First Mover Asia: Bitcoin Rises on Encouraging Omicron News Before Falling Back; Ether Drops Slightly

Good morning. Here’s what’s happening this morning:

Market moves: Bitcoin rose following gains in the traditional market.

Technician’s take: Bitcoin is attempting to reverse its weekend sell-off, although upside appears limited.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $50,529 -.10%

Ether (ETH): $4,303 -0.6%

Markets

S&P 500: $4,686 +2%

Dow Jones Industrial Average: $35,719 +1.4%

Nasdaq: $15,686 +3%

Gold: $1,783 +0.1%

Market moves

Bitcoin spent most of Tuesday trading above $51,000 as the stock market rose sharply amid growing optimism that the new omicron coronavirus variant would be less damaging to the economy than previously thought.

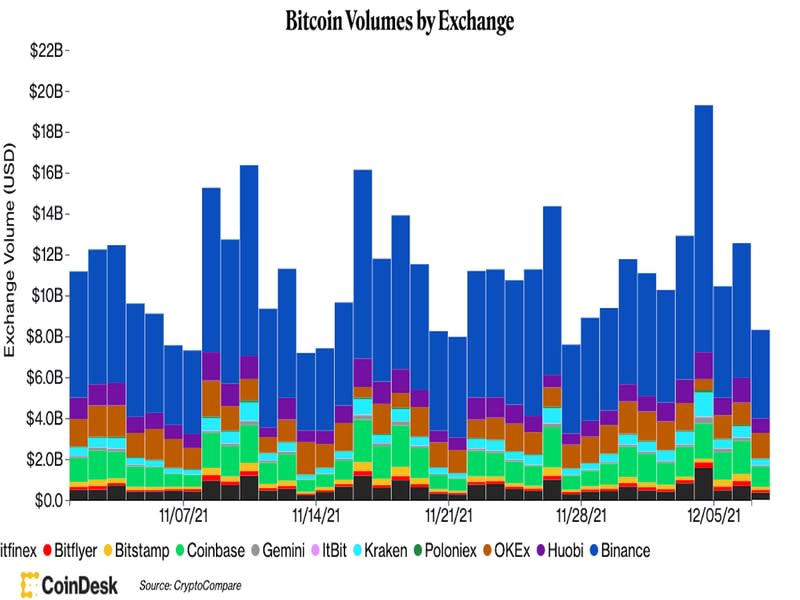

Bitcoin’s price had fallen back by the time of publications, was slightly down over the past 24 hours. The No. 1 cryptocurrency by market capitalization’s trading volume across major centralized exchange was low on Tuesday. Ether, meanwhile, was down about 1% over the same period.

Blockchain data suggested that the market crash over the weekend resulted from a “weak hand purge,” according to blockchain analytics firm Santiment. Bitcoin’s network realized profit/loss (NPL in short) chart shows that Saturday’s correction triggered one of this year’s largest drops in bitcoin’s NPL.

NPL takes the price at which bitcoin last moved on the blockchain – assuming it was bitcoin’s acquisition price – and divides by the price of the bitcoin when it changes addresses again, which is the price Santiment assumes as the sell price.

The drop in NPL suggests “a significant amount of BTC transferred over the weekend were being moved at a loss compared to the last time they changed addresses,” Santiment explained in its analysis on Tuesday.

The takeaway? Bitcoin may face some short-term downward pressure amid “rising FUD [fear, uncertainty and doubt] among some BTC holders,” Santiment concluded.

Alternative cryptocurrencies (altcoin) gained and some of the biggest winners of the day included tezos (XTZ), omg network (OMG), and harmony (ONE).

Technician’s take

Bitcoin Returns Above $50K; Resistance at $53K-$55K

Bitcoin (BTC) is attempting to reverse its weekend sell-off, although the cryptocurrency’s price could face short-term resistance around $53,000-$55,000. BTC was trading around $50,000 at the time of publication and is up about 3% over the past 24 hours.

The relative strength index (RSI) on the four-hour is rising from extreme oversold levels, suggesting that buyers could remain active over the short-term. Still, BTC remains in a month-long downtrend, defined by the downward sloping 100-period moving average on the four-hour chart. Downtrends tend to limit price rises as sellers outnumber buyers.

Price momentum is still negative on the weekly chart, which means more time is needed for bitcoin to decisively break above its short-term downtrend.

Important events

1 p.m. HKT/SGT (5 a.m. UTC): Japan economic watchers survey (Nov.)

2:30 p.m. HKT/SGT (6:30 a.m. UTC): France non-farm payrolls (Q3)

8 p.m. HKT/SGT (12 p.m. UTC): MBA mortgage applications (weekly)

11 p.m. HKT/SGT (3 p.m. UTC): U.S. job openings

CoinDesk TV

In case you missed it, here are the most recent episodes of “First Mover” on CoinDesk TV:

Bitcoin Outlook as Price Breaks $50K, CoinDesk’s ‘Most Influential 2021′ Winners Announced

Announcing CoinDesk’s “Most Influential 2021″ winners! Most Influential is an annual list of people who defined the year in crypto. Managing Editor Ben Schiller reveals the top winners and why they made the list. Also joining are Huobi Brokerage Director Victor Wei with markets analysis and Michael Bouhanna of Sotheby’s to discuss art in the metaverse.

Latest headlines

Google Sues to Shutter Cryptojacking Botnet That Infected 1M+ Computers: The botnet used the Bitcoin blockchain to evade cybersecurity officials and remain online, Google alleged.

OCC Nominee Omarova Withdraws From Bank Regulator Consideration: Saule Omarova’s nomination was met with hostility from the traditional banking sector.

Crypto Fans Rejoice, Gamers Revolt as Ubisoft Announces NFT Plans: The first major game maker to roll out in-game NFTs was met with backlash Tuesday from a crypto-wary public.

Ex-Google CEO Eric Schmidt Joins Oracle Provider Chainlink as Strategic Advisor: Schmidt will help guide Chainlink as it scales its operations and seeks to “build a world powered by truth.”

Crypto-Focused 10T Holdings to Raise $500M in New Fund: The private equity firm has raised $750 million since launching last year.

Longer reads

DAOs and the Next Crowdfunding Gold Rush: Fundraiser DAOs are essentially informal, unregulated Kickstarters. Is that why people are buying in?

Today’s crypto explainer: How Do Bitcoin Transactions Work?

Other voices: ‘I put my life savings in crypto’: how a generation of amateurs got hooked on high-risk trading (The Guardian)

Yahoo Finance

Yahoo Finance