FOX Q3 Earnings Up Y/Y, Strong Television Aids Revenue Growth

Fox Corporation FOX reported third-quarter fiscal 2019 adjusted earnings of 76 cents per share that increased 2.7% year over year.

Revenues were up 11.7% year over year to $2.75 billion. Affiliate fees (51.6% of revenues) grew 10.9% to $1.42 billion. Advertising (39.5%) revenues increased 8.7% to $1.09 billion.

Other revenues (8.9%) rallied 34.8% to $244 million. Higher digital content licensing revenues at the Television segment drove year-over-year growth.

Notably, this was Fox’s first quarterly earnings after it became a standalone, publicly-traded company on Mar 21, 2019, following the merger of Disney and Twenty-First Century Fox, Inc.

The standalone Fox’s portfolio comprises Twenty-First Century Fox’s news, sports and broadcast businesses. These include FOX News, FOX Business, FOX Broadcasting Company (the FOX Network””), FOX Sports, FOX Television Stations Group, sports cable networks FS1, FS2, FOX Deportes and Big Ten Network, and certain other assets.

Top-Line Details

Cable Network Programming (50.3% of revenues) revenues increased 4.4% year over year to $1.38 billion. Affiliate fee, advertising and other revenues increased 4%, 3.8% and 8.6%, respectively.

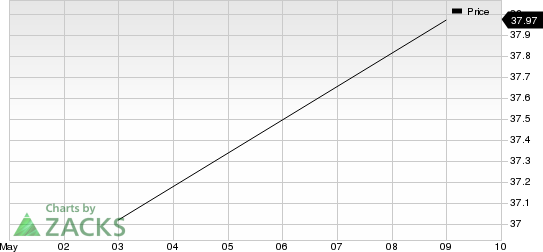

Fox Corporation Price

Fox Corporation price | Fox Corporation Quote

The growth in affiliate revenues was driven by contractual price increases at FOX News and FS1, partially offset by linear subscriber declines. Advertising revenues increased due to higher digital sales at FOX News and stronger ratings for daily studio programming at FS1.

Television (49.8%) revenues surged 20.4% from the year-ago quarter to $1.37 billion. Advertising revenues, affiliate fee and other revenues increased 10.5%, 29.1% and 100%, respectively.

Operating Details

In third-quarter fiscal 2019, operating expenses increased 15% year over year to $1.66 billion. As percentage of revenues, operating expenses expanded 170 basis points (bps) to 60.3%.

Selling, General & Administrative (SG&A) expenses increased 3.7% on a year-over-year basis to $336 million. As percentage of revenues, SG&A expenses contracted 90 bps to 12.2%.

Segment EBITDA increased 8.5% year over year to $766 million. EBITDA margin contracted 80 bps to 27.8%.

Cable Network Programming EBITDA increased 7.1% to $741 million. EBITDA margin expanded 140 bps to 53.6%.

Television EBITDA surged 22.2% to $99 million. EBITDA margin expanded 10 bps to 7.2%.

Balance Sheet

As of Mar 31, 2019, Fox had approximately $2.82 billion in cash and cash equivalents. Long-term debt was $6.75 billion.

On May 9, 2019, Fox announced that its board of directors has approved a semi-annual dividend of 23 cents per share to be paid on Jun 3, 2019 to shareholders of record as on May 20, 2019.

Zacks Rank & Stocks to Consider

Fox currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Consumer Discretionary sector include Comcast CMCSA, Electronic Arts EA and International Game Technology IGT. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Comcast, Electronic Arts and International Game Technology is 12.8%, 16.5% and 10%, respectively.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Game Technology (IGT) : Free Stock Analysis Report

Comcast Corporation (CMCSA) : Free Stock Analysis Report

Fox Corporation (FOX) : Free Stock Analysis Report

Electronic Arts Inc. (EA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance