Forex: Pound May Rally as CPI Data Reduces Scope for BoE Easing

THE TAKEAWAY: The British Pound may advance if CPI is higher than expected as the scope for BoE easing may be limited, especially as credit conditions improve.

November’s UK CPI figure is tipped by economists to come in unchanged from October’s reading at 2.7%. However there may be room for a higher print which may lead to an appreciation in the sterling.

The Bank of England (BoE) had noted in their November policy minutes that they expected an increase in utility bills and tuition fees that could contribute to an increase in CPI of 1% by mid 2013. In addition there has been an improvement in credit conditions in the Eurozone with Italian and Spanish bond yields having fallen in the second half of the year.

The Monetary Policy Committee (MPC) had previously cited that high borrowing costs seen in Euro Area Member States posed risks to regional growth and medium term inflation. This partly led to their decision to add extend their quantitative easing by 50bn pounds in July.

Another rise in inflation from more idiosyncratic forces coupled with improved credit conditions may give the BoE less motivation to implement further monetary easing. This may prove bullish for the GBP in the medium term as other central banks add to stimulus measures.

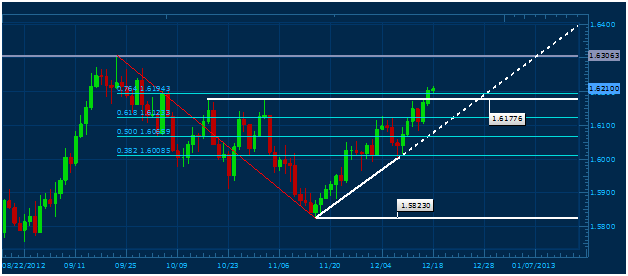

On a technical basis we have witnessed the GBP/USD make a break above key resistance at 1.6180. There is now more potential for an advancement to the September high of 1.6310. Conversely, a move below the rising trend line from the November low may point to a decline to the next major support level at the psychologically significant 1.60 mark.

Created Using FXCM Marketscope – Prepared by David de Ferranti

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance