Forex Technical Analysis & Forecast for July 1, 2020

EUR/USD, “Euro vs US Dollar”

After completing another correctional structure at 1.1260, EUR/USD is falling towards 1.1215. Possibly, today the pair may reach this level and then form a new consolidation range around it. If later the price breaks this range to the downside, the market may continue trading downwards with the short-term target at 1.1170. After that, the instrument may correct to test 1.1215 from below and then form a new descending structure to reach 1.1144.

GBP/USD, “Great Britain Pound vs US Dollar”

After breaking 1.2300 upwards, GBP/USD has completed another ascending wave at 1.2370, which may be considered as a correction. Today, the pair may consolidate around 1.2370. If later the price breaks this range to the downside at 1.2350, the market may resume trading downwards to break 1.2300 and then continue falling inside the downtrend with the target at 1.2200.

USD/RUB, “US Dollar vs Russian Ruble”

After extending the ascending structure up to 71.31, USD/RUB is expected to correct towards 69.69. After that, the instrument may resume trading upwards to reach 71.81 and then start another decline with the target at 68.00.

USD/JPY, “US Dollar vs Japanese Yen”

After reaching another upside target at 108.15, USD/JPY is expected to fall towards 107.50. Later, the market may form one more ascending structure to reach 108.22, thus forming the third ascending wave within the correction.

USD/CHF, “US Dollar vs Swiss Franc”

After forming another consolidation range around 0.9515 and breaking it to the downside, USD/CHF has reached 0.9460; right now, it is forming a new range above this level. Possibly, the pair may resume trading upwards to break 0.9540 and then continue growing within the uptrend with the target at 0.9660.

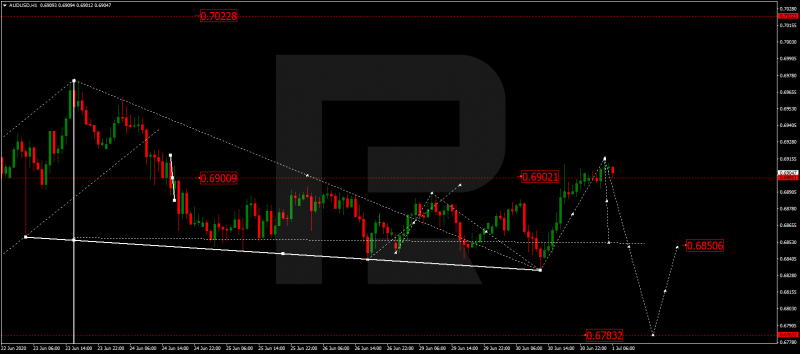

AUD/USD, “Australian Dollar vs US Dollar”

After rebounding from 0.6832, AUD/USD has completed the ascending structure at 0.6900. Today, the pair may start a new decline to break 0.6850 and then continue trading downwards with the target at 0.6787.

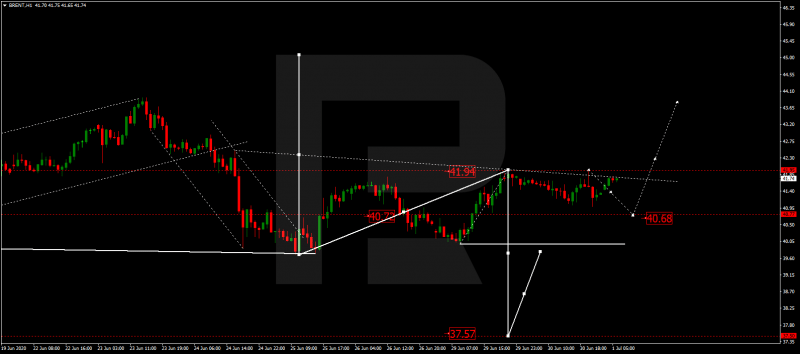

BRENT

Brent is consolidating around 40.70 within a Triangle pattern. Possibly, today the pair may test 40.70 from above, rebound from it, and then resume trading upwards to break 42.20. Later, the market may continue growing with the target at 43.80. However, there might be another scenario, according to which the price may break 40.70 to the downside and then continue the correction to reach 37.70.

XAU/USD, “Gold vs US Dollar”

After breaking 1775.00, Gold has reached 1785.50. Today, the pair may form a new descending structure to return to 1775.50 and then start another growth with the target at 1791.55 or even 1800.00.

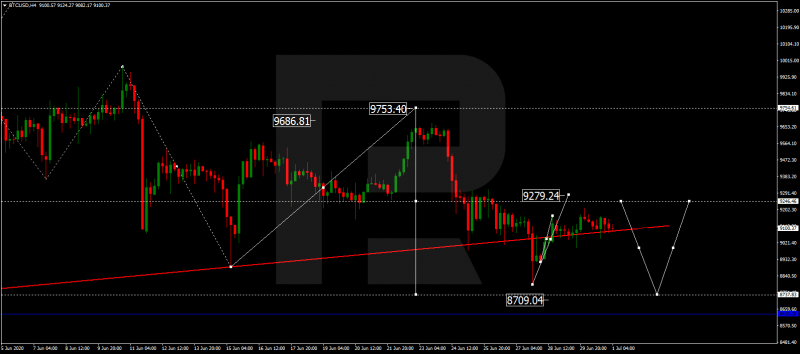

BTC/USD, “Bitcoin vs US Dollar”

BTC/USD is still consolidating around 9100.00. Possibly, today the pair may start another growth to reach 9280.00 and then resume trading downwards with the target at 8700.00. Later, the market may correct towards 9200.00..

S&P 500

After attempting to break 3076.0 to the upside, the Index is expected to continue growing towards 3145.5 or even 3233.3. After that, the instrument may resume trading inside the downtrend with the target at 3075.5.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

Disclaimer

Any predictions contained herein are based on the author’s particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance