Fluor (FLR) JV Wins $28B Contract from NNSA, Boosts Backlog (revised)

Fluor Corporation FLR and Amentum’s joint venture (JV) — Nuclear Production One, LLC (NPOne) — has been awarded a contract by the U.S. Department of Energy’s (DOE) National Nuclear Security Administration (NNSA) to modernize two nuclear production sites. The contract is worth $2.8 billion annually over 10 years.

This is a Management and Operating (M&O) contract that has a four-month transition period. It also has a five-year base period with five one-year options. This brings the total contract period up to 10 years if all options are exercised. The NPOne team also has subcontractors like Criterion Systems, Inc., General Atomics, and SOC, LLC.

The Fluor-led team will achieve NNSA’s production targets of constructing and revamping America’s two nuclear production sites — the Pantex Plant near Amarillo, TX, and the Y-12 National Security Complex in Oak Ridge, TN.

In connection with the latest contract, Tom D’Agostino, group president of Fluor’s Mission Solutions business, said, “We have supported our nation’s security since 1944 and look forward to bringing that experience to both the Oak Ridge, Tennessee and the Amarillo, Texas sites. With the united purpose of revitalizing America’s national security, NPOne is committed to building a culture of safety, production delivery and program excellence, trust and transparency, and site integration."

Contract Wins & Solid Backlog Level: A Boon

Fluor has been a distinguished player in the nuclear industry for 70 years. Since 1977, Fluor has provided operating plant support services to 90 U.S. and international nuclear units.

Efficient project execution has been one of the main factors driving its performance over the last few quarters. The company’s ongoing contract wins are a testimony to the fact. Fluor's total new awards for third-quarter 2021 came in at $3 billion compared with $1.28 billion a year ago. Consolidated backlog at quarter-end came in at $21.03 billion.

Precisely, Fluor’s Mission Solutions segment’s quarterly results reflect increased execution activity on DOE projects and higher-than-anticipated performance-based fees. It booked new awards worth $1.6 billion, significantly up from $188 million a year ago. Backlog at quarter-end was $3.4 billion.

Share Price Performance

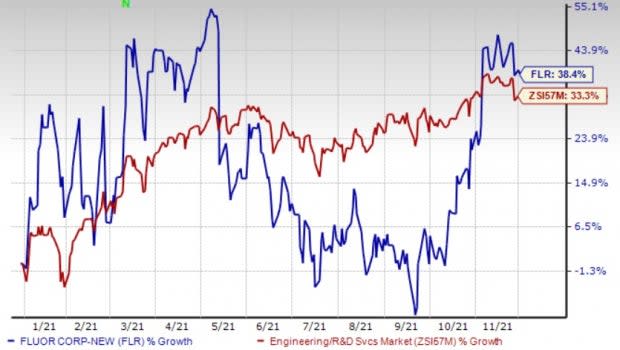

Shares of Fluor have climbed 38.4% this year, outperforming the industry's 33.3% growth. Continuous contract wins, strong end-market prospects and a good business portfolio mix are expected to benefit the company.

Image Source: Zacks Investment Research

Zacks Rank

Fluor currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Better-Ranked Stocks From the Broader Construction Sector

Beazer Homes USA, Inc. BZH currently sports a Zacks Rank #1. This Atlanta-based homebuilder continues to gain from strong operational execution and continued strength in the housing market.

Beazer Homes has gained 29.6% year to date (YTD). Earnings are expected to grow 23.7% in fiscal 2022.

Meritage Homes Corporation MTH currently sports a Zacks Rank #1. Based in Scottsdale, AZ, Meritage Homes is one of the leading designers and builders of single-family homes. Its focus on entry-level LiVE.NOW homes has been a major driving factor.

Meritage Homes has gained 36.2% YTD. Earnings are expected to grow 74.4% in 2021 and 22.2% in the next.

TRI Pointe Group Inc. TPH currently carries a Zacks Rank #2 (Buy). This Irvine, CA-based homebuilder designs, constructs, and sells single-family detached and attached homes in the United States. Robust demand and pricing as well as improved operating leverage have been driving TRI Pointe's performance. Cost-cutting initiatives implemented earlier this year and focus on entry-level buyers have been adding to the positives.

TRI Pointe has gained 44.7% YTD. Earnings for 2021 and 2022 are expected to grow 80.2% and 9.6%, respectively.

(NOTE: We are reissuing this report to correct an error. The original version, published yesterday, December 1, 2021, should no longer be relied upon.)

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

Beazer Homes USA, Inc. (BZH) : Free Stock Analysis Report

Tri Pointe Homes Inc. (TPH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance