Fiserv (FI) Benefits From Acquisitions Amid Rising Competition

Fiserv FI has had an impressive run over the past year, wherein its shares have gained 29.6%, outperforming the 14.8% rally of the industry it belongs to and the 23.1% rise of the Zacks S&P 500 Composite.

FI reported mixed first-quarter 2024 results. Adjusted earnings per share (excluding 65 cents from non-recurring items) of $1.9 beat the consensus mark by 6.2% and increased 19% year over year. Adjusted revenues of $4.5 billion missed the consensus estimate by a slight margin and decreased marginally on a year-over-year basis.

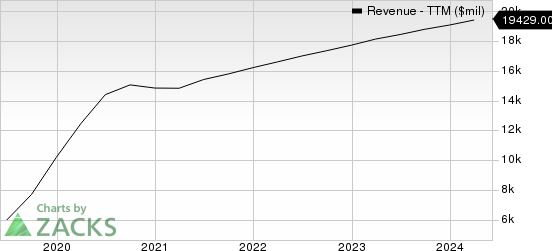

Fiserv, Inc. Revenue (TTM)

Fiserv, Inc. revenue-ttm | Fiserv, Inc. Quote

How Is FI Doing?

Fiserv enhances its product portfolio through strategic acquisitions. In 2023, Skytef and Sled were acquired for $17 million to support the expansion of the company's distribution network, point-of-sale (POS) and direct payment services. In 2022, Finxact was acquired to offer FI’s clients seamless and personalized digital banking experiences. OrangeData, NexTable and City POS were also acquired in 2022 to strengthen the acceptance segment. The acquisition of BentoBox in 2021 enabled Fiserv to cater to the rising demand for capabilities that improve interaction between merchants and customers online.

The company’s current ratio (a measure of liquidity) at the end of first-quarter 2024 was pegged at 1.06, higher than the 1.04 reported at the end of the preceding quarter. A current ratio of more than 1 indicates that the company should not have problems meeting its short-term obligations.

Fiserv has been consistent with share repurchases. In 2023, 2022 and 2021, Fiserv repurchased 40 million, 25.4 million and 23.3 million shares for $4.7 billion, $2.50 billion and $2.57 billion, respectively. Such a strategy instills investors’ confidence and positively impacts the bottom line.

FI’s core banking products and services operate in a highly competitive market. The industry is getting more competitive with the entry of several non-banking bodies, such as internal data processing departments, large computer hardware manufacturers and data processing affiliates of large companies.

Fiserv might encounter integration risks due to frequent acquisitions. Such acquisitions can adversely impact its balance sheet in the form of high goodwill and intangible assets. Moreover, organic growth may be hindered due to frequent acquisitions serving as distractions for management.

Zacks Rank & Stocks to Consider

Fiserv currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Charles River Associates CRAI and Omnicom Group OMC.

Charles River Associates has a Zacks Rank of 2 (Buy) at present. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

CRAI has a long-term earnings growth expectation of 16%. It delivered a trailing four-quarter earnings surprise of 19.1%, on average.

Omnicom Group currently carries a Zacks Rank of 2. It has a long-term earnings growth expectation of 5.5%.

OMC delivered a trailing four-quarter earnings surprise of 3.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Fiserv, Inc. (FI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance