Fluor (FLR) Receives $409M Task Order Under the US AFCAP V

Fluor Corporation FLR recently won the task order for Pavement and Transportation Support from the U.S. Air Force Installation Contracting Agency. The contract will be based in North Field, Tinian, which is part of the Commonwealth of the Northern Mariana Islands.

This task order contract has a period of performance of 60 months and is valued at about $409 million. The cost-plus and fixed-fee task order was awarded to FLR under the Air Force Contract Augmentation Program V (“AFCAP V”).

Fluor is positive about the development of the contract as it believes its timely and cost-effective solutions align best with this project and will help strengthen the U.S. Air Force’s deterrence capability.

Growing Backlog Bodes Well

Fluor has been witnessing business prospects and a demand uptrend in various sectors, including the chemicals sector, energy transition, fuel production, as well as mining and metals, and big data. This growing trend is reflected in a solid uptick in new awards and backlog value.

In 2023, FLR successfully secured consolidated new awards amounting $19.52 billion, with 87% of them being reimbursable. At 2023 end, the total backlog of the company was $29.44 billion (76% reimbursable), up 13.2% year over year. Among the total backlog, 62% of the total projects are located outside of the United States, up from 49% reported in the prior year.

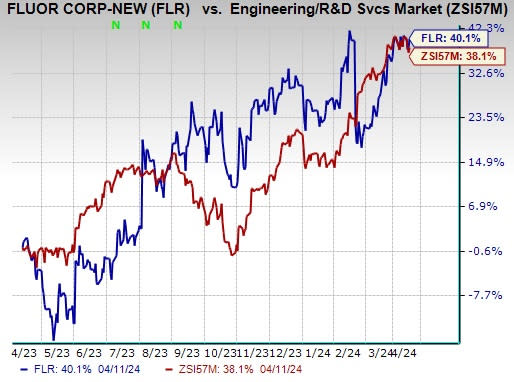

Image Source: Zacks Investment Research

Shares of this current Zacks Rank #3 (Hold) company have gained 40.1% in the past year, outperforming the Zacks Engineering - R and D Services industry’s 38.1% growth. The substantial backlog level underscores the continued strong demand for the company’s services and the recognized value it brings to its clients.

Key Picks

Here are some better-ranked stocks from the Construction sector.

Armstrong World Industries, Inc. AWI currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AWI delivered a trailing four-quarter earnings surprise of 13.1%, on average. The stock has surged 69.1% in the past year. The Zacks Consensus Estimate for AWI’s 2024 sales and earnings per share (EPS) indicates growth of 4.1% and 7.9%, respectively, from the prior-year reported levels.

Vulcan Materials Company VMC presently sports a Zacks Rank of 1. VMC delivered a trailing four-quarter earnings surprise of 19.5%, on average. The stock has jumped 56.7% in the past year.

The Zacks Consensus Estimate for VMC’s 2024 sales and EPS indicates improvements of 1.3% and 19.7%, respectively, from a year ago.

Sterling Infrastructure, Inc. STRL currently sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 20.4%, on average. STRL shares have surged 192.6% in the past year.

The Zacks Consensus Estimate for STRL’s 2024 sales and EPS indicates increases of 11.7% and 11.4%, respectively, from the prior-year reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Vulcan Materials Company (VMC) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance