Forex: Early Week Rebound for Yen, Again; S&P 500 Back Below 1500

ASIA/EUROPE FOREX NEWS WRAP

Demand for high beta currencies and risk-correlated assets is mixed after the Asian session and midway through the European session, as some better than expected New Zealand trade data has lifted both the Aussie and the Kiwi, although the Canadian Dollar continues to struggle in the wake of several bank downgrades yesterday.

Today seems like a day in which markets are coming unstuck and correlations are breaking down, as the commodity currencies have diverged quite meaningfully from US equity markets, with the S&P 500 futures pointing to an open back towards 1492. Seemingly, this has come on the back of a stronger Japanese Yen, which has continued an interesting trend of recent: strength at the beginning of the week, moderation by Wednesday, and another big sell-off by the Yen headed into the weekend.

Both the Yen and the S&P 500 are at critical junctures, considering that both are nearing levels of technical exhaustion. On one hand, Japanese policymakers are doing little to stand in the way of the Yen’s depreciation; on the other, Fed policymakers are talking about a potential exit strategy despite upping their asset purchase program in December. In both cases, volatility across major assets will be likely, as central banks grapple with the daunting task of keeping market participants calm as liquidity is withdrawn and injected at spurious moments.

Taking a look at European credit, peripheral yields are slightly lower despite a mostly positive Italian bond auction this morning, providing little support for the Euro. The Italian 2-year note yield has decreased to 1.497% (-3.4-bps) while the Spanish 2-year note yield has decreased to 2.425% (-3.9-bps). Likwise, the Italian 10-year note yield has decreased to 4.183% (-1.7-bps) while the Spanish 10-year note yield has decreased to 5.172% (-4.4-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 11:40 GMT

JPY: +0.43%

AUD: +0.25%

GBP: +0.24%

CHF:+0.22%

NZD:+0.17%

CAD:-0.02%

EUR:-0.19%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.06% (+0.72% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

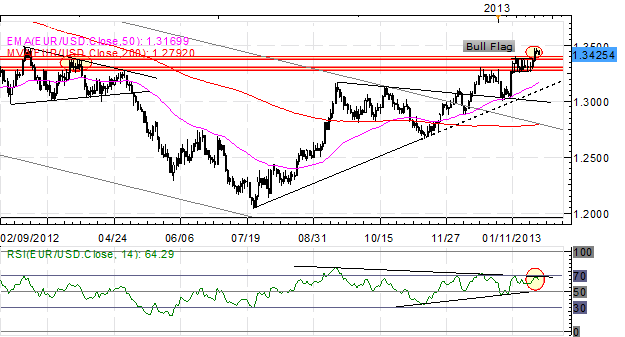

EURUSD: Consolidation has taken place after the breakout on Friday, though the Bull Flag remains in play, with a final measured move pointing towards 1.3635. The Bull Flag remains valid so long as 1.3285 holds. Support comes in at 1.3380/85 (mid-March swing high, Bull Flag resistance), 1.3280/3310, and 1.3120/45. Resistance is 1.3485 (late-February swing high), 1.3545/50, and 1.3635.

USDJPY: No change as consolidation occurs: “Market positioning has eased and further dovish commentary from Japanese officials has lifted this pair towards 91.00. The focus remains on buying dips, and generally speaking, selling Yen strength (EURJPY, USDJPY preferred for gains; CADJPY, GBPJPY preferred for loses). Resistance comes at 90.90 (weekly R1), 91.75/90 (weekly R2), and 95.00 (monthly R3). Support comes in at 90.00 (monthly R2) and 89.10/40 (monthly R1, weekly S1, mid-January swing lows).”

GBPUSD: No change: “Weak data and a breakout across all GBP-based pairs (but for GBJPY) has provoked the GBPUSD to settle near key support just under 1.5750. As long as the daily RSI downtrend holds, it is possible for a move lower.” Support is 1.5700 and 1.5675/80 (61.8% Fibonacci retracement on June low to January high). Resistance comes in at 1.5750, 1.5825, 1.5900/10, and 1.6000/10.

AUDUSD:The pair continues to range although it has showed signs of cracking, with both the ascending trendline off of the June low and the October low having been breached, as well as the ascending TL off of the June low and the December low. Accordingly, a weekly close below 1.0460 could signal a deeper retracement towards 1.0350/400, before a greater breakdown towards parity. Support comes in at 1.03800/400 (weekly low), 1.0340/50 (December low), and 1.0140/50 (October low). Resistance is 1.0460/70 (ascending TL off of the June and December lows, 50-EMA) and 1.0500/15. Note: A potential Morning Star candlestick cluster is forming on the daily chart, which would nullify the bearish bias and suggest a rebound back towards the highs.

S&P 500: Last week I said: “A move above the September highs points to resistance at the 161.8% Fibonacci extension at 1492, 1500 and 1520/25 (December 2007 high). Support comes in at 1470/75, 1450/55, 1425, and 1400.” The first such target above 1500 was nearly hit, as indicated on the charts the past weeks, noting “nearing the top 1505/1512” – the top was 1504.6. If this breaks, 1520 is in sight.

GOLD: The past few weeks I’ve maintained: "When considering the move off of the September highs, a measured A-B=C-D (as expressed on the Daily) suggests that a bottom could be in place at [1630/40].” The rebound has ensued, with the alternative safe haven rallying up to 1690 today. A daily close above 1700 points towards 1722/25 and 1755. Support is 1663 (200-EMA) and 1640/45.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance