Forex Daily Recap – DXY Kept Hold Gains Post-Release of FOMC Minutes

USD Index

Greenback continued to linger in the upper vicinity of the Bollinger Bands, keeping intact accumulated gains.

Later the day, the July FOMC meeting minutes came out at around 18:00 GMT. The policymakers indicated that the last rate cut was a “mid-cycle adjustment”. The Fed officials also added that the rate cut shouldn’t be taken as a “pre-set course” for future cuts. Quite surprisingly, the minutes also noted that few members wanted a 50 bps cut, based primarily on the weak inflation readings.

GBP/USD

Cable continued to stay consolidated near 1.1264 level on Wednesday. Red Ichimoku Clouds and adjoining base line of the indicator were hovering above the pair. Anyhow, the conversion line stood well below the GBP/USD pair, pouring cold water over the bearish sentiment. Also, the Relative Strength Index (RSI) was taking rounds near 37/41 range level, upkeeping a neutral market perspective.

At around 08:30 GMT, the UK July Public Sector Net Borrowing came out, disappointing the market participants. The Net Borrowing recorded near £-1.971 billion over £-2.650 billion estimates.

Meantime, today, German Spokesperson, Steffen Seibert proclaimed, “Germany prepares to accept a disorderly Brexit, considering the realities.” The Spokesperson also added that the country always would prefer an orderly Brexit. However, Steffen highlights the importance of accepting the reality in case of an unavoidable no deal EU-UK divorce.

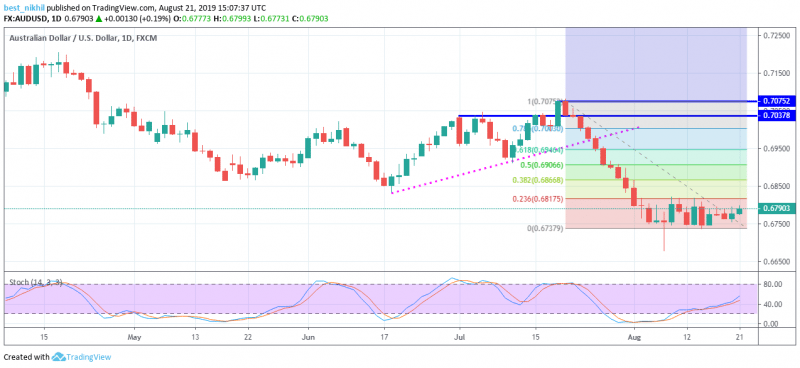

AUD/USD

The daily volatility in the Aussie pair remained choppy as the day was approaching closing. Notably, the AUD/USD pair had opened up near 0.6778 level and was +0.15% up in the North American session. Earlier the day, the July MoM Westpac Leading Index reported upbeat data this time. The Leading Index recorded 0.14% over the prior -0.08%.

Anyhow, the bulls appeared quite out-of-mood to make some rigorous moves today. Nevertheless, the AUD/USD pair stood underway struggle to breach above the 23.6% Fibonacci retracement level or 0.6818 level. Ability to break above aforementioned resistance handle would immediately activate the upside barriers near 0.7037 and 0.7075 marks. Additionally, the Stochastic line (%K) was showing resilient movement, moving above the %D line of the indicator, pleasing the buyers.

USD/CAD

After testing the sturdy 1.3323 resistance, the Loonie pair was heading downside into the red Ichimoku Clouds. Here, the Clouds were acting as a strong support region, disallowing the bears’ entry. Also, the MACD line and the signal line of the MACD technical indicator appeared to look south side today.

Anyhow, the below-lying Parabolic SAR helped to keep the tempo higher, providing near-term hopes to the bulls. Upbeat July Canadian Consumer Price Index (CPI) remained as the primary driver that lifted the CAD currency. However, such a price action had an inverse impact on the Loonie pair allowing the bears to take over the pair. The July YoY BoC CPI Core rose 0.3% over the previous 0.0%. Also, the MoM CPI data surged 0.2% in comparison to the prior 0.1%.

On the other hand, the Crude prices also grew, further pushing down the USD/CAD pair. Today, EIA Crude Oil Stocks Change computed since August 16, published -2.732 million over -1.889 million forecasts. Hence, the inventories drop signaled for a rise in the demand for the commodity, allowing a price upsurge.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance