Franklin's (BEN) Q4 Earnings Miss Estimates, AUM Declines

Franklin Resources Inc. BEN reported a negative earnings surprise of 6.2% in fourth-quarter fiscal 2019 (ended Sep 30). Earnings of 61 cents per share lagged the Zacks Consensus Estimate of 65 cents. Results also compare unfavorably with the earnings of 96 cents per share recorded in the prior-year quarter.

The company’s results display escalating expenses, lower revenues and reduced assets under management (AUM). Further, net outflows were an undermining factor. However, a strong capital position was a positive.

Operating income was $391.5 million in the reported quarter compared with the prior-year quarter’s $478.7 million.

For fiscal 2019, earnings per share were $2.35 versus $1.39 recorded in the prior year. Results include certain one-time items.

Net income was $306.4 million compared with the $502.5 million recorded in the prior-year quarter. For fiscal 2019, net income was $1.2 billion compared with the prior year’s $764.4 million.

Revenues Drop, Costs Up

For fiscal 2019, total operating revenues slipped 9% year over year to $5.77 billion. The revenue figure however outpaced the Zacks Consensus Estimate of $5.75 billion.

Total operating revenues decreased 5% year over year to $1.45 billion in the fiscal fourth quarter, mainly due to lower investment management and other fees, sales along with distribution fees and shareholder-servicing fees. The figure comes in line with the Zacks Consensus Estimate.

Investment management fees declined 5% year over year to $1 billion, while sales and distribution fees were down 4% year over year to $363.8 million. Additionally, shareholder-servicing fees dipped 1% on a year-over-year basis to $51.4 million, while other net revenues remained stable at $35.7 million.

Total operating expenses flared up 1% year over year to $1.06 billion. This upside resulted from higher compensation and benefits, occupancy as well as technology expenses, partly mitigated by lower sales, distribution and marketing, along with general, administrative and other expenses.

As of Sep 30, 2019, total AUM came in at $692.6 billion, down 3% from $717.1 billion as of Sep 30, 2018. Notably, the company recorded net new outflows of $12.8 billion in the quarter. Simple monthly average AUM of $702 billion slipped 3%, year on year.

Stable Capital Position

As of Sep 30, 2019, cash and cash equivalents, along with investments were $8.5 billion compared with $9.1 billion as of Sep 30, 2018. Furthermore, total stockholders' equity was $10.6 billion compared with $10.2 billion as of Sep 30, 2018.

During fiscal 2019, the company repurchased 24.6 million shares of its common stock at a total cost of $756.3 million. Notably, during the September-end quarter, the company repurchased 5.6 million shares of its common stock at a total cost of $163.4 million.

Our Viewpoint

The company’s global footprint is an exceptionally favorable strategic point as its AUM is well diversified. Though Franklin’s steady capital-deployment activities raise investors’ optimism, lower revenues, escalating expenses and fall in AUM remain concerns.

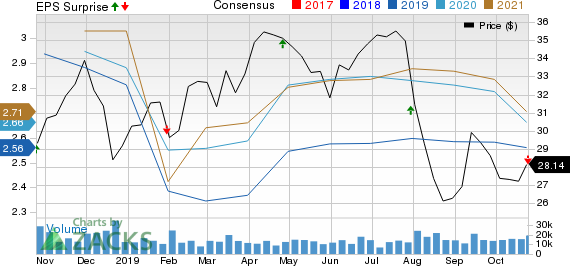

Franklin Resources, Inc. Price, Consensus and EPS Surprise

Franklin Resources, Inc. price-consensus-eps-surprise-chart | Franklin Resources, Inc. Quote

Currently, Franklin flaunts a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Competitive Landscape

T. Rowe Price Group, Inc. TROW reported a positive earnings surprise of 7.6% in third-quarter 2019. Adjusted earnings per share came in at $2.13, outpacing the Zacks Consensus Estimate of $1.98. Results also improved 7% from the year-ago figure of $1.99.

BlackRock, Inc.’s BLK third-quarter 2019 adjusted earnings of $7.15 per share surpassed the Zacks Consensus Estimate of $6.95. However, the figure was 4.9% lower than the year-ago quarter’s number.

Ameriprise Financial’s AMP third-quarter 2019 adjusted operating earnings per share (excluding unlocking) of $4.24 surpassed the Zacks Consensus Estimate of $3.97. Further, the figure came in 8.2% higher than the year-ago quarter.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameriprise Financial, Inc. (AMP) : Free Stock Analysis Report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance