Forex Sentiment Turns on a Dime - Watch Key Yen Risk

DailyFX.com -

Why and how do we use the SSI in trading? View our video and download the free indicator here

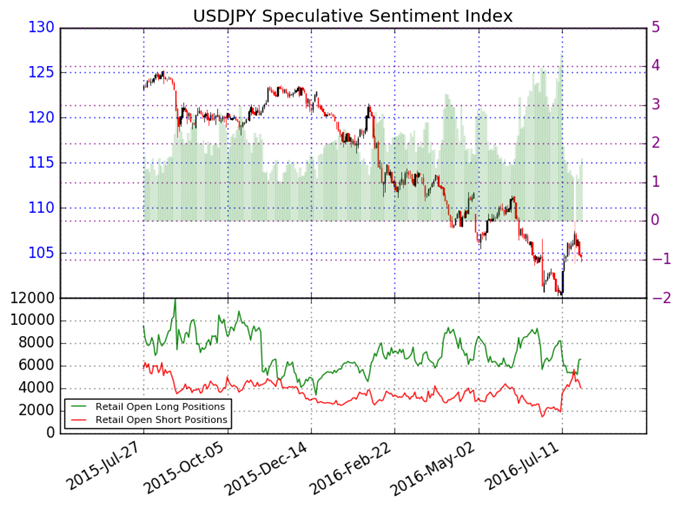

USDJPY– Retail FX traders are once again heavily long the US Dollar versus the Japanese Yen—a sharp shift from just a week ago—and a contrarian view of crowd sentiment points to further USD/JPY weakness. Last week we noted the opposite as traders had turned net-short USD/JPY, but that proved quite short-lived. Now we are far more circumspect as the Japanese Yen nears critical resistance (USD/JPY support) ahead of key US Federal Reserve and Bank of Japan interest rate decisions.

The larger trend favors Dollar weakness against the Yen and indeed a contrarian view of retail sentiment acts as a confirmation of the downtrend. Yet it will be very important to watch the USD/JPY exchange rate’s next moves ahead of critical event risk and a test of key technical levels.

See next currency section:XAUUSD - Gold Prices Face Key Risk of Turn Lower

Written by David Rodriguez, Senior Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via Twitter at http://www.twitter.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance