First Solar Leads 3 US Stocks Estimated To Be Trading Below Fair Value

With the S&P 500 reaching record highs and optimism surrounding the U.S. economy, investors are keenly searching for opportunities amid a buoyant market. Identifying undervalued stocks can be particularly rewarding in such an environment, as these equities may offer significant growth potential at a lower entry cost. In this article, we will explore three U.S. stocks that are estimated to be trading below their fair value, with First Solar leading the pack.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

Western Alliance Bancorporation (NYSE:WAL) | $85.36 | $168.14 | 49.2% |

Phibro Animal Health (NasdaqGM:PAHC) | $22.10 | $42.63 | 48.2% |

KBR (NYSE:KBR) | $64.66 | $127.21 | 49.2% |

Kanzhun (NasdaqGS:BZ) | $16.12 | $31.12 | 48.2% |

Tenable Holdings (NasdaqGS:TENB) | $40.08 | $79.04 | 49.3% |

EverQuote (NasdaqGM:EVER) | $20.77 | $39.75 | 47.7% |

EVERTEC (NYSE:EVTC) | $33.21 | $65.74 | 49.5% |

Enphase Energy (NasdaqGM:ENPH) | $113.61 | $224.37 | 49.4% |

STAAR Surgical (NasdaqGM:STAA) | $33.87 | $65.37 | 48.2% |

Vasta Platform (NasdaqGS:VSTA) | $2.62 | $5.07 | 48.3% |

We're going to check out a few of the best picks from our screener tool.

First Solar

Overview: First Solar, Inc. is a solar technology company that provides photovoltaic (PV) solar energy solutions globally and has a market cap of approximately $25.88 billion.

Operations: First Solar generates revenue primarily from its Modules segment, which accounted for $3.76 billion.

Estimated Discount To Fair Value: 45.8%

First Solar is trading at 45.8% below its estimated fair value of US$471.72, with a current price of US$255.66, making it highly undervalued based on discounted cash flow (DCF) analysis. The company has forecasted annual earnings growth of 27.2%, significantly outpacing the US market's 15.2%. Recent earnings reports show strong performance, with Q2 net income doubling year-over-year to US$349.36 million and substantial investments in R&D expected to drive future innovation and profitability further.

Our growth report here indicates First Solar may be poised for an improving outlook.

Click to explore a detailed breakdown of our findings in First Solar's balance sheet health report.

Netflix

Overview: Netflix, Inc. (NasdaqGS:NFLX) provides entertainment services and has a market cap of $309.67 billion.

Operations: Netflix's revenue primarily comes from its Streaming Entertainment Service, which generated $36.30 billion.

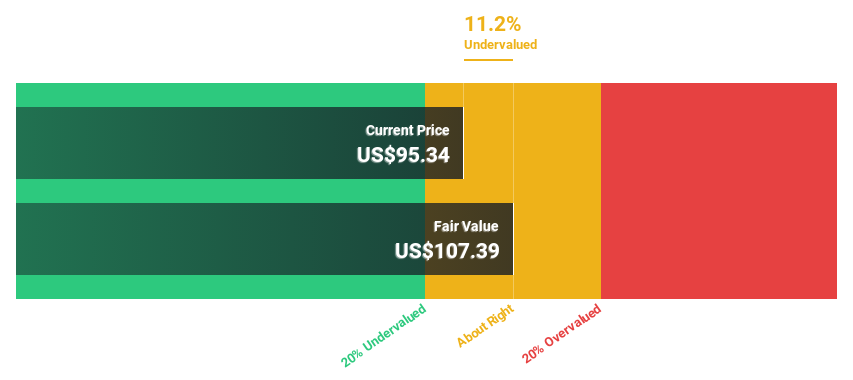

Estimated Discount To Fair Value: 10.5%

Netflix is trading at $711.43, about 10.5% below its estimated fair value of $794.68 based on discounted cash flow analysis, suggesting it may be undervalued. Earnings are forecast to grow 16% per year, outpacing the US market's 15.2%. Recent strategic partnerships, such as with Kingsmen Creatives for "Squid Game: The Experience," enhance its brand engagement and potential revenue streams while recent earnings reports show robust growth in both sales and net income year-over-year.

Vertiv Holdings Co

Overview: Vertiv Holdings Co (NYSE:VRT) designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments globally, with a market cap of approximately $37.79 billion.

Operations: Revenue segments for Vertiv Holdings Co are as follows: Americas: $4.11 billion, Asia Pacific: $1.68 billion, and Europe, Middle East & Africa: $1.95 billion.

Estimated Discount To Fair Value: 30.8%

Vertiv Holdings Co is trading at $100.62, approximately 30.8% below its estimated fair value of $145.48 based on discounted cash flow analysis, indicating it may be undervalued. Earnings are expected to grow significantly over the next three years, with a forecasted annual growth rate of 29.65%. Despite having a high level of debt, Vertiv's revenue and earnings growth outpace the US market averages, and its recent inclusion in the FTSE All-World Index highlights its expanding market presence.

Make It Happen

Embark on your investment journey to our 184 Undervalued US Stocks Based On Cash Flows selection here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:FSLR NasdaqGS:NFLX and NYSE:VRT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance