”

'Inflation rebound may be sharper than predicted'

07:27 , Daniel O'Boyle

Despite the fall inflation to the 2% target, NIESR Economist Paula Bejarano Carbo warned that inflation could rebound more sharply than expected.

She said: “Annual CPI inflation has fallen to the Bank of England’s 2 per cent target for the first time since July 2021. While this is positive news, we expect to see inflation rebound somewhat from June onwards. Given that today’s data indicate that core inflation remains elevated, this rebound might be sharper than projected. As a result, we expect the MPC to exert caution at its upcoming meeting and hold interest rates, despite today’s encouraging fall in the headline rate.”

Top stock Nvidia leads S&P 500 to fresh record, Brent Crude at $85

07:23 , Graeme Evans

The S&P 500 index closed at another record last night, fuelled by Nvidia after the AI chipmaker’s 3.5% rise made it the world’s most valuable public company.

Nvidia’s market cap of $3.3 trillion overtakes Microsoft, with this year’s 180% jump accounting for about 35% of the S&P 500 gains in the year to date.

Deutsche Bank added today that as recently as October 2022 Nvidia was the 18th largest company in the S&P 500 worth less than $300 billion.

Ahead of today’s Juneteenth holiday the S&P 500 index last night set a record high for the second session in a row by adding 0.25%.

The FTSE 100 index is forecast to open marginally higher after rising 0.6% during yesterday’s improved session for European markets.

Brent Crude today traded at $85.22 a barrel, its highest level in seven weeks after adding more than 1% in yesterday’s session.

Inflation finally falls back to its 2% target in major victory for the Bank of England

07:11 , Daniel O'Boyle

The rate of inflation has finally fallen back to its 2% target for the first time in almost three years.

Latest data from the Office for National Statistics (ONS) show that the Consumer Prices Index (CPI) the headline measure of inflation, rose by 2.0% in the year to May, down from 2.3% in April. That was in line with City expectations.

'Aggressive rate hikes have brought prices into check'

07:09 , Daniel O'Boyle

Jeremy Batstone-Carr, European Strategist, Raymond James Investment Services, says interest rate hikes have largely tamed inflation without a major decline in economic output, though there is still more to do.

He said: “This morning’s data has confirmed that inflation has at last dropped back to the Bank of England’s 2% target for the first time since July 2021. Today’s outcome demonstrates that aggressive rate hikes have brought headline prices into check, without dampening economic activity too severely.

“Much of the drop in today’s inflation data is the consequence of abnormally large price increases from spring 2023 dropping out of the annual calculation. Nevertheless, the slower-paced increase in food prices will be welcomed by households.

“Underlying price pressures, which the rate-setters take most seriously, are continuing to abate more slowly given persistent strength in services inflation. Whilst the dip from April is encouraging, the fact that services companies are continuing to pass higher costs to customers may weigh on tomorrow’s much-anticipated rate decision. “

Inflation hits Bank of England 2% target

07:06 , Daniel O'Boyle

Inflation in the UK fell to the Bank of England’s 2% target in May, for the first time since July 2021.

The 2% figure had been expected by economists.

Despite inflation hitting its target, the Bank of England is unlikely to cut interest rates this week.

Core inflation was 3.5%, also in line with expectations. Service-sector inflation was higher than expected, at 5.7%.

Recap

06:47 , Simon Hunt

Good morning from the Standard City desk

The FTSE 100 ticked up on Tuesday after overtaking France’s top index as Europe’s biggest stock market earlier this week.

The blue-chip index rose 49 points to 8,191 on Tuesday, a 0.6% rise, with Hargreaves Lansdown, SSE and Whitbread among the biggest risers.

Tuesday’s gains came ahead of official figures on consumer price inflation (CPI) tomorrow morning, which is expected to fall back to the Government’s target of 2%.

However, experts do not predict it will be enough to persuade Bank of England policymakers to cut the base interest rate from 5.25% on Thursday.

The FTSE overtook France’s CAC 40 on Monday as Europe’s biggest index after political divisions resulted in billions of euros being wiped off Paris’s top index in a matter of days.

The CAC 40 rebounded today to finish 0.73% up, while elsewhere in Europe, Germany’s Dax moved upwards 0.31%.

Stateside, the S&P 500 was up 0.14% as markets closed in London, while the Dow Jones was 0.04% up.

Yahoo Finance

Yahoo Finance