Flowers Foods (FLO) Is Poised on Core Priorities, Solid Pricing

Flowers Foods, Inc. FLO appears to be in good shape. The producer and marketer of packaged bakery products has been focused on its strategic priorities, which include developing its team, concentrating on brands, prioritizing margins and looking out for prudent mergers and acquisitions. The company is also benefiting from its pricing actions. These upsides were visible in the company’s third-quarter fiscal 2021 results, wherein management raised its view for the fiscal.

However, the raised guidance still suggests a sales decline from the year-ago period. Apart from this, Flowers Foods is battling cost hurdles like many other food stocks. However, the company is on track with its pricing efforts to counter commodity cost inflation. Price/mix increased 6.4% in the third quarter due to better pricing, which helped the company combat inflationary pressure.

Let’s delve deeper.

Flowers Foods, Inc. Price, Consensus and EPS Surprise

Flowers Foods, Inc. price-consensus-eps-surprise-chart | Flowers Foods, Inc. Quote

Focus on Core Priorities

Flowers Foods has been shifting its focus to value-added branded retail products, which are aimed at aiding the top line and enhancing margins. Branded-retail sales increased 4.8% to $689.1 million in the third quarter of fiscal 2021 due to a better price/mix. Also, the company expects its optimized portfolio to drive market share gains through innovation. The company’s bread category has been benefiting from strength in brands like Dave’s Killer Bread (DKB), Canyon Bakehouse and Nature’s Own Perfectly Crafted. The company is focused on undertaking innovation in its leading brands, which is likely to aid growth.

Moving to margins, FLO’s brand-building efforts, such as plans to shift a larger proportion of sales mix to branded retail, are aiding margin performance. The company is on track to achieve $30-$40 million in portfolio optimization savings during 2021. Finally, management intends to remain committed to making marketing investments and undertaking innovation for smart merger and acquisition activities in line with its portfolio strategy. Talking of buyouts, tracked channel sales of Canyon Bakehouse, Nature’s Own and DKB increased 17%, 4% and 14%, respectively, in the third quarter.

Another factor aiding Flowers Foods’ top line in the quarter was strength in non-retail and other sales, which jumped 9.2% to $214.2 million. This was backed by an enhanced price/mix and better volumes. With things opening and consumers moving out, non-retail and other sales are likely to keep gaining.

Management had earlier highlighted that over the long term, it expects sales growth of 1-2% annually, EBITDA growth of 4-6% and earnings per share (EPS) increase of 7-9%. Both sales and EBITDA outlook exclude the impacts of future buyouts.

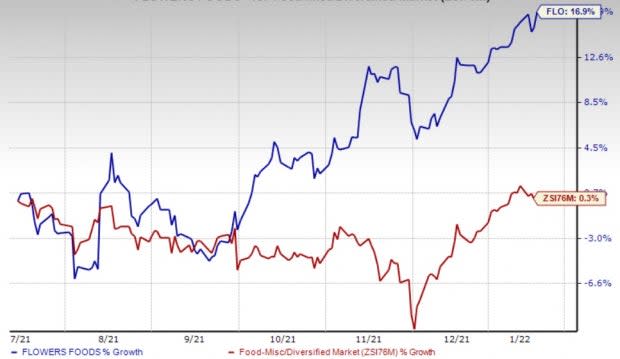

Image Source: Zacks Investment Research

A Look at Q3 & Ahead

In the third quarter of fiscal 2021, Flowers Foods’ top and bottom lines exceeded the Zacks Consensus Estimate and grew year over year. The company continued witnessing market share gains for its key brands. Also, non-retail business is steadily recovering from the impacts of the pandemic. Adjusted EPS of 30 cents surpassed the Zacks Consensus Estimate of 25 cents. The bottom line rose 3.4% from 29 cents earned in the year-ago period. Sales rose 3.9% to $1,027.8 million and surpassed the Zacks Consensus Estimate of $1,012 million.

On its earnings call, management stated that it remained impressed with Flowers Foods’ year-to-date performance, powered by its leading brands and continued investments toward enhancing sales and optimizing the network. The company remains encouraged about its potential due to the firm focus on its four key strategies. Management raised its 2021 view and EPS is now envisioned in the range of $1.22-$1.26, up from the prior projection of $1.17-$1.22. The guidance includes an effect of nearly two cents from a week less in 2021 and an impact of one cent in the final quarter for appreciation bonuses to its frontline workers.

Though management raised the fiscal 2021 sales guidance, it still suggests a decline from the year-ago period. Management now projects sales in the range of $4.300-$4.344 billion, suggesting a 1-2% decline from the year-ago reported figure. This guidance includes a 1.8% sales reduction due to one less week in the current year. Earlier, sales were anticipated in the band of $4.256-$4.300 billion.

Cost Inflation

Flowers Foods is seeing elevated costs, which weighed on its adjusted EBITDA margin in the third quarter of fiscal 2021. During the quarter, SD&A costs, as a percentage of sales, flared up 40 basis points (bps) to 38.4% on account of escalated transportation costs and marketing investments. Adjusted EBITDA margin contracted 30 bps to 11.5%. The company is battling commodity, freight, labor and logistics cost inflation. It expects more meaningful commodity cost inflation in 2022. Input cost inflation is stemming from higher input prices as well as the challenges associated with sourcing them. That said, the company has been focused on undertaking pricing actions to counter commodity cost inflation. Management also expects labor market hurdles to persist.

However,, efficient pricing actions and the abovementioned upsides are likely to boost the company’s growth. Shares of this Zacks Rank #3 (Hold) company have rallied 16.9% in the past six months compared with the industry’s rise of 0.3%.

Hot Consumer Staple Bets

Some better-ranked stocks are Medifast, Inc. MED, United Natural Foods UNFI and The Estee Lauder Companies Inc. EL.

Medifast, the manufacturer and distributor of weight loss, weight management, healthy living products, and other consumable health and nutritional products, currently carries a Zacks Rank #2 (Buy). Shares of Medifast have declined nearly 26% in the past six months. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Medifast’s current financial year sales and EPS suggests growth of about 63% and 49.3%, respectively, from the year-ago reported figure. MED has a trailing four-quarter earnings surprise of 17.3%, on average.

United Natural Foods, the leading distributor of natural, organic, and specialty food and non-food products in the United States and Canada, carries a Zacks Rank #2 at present. Shares of United Natural Foods have moved up 38.5% in the past six months.

The Zacks Consensus Estimate for United Natural Foods’ current financial-year sales and EPS suggests growth of 4.8% and 7.7%, respectively, from the year-ago reported number. UNFI has a trailing four-quarter earnings surprise of 35.4%, on average.

The Estee Lauder Companies, which manufactures, markets and sells skincare, makeup, fragrance and hair care products, carries a Zacks Rank #2 at present. Shares of The Estee Lauder Companies have moved up 16.9% in the past six months.

The Zacks Consensus Estimate for The Estee Lauder Companies’ current financial-year sales and EPS suggests growth of 15.5% and 15.2%, respectively, from the year-ago reported number. EL has a trailing four-quarter earnings surprise of 37%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance